What do we mean by Internal Rate of Return and Time-Weighted Return?

Internal Rate of Return and Time-weighted return are both financial analysis metrics that tell us how profitable a potential investment opportunity can be. The internal rate of return, or IRR, is the discount rate/interest rate or the nominal rate at which the net present value of the total expected cash flow over the period of investment or project becomes zero. On the other hand, time-weighted returns are calculated by determining the geometric means of returns on an investment or portfolio.

The concept of internal rate of return primarily uses the weighted average cost of capital as a calculation basis. If a project has a WACC greater than its IRR, it is unprofitable to proceed with it. Therefore, it should be deferred or discontinued. A project with an IRR higher than its WACC is beneficial and preferable to the company. An IRR equal to the WACC means that the Net Present Value of the total expected cash flow from the project is zero. This is the minimum requirement to consider carrying on with any project.

- What do we mean by Internal Rate of Return and Time-Weighted Return?

- What are the main differences between the Internal Rate of Return and Time-Weighted Return?

- What are the advantages of internal rate of return over time-weighted return?

- What are the advantages of Time-Weighted Return over Internal Rate of Return?

Calculating time-weighted returns breaks each investment portfolio down into several parts or time intervals, then calculates the return it generates during each part or time interval. Then a geometric mean of all these returns is calculated and annualized to obtain the final result. This helps to negate the effect of multiple deposits and inflows into the fund. And also of the withdrawals made time and again from that fund.

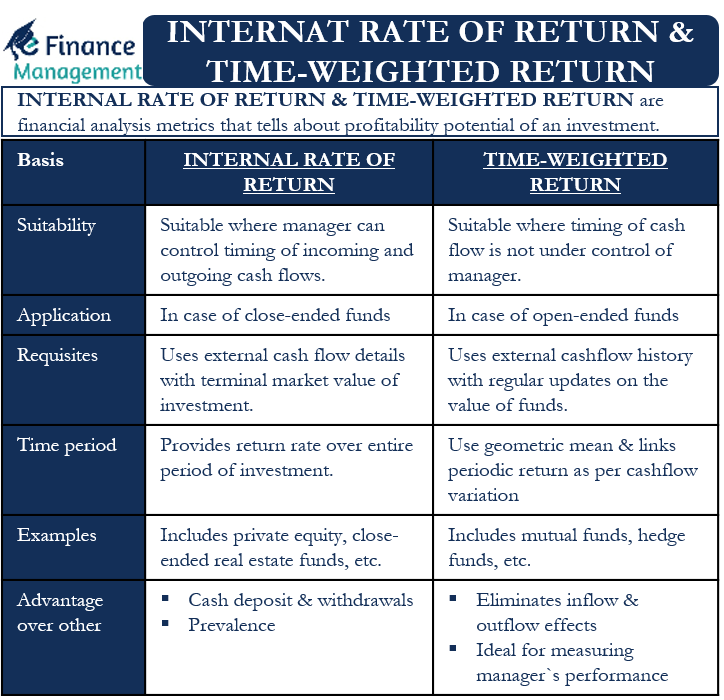

What are the main differences between the Internal Rate of Return and Time-Weighted Return?

Suitability

Internal rate of return is of use in cases and funds where the manager can control the timing of incoming and outgoing cash flows. Time-weighted returns are useful where the timing of cash flows is not within the control of the fund manager. Briefly, time-weighted returns are used where the frequency and quantity of cash flows cannot be predicted with reasonable certainty.

Application

The internal rate of return is generally useful for closed-ended funds. The timing of external cash flows influences the performance of such funds, so the internal rate of return is a suitable metric.

Open-ended funds use time-weighted return metrics. In such cases, the timing of the external flow of money does not affect the performance of the fund. Therefore, it is an appropriate measure of how well the fund advisor has performed. Investors can also use its result as a benchmark to compare the performance of funds and even industries.

Requisites

External cash flow history along with regular updates of the value of funds, usually monthly, is necessary for the event of a time-weighted return. But the internal rate of return uses external cash flow details along with the terminal market value of the investment.

Time-period

To calculate the rate of return over the investment period, the time-weighted rate of return uses a geometric mean. It links the periodic returns according to the variation in cash flow and converts these returns into an annual return.

Also Read: ROI vs IRR – All You Need To Know

On the other hand, the internal rate of return delivers the return over the entire investment period and not just fragments of time.

Common examples

The internal rate of return metric is common for investments that require commitment, such as private equity funds, close-ended real estate funds, etc. A point to note here is that we have two different types of IRRs for project and equity evaluation. These are project IRR and equity IRR.

Investment options with less formalities regarding deposits and withdrawals usually use a time-weighted rate of return. Examples are investment funds, hedge funds, exchange-traded funds, etc.

What are the advantages of internal rate of return over time-weighted return?

Cash deposits and withdrawals

Internal rate of return is a simple measure that considers the volume of cash inflows and outflows. It weights the time intervals higher with higher cash inflows or outflows. It is a perfect tool to measure the absolute growth of a project or portfolio for a short period of time, say a few months or so.

Prevalence

Internal rate of return is a more appropriate measure when we need to determine returns on assets with limited liquidity. It is also useful in terms of assets that cannot easily be marketed or sold. Such projects and assets include real estate funds, acquisitions, buyouts, etc.

What are the advantages of Time-Weighted Return over Internal Rate of Return?

Eliminates cash inflows and outflow effect

The time-weighted rate of return eliminates the impact of numerous cash deposits and withdrawals into a fund or portfolio. It, therefore, provides a clear picture of the return you actually earn after each deposit or withdrawal. In other words, it divides a fund into several parts based on a cash deposit or withdrawal. It treats each of these parts separately, thus reflecting the actual performance of the investment in real terms.

Ideal for measuring fund manager’s performance

The time-weighted rate of return is an ideal measure of fund managers’ performance due to the above-mentioned factor of dividing periods based on cash deposits or withdrawals. The calculation is free of the tendency to overinvest or underinvest at any time in the portfolio. It is also not in the hands of a fund manager to control cash deposits or withdrawals from assets such as an investment fund or hedge fund.