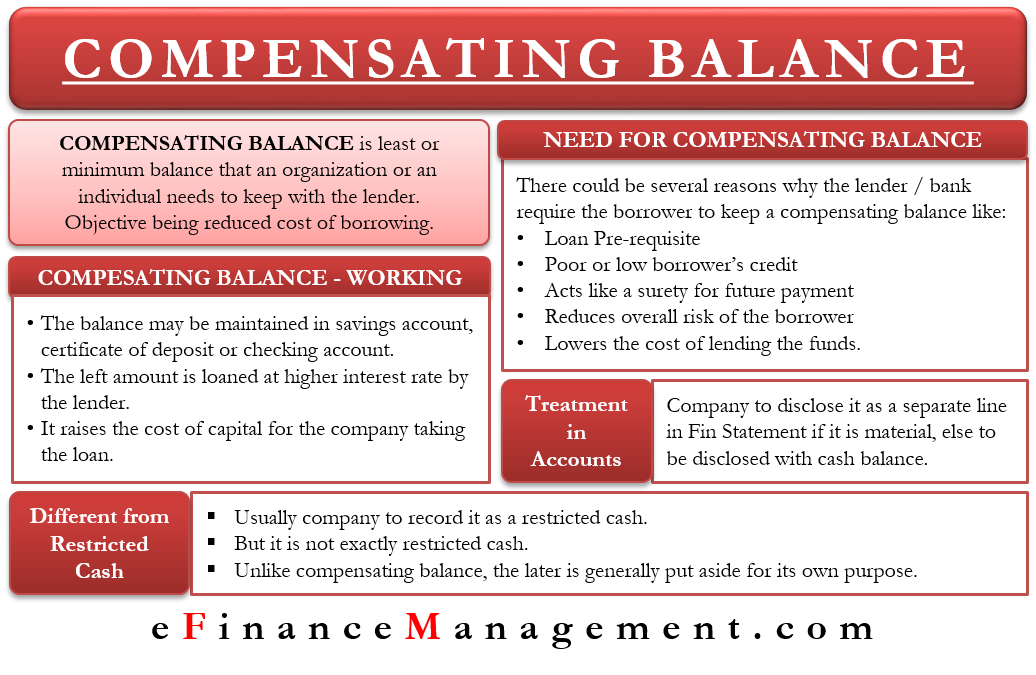

Compensating balance is the least or minimum balance that an organization or an individual needs to keep with the lender. The primary objective of such a balance is to reduce the lending cost of a borrower. For instance, a company takes a loan of $50,000 from a bank and agrees never to use $5,000. It means the effective loan amount is $45,000 only.

How Compensating Balance Works?

Such a requirement is a common phenomenon with corporate loans. The need to maintain the balance could be in a savings account, certificate of deposit, or checking account, depending on the terms of the contract.

The lender can use this left amount to earn interest by loaning it at a higher interest or using it for any other investment opportunities. This results in a loss for the borrower as the borrower has to pay the interest on the full loan amount. Or, we can say, it raises the cost of capital for the company taking a loan.

Example of Compensating Balance

Company ABC has a loan of $100,000 million from Bank A. The terms of the loan include an interest rate of 5% and a compensating balance of $10,000. The borrower should keep this amount in a non-interest-bearing account with the same bank.

Also Read: Advantages and Disadvantages of Bank Loans

In this case, interest on the loan in dollar terms is $5,000. Though the interest rate is 5%, the effective interest rate will be higher. As the borrower only gets to use $95,000. Thus, the effective interest rate is 5.3% ($5,000 / $95,000).

Need for Compensating Balance

There could be several reasons why a bank or a lender may require the borrower to keep a compensating balance. These are:

- A pre-requisite to grant a loan.

- A borrower has a low or poor credit rating.

- It acts as a surety that the borrower will repay the lender.

- It’s a condition pre-requisite for the loan from the borrower. For example, a borrower promises to keep $2 million in a checking account if the bank agrees to grant him a credit of $8 million at an interest rate lower than the market rate.

- Reduces the borrower’s overall risk in granting the loan.

- It helps to lower the cost of lending.

Accounting Treatment of Compensating Balance

A company must reveal compensating balances (if any) in its financial statements. As per the accounting rules, if the amount of compensating balances is material, then a company must reveal compensating balances separate from the cash balances in the financial statements. As to what constitutes a material amount, the rules say the amount should be significant enough to influence a person’s opinion.

Usually, a company needs to report any such balance as restricted cash. It is cash that a company holds for a specific objective, and thus, it is not accessible for regular business use. A point to note is that a compensating balance is not the same as restricted cash.

Restricted cash is the one that a company sets aside on its own for a specific purpose. On the other hand, compensating balance is the minimum amount that an organization needs to keep due to a contractual agreement with the bank.

Another difference between the two is that a company has control over the restricted cash while it has no control over compensating balances. Instead, the bank or the lender has control over the compensating balances.