The credit policy of a firm plays a pivotal role in managing its cash flow, mitigating credit risks, and fostering customer relationships. It encompasses the terms and conditions under which the firm extends credit to its customers, including credit limits, payment terms, and collection procedures. It is influenced by a multitude of factors that need careful consideration to strike the right balance between profitability and risk management.

What Is Credit Policy?

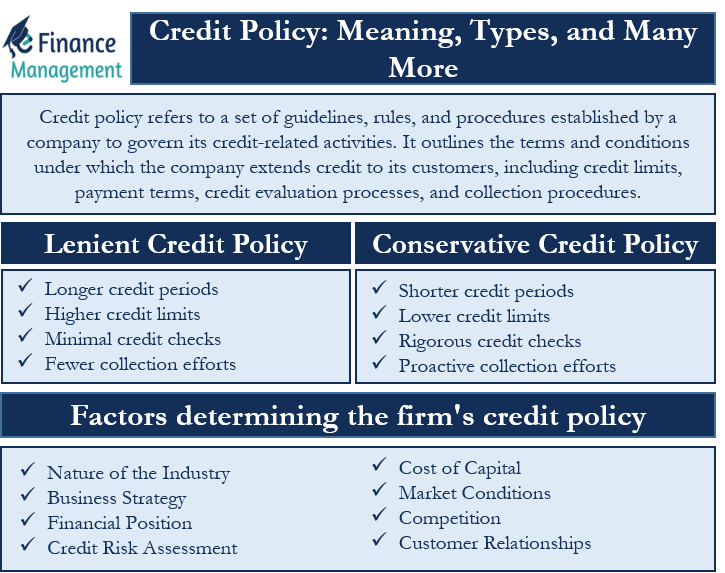

Credit policy refers to a set of guidelines, rules, and procedures established by a company to govern its credit-related activities. It outlines the terms and conditions under which the company extends credit to its customers, including credit limits, payment terms, credit evaluation processes, and collection procedures. It serves as a framework to manage the credit risk associated with granting credit to customers and ensures consistency in credit decisions across the organization.

The primary purpose of a credit policy is to strike a balance between maximizing sales and minimizing potential losses due to non-payment or late payment by customers. It aims to define the creditworthiness criteria for customers, establish credit terms, and provide guidelines for credit monitoring and collection processes. By implementing a well-defined policy, companies can maintain healthy cash flow, minimize bad debts, and build strong relationships with their customers.

2 Types of Credit Policy

The following are two types of credit policies prevailing in credit management.

Liberal or Lenient Credit Policy

A liberal credit policy refers to a more relaxed and lenient approach toward extending credit to customers. This type of policy aims to attract customers by offering generous credit terms and flexible payment options.

Also Read: Financing Policy

A liberal credit policy offers flexibility to customers, attracting new ones and increasing sales. However, late payments can lead to financial losses and management challenges for the business. If customers don’t pay their bills on time, the business may lose money and have trouble managing their own finances. Some characteristics of a liberal credit policy include:

Longer Credit Periods

The company provides customers with extended timeframes to make payments, which can help attract more customers and encourage larger purchases.

Higher Credit Limits

The company sets higher credit limits for customers, allowing them to make larger purchases on credit.

Minimal Credit Checks

The credit evaluation process may be less stringent, and the emphasis may be placed more on customer relationships and trust.

Fewer Collection Efforts

The company may adopt a more relaxed approach to collections, allowing for more flexibility in payment schedules and granting more leeway for late payments.

Conservative or Tight Credit Policy

A conservative credit policy, on the other hand, takes a more cautious and risk-averse approach to credit management. This type of policy focuses on minimizing credit risks and ensuring the timely collection of payments.

A conservative credit policy helps businesses mitigate credit risks, maintain healthy cash flow, and reduce the likelihood of bad debts. However, it can also limit sales opportunities and potentially deter customers who prefer more flexible credit terms. Some characteristics of a conservative credit policy include:

Shorter Credit Periods

The company imposes shorter timeframes for customers to make payments, reducing the risk of late or non-payment.

Lower Credit Limits

The company sets lower credit limits for customers to limit exposure to potential bad debts.

Rigorous Credit Checks

The credit evaluation process is thorough, including assessing the financial stability and creditworthiness of customers.

Proactive Collection Efforts

The company takes a proactive approach to collections, closely monitoring payment schedules and following up on late payments promptly.

4 Components of the Firm’s credit policy

By implementing effective processes within each component, businesses can minimize credit risks, maintain healthy cash flow, and foster strong customer relationships. The components of a comprehensive credit policy are as follows:

Also Read: Credit Risk

Credit Evaluation

This component outlines the procedures and methods used to assess the creditworthiness of customers. It includes conducting credit checks, which may involve obtaining credit reports, reviewing financial statements, and analyzing trade references. The purpose is to evaluate the financial stability and payment history of customers to determine their creditworthiness and the level of risk associated with extending credit to them.

Credit Terms

This component defines the specific payment terms offered to customers. It includes factors such as payment due dates, credit limits (the maximum amount of credit a customer can avail of), and any special conditions or discounts offered. Clear and well-defined credit terms ensure that both the company and the customer understand the expectations regarding payment obligations.

Collection Procedures

This component outlines the processes and steps involved in managing collections and ensuring timely payment from customers. It includes procedures for generating and sending invoices promptly upon delivery of goods or completion of services. This also includes sending reminders and taking further actions to remind and motivate customers to pay their bills on time. It’s like when your mom reminds you to clean your room and takes away your phone if you don’t do it. Additionally, collection procedures address how to escalate collection efforts, such as engaging third-party collection agencies or taking legal action, if necessary.

Credit Monitoring

This component emphasizes the ongoing monitoring of customer payment behavior, credit limits, and credit reviews. It involves tracking customer payment patterns, detecting any potential signs of financial distress or deteriorating creditworthiness, and taking proactive measures to address risks. Credit monitoring helps businesses identify any changes in customers’ ability to fulfill their payment obligations, enabling timely adjustments to credit terms or collection efforts if needed.

Factors Determining the Firm’s credit policy

The credit policy of a firm is influenced by various factors that help determine the terms and conditions under which the firm extends credit to its customers. These factors include:

Nature of the Industry

Different industries have different credit practices based on their specific characteristics. For example, industries with high competition and low-profit margins may offer shorter credit periods to maintain healthy cash flow.

Business Strategy

The way a company gives credit to its customers should match its overall plan for success. It’s like having a game plan that matches your team’s strategy in a sports game. If a firm aims to attract more customers and increase sales, it may adopt a more lenient credit policy. On the other hand, if the focus is on maintaining financial stability, a stricter credit policy may be implemented.

Financial Position

The financial strength and stability of a firm play a crucial role in determining its credit policy. A firm with strong financials may be more flexible in offering credit terms, while a financially constrained firm may adopt a more conservative approach.

Credit Risk Assessment

Assessing the creditworthiness of customers is a vital factor in determining the credit policy. Factors such as credit history, financial stability, and payment behavior of customers help determine the level of credit risk associated with them.

Cost of Capital

The cost of capital for a firm, including interest rates on borrowing or the opportunity cost of tying up capital in receivables, influences the credit policy. Higher borrowing costs may lead to stricter credit terms to mitigate financial risks.

Market Conditions

Market conditions, including economic trends, interest rates, and inflation rates, impact a firm’s credit policy. During economic downturns or periods of high-interest rates, firms may adopt a more cautious approach to credit to minimize potential losses.

Competition

The credit policies of competitors within the industry also influence a firm’s credit policy. Firms may adjust their credit terms to remain competitive and attract customers while balancing the need for financial stability.

Customer Relationships

Existing customer relationships and their value to the firm can influence the credit policy. Established and loyal customers may be granted more favorable credit terms compared to new or high-risk customers.

Conclusion

Overall, a credit policy is a crucial tool for companies to manage their credit activities effectively, strike a balance between sales growth and credit risk, and maintain financial stability. By establishing clear guidelines and procedures, companies can make informed credit decisions, reduce the potential for bad debts, and foster strong customer relationships.

Frequently Asked Questions (FAQs)

It is important for a business as it helps manage the risk associated with extending credit. This text is talking about a system that helps businesses decide if customers can be trusted to pay back the money they credit purchases. It also helps to set fair rules for credit and makes sure payments are made on time. A well-designed credit policy promotes financial stability, reduces bad debt losses, and supports cash flow management.

It can impact sales by either increasing or limiting them. A lenient credit policy that offers more favorable credit terms may attract additional customers who can purchase on credit, potentially boosting sales. Conversely, a stricter credit policy may restrict the number of customers who qualify for credit, potentially reducing sales.

It has a direct impact on the occurrence of bad debts. A well-designed credit policy that thoroughly evaluates customer creditworthiness and sets appropriate credit limits can help minimize the risk of bad debts. In contrast, a loose credit policy may increase the likelihood of customers defaulting on payments, leading to higher bad debt losses.

It influences accounts receivable by setting the terms and conditions for customer payments. The policy determines the credit period, payment terms, and collection procedures. A stricter credit policy with shorter credit periods and proactive collection efforts can help improve accounts receivable turnover and cash flow management.