Inflation Definition

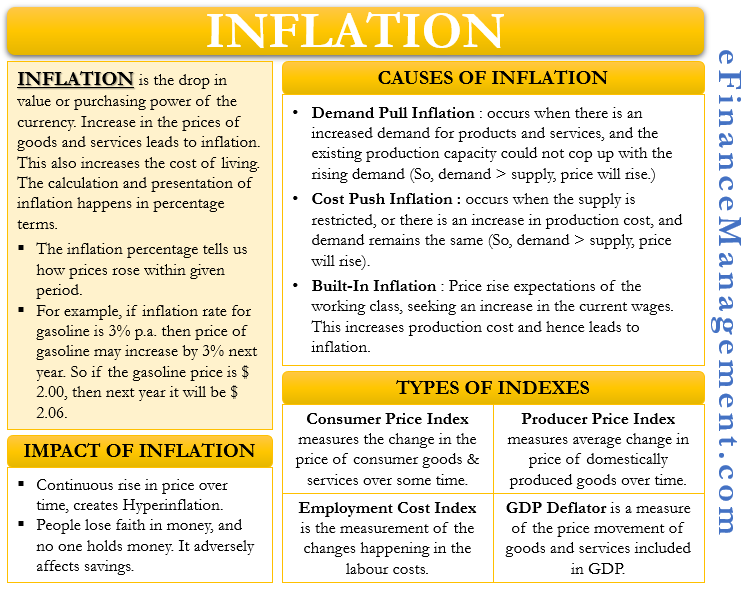

Inflation is the drop in the value or purchasing power of the currency. For example, what you can buy today at $1, you may not be able to buy the same thing for $1 after some period. The increase in the prices of goods and services leads to inflation. For a proper understanding of the change, the calculation and presentation happen in percentage terms. As it increases, the cost of living also increases because it impacts the purchasing power of a currency.

Understanding the Inflation

The inflation percentage tells us how the prices rose within the given period. For example, if the inflation rate for gasoline is 3% p.a., then the price of gasoline may increase by 3% next year. So if the gasoline price is $ 2.00, then next year it will be $ 2.06.

As the price rises, the currency loses its value. Generally, the monetary authority of a country takes steps to curb inflation. Because for running the economy smoothly, the authority must keep within it within limits. Moreover, the authority also keeps a close watch on the economy to identify the deflationary trend.

Hyperinflation – An Impact on the Economy

Continuous high inflation over time creates hyperinflation. In hyperinflation, people lose faith in money as the value of the currency decreases faster than usual. No one wants to hold the funds. Hyperinflation adversely affects the savings, as the prices are on the rise, and money’s worth is getting down day by day. In such a scenario, to keep up the spending, the middle class diverts their savings to spending. Hyperinflation in Austria & Germany in the 1920s is an example of that.

Also Read: Inflation and Deflation

If inflation and recession occur at the same time, it is called stagflation. It is an infrequent scenario for any country. However, stagflation occurs when normal market working is significantly disturbed or disrupted due to the change in government policy intervention. Stagflation consists of three things: hyperinflation, stagnation, and unemployment. It creates rising prices of goods with no economic growth, bringing high unemployment.

Causes of Inflation

Different factors contribute to the rise in price, which ultimately causes inflation. However, we can classify these factors broadly in three categories as below:

Demand-pull inflation

Demand-pull inflation occurs when there is an increased demand for products and services. And the existing production facility can not cope up with this increased demand. It creates a gap between the demand & supply of the product and the services. High demand & low supply increases the price.

This demand pull can be due to the increased liquidity or money supply in the economy. And that gives a Philip to the purchasing power of the population. An increase in the money supply can also impact the purchasing power of the people. As people have more money, they will tend to spend more. It increases demand while supply remains the same, which creates a gap in demand supply and leads to a price rise.

Cost-Push Inflation

Cost-push inflation occurs when the supply is restricted or there is an increase in production cost. A frequent example of such a situation concerns the decision by OPEC about the quantum of oil production. It leads to a gap between demand & supply as the demand remains the same, but supply is restricted. In the same manner, an increase in production cost leads to a higher cost of finished goods & leads to a rise in price.

Sometimes natural disasters can also create cost-push inflation as demand remains the same, but supply gets restricted.

Built-In Inflation

Price rise expectations of the working class, seeking an increase in the current wages, are the Built-in inflation. Everyone needs to maintain their cost of living, including one of the production cost factors, labor. To cope up with rising prices, they also demand a raise in wages. Increased wages leads to higher production cost & this cause and effect continuity becomes a wage-price spiral.

It happens based on past events and persists in the present. Therefore it is also known as Hangover Inflation. Inflationary expectation plays a role because if workers expect inflation to continue in the future, they will ask for a raise now.

Type of Index

Some are widespread index reports that investors and economics follow.

- Consumer Price Index (CPI)

- Producer Price Index (PPI)

- Employment Cost Index (ECI)

- Gross Domestic Product Deflator

Consumer Price Index (CPI)

The CPI measures the change in the price of consumer goods & services over some time. Transportation, food, and medical care costs are the main components of this index. It reflects the change in the cost of living. CPI is calculated by taking the price change of each item of consumable goods & services. Then it is compared with the base period price of the goods & services. CPI data is published every month by the US Bureau of Labor Statistics publishes.

The formula for calculation of CPI is — C*100/B.

C =Current Period Price of the Basket of goods and services

B = Base Period Prices of the Basket of goods and services

Producer Price Index (PPI)

PPI measures the average change in the selling prices of domestically produced goods and services in the given period. It measures the move from a seller’s perspective. In contrast, CPI measures the index from the buyer’s point of view.

In PPI, it is also possible that a rise in the price of one product is adjusted or offset by a decrease in the price of other products. For example, the price rise of gasoline changes by a reduction in the price of rice.

Employment Cost Index (ECI)

ECI is the measurement of the changes happening in the labor cost. It is measured by summing up wages and benefits across the hierarchy. The data is broken down by industry, occupation, and union vs. non-union workers. The Bureau of Labor Statistics in the US Department of Labor prepares ECI.

Gross Domestic Product Deflator

GDP Deflator is a measure of the price movement of goods and services included in GDP. The total output of goods and services of the country is known as GDP. GDP Deflator is calculated by comparing the current year’s price to the price of the base year. The GDP price deflator expresses the price level changes within the economy.

Please keep notifying me.