What is a Cash Flow Coverage Ratio?

The cash flow coverage ratio is the ratio of operating cash flow to its debt. It is a coverage ratio that helps to understand the position of the cash in a business and whether that is sufficient or not to pay off the debts of the business or not. This ratio is useful to investors, banks, creditors, and the management of the company itself for self-evaluation.

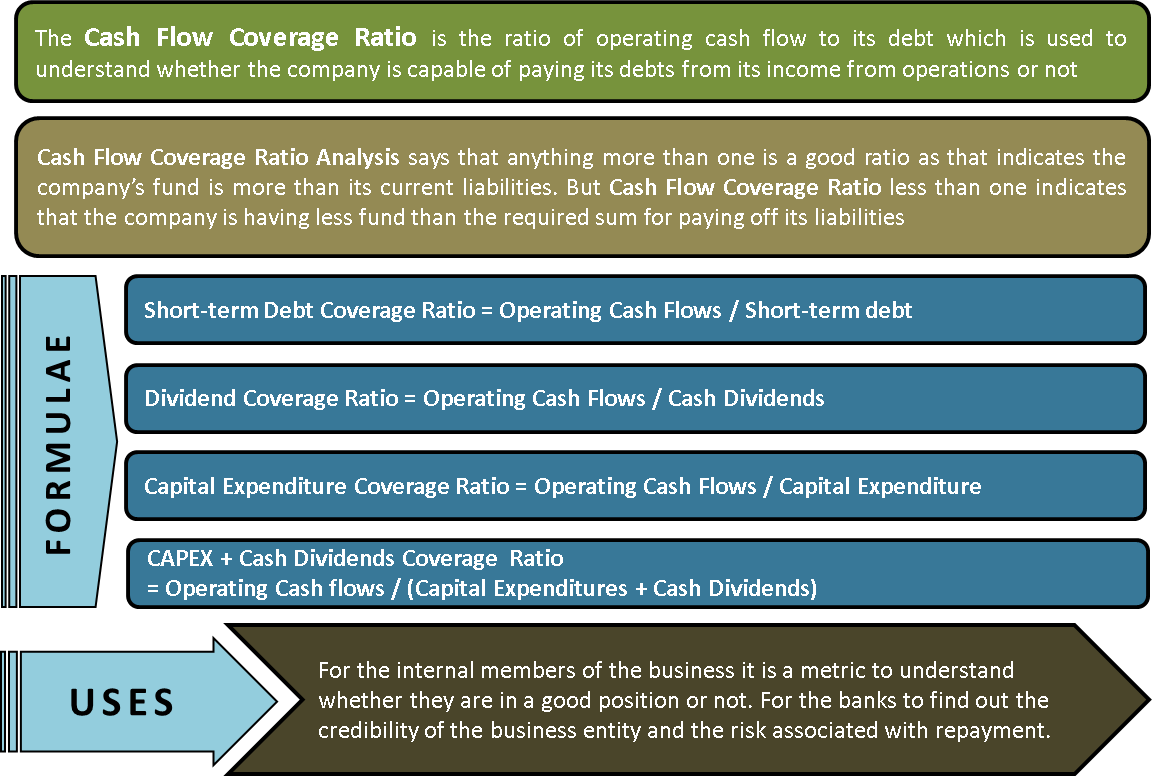

This ratio can be defined as the measure or indicator of a company’s or business’s capability to fund its debt. This ratio indicates whether the cash generated from the main operation of the business is enough or not to pay off its obligations. The operating cash flow is the amount obtained by the business with its primary products or services. The simple cash flow coverage ratio analysis says that anything more than one is a good ratio, indicating that the company’s fund is more than its current liabilities. But a ratio less than one indicates that the company has fewer funds than the required sum for paying off its liabilities. It might have to consider refinancing or restructuring the operations to generate more cash flows.

Importance of Cash Flow Coverage Ratio

Businesses need cash flow to pay off their liabilities. Whether a big firm or an SME, cash flows are a very important aspect of every business entity. The cash flow coverage ratio is a liquidity ratio that helps to understand the position of the cash in a business and whether that is sufficient or not to pay off the debts of the business or not.

Every business has some current liabilities which it has to meet and thus requires money which is the cash flow generated from the operations. If a company cannot pay off its obligations, it is either not utilizing its resources fully, or there is inefficiency in the uses of the resources. Thus cash flows fall short of the obligations it has. It is a measure of the liquidity of the business at current times, whether it can pay off the mandatory expenses like rent, interests, preference dividends, etc., or not.

Also Read: Cash Flow Coverage Ratio Calculator

The other two terms similar to this ratio are:

Formula of Cash Flow Coverage Ratio

The basic formula for calculation is as follows:

Cash Flow Coverage Ratio = Operating Cash Flows / Total Debts

You can also use our Cash Flow Coverage Ratio Calculator for instant calculations.

Examples of Cash Flow Coverage Ratio

Let us assume Johnson & Co. has a short-term debt of USD 100000, Cash dividends to be paid of USD 50000, Capital Expenditure of USD 500000, and an operating cash flow for the year is USD 900000.

Then,

Short-term Debt Coverage Ratio = Operating Cash Flows (OFC) / Short-term debt = 900000/100000 = 9

Dividend Coverage Ratio = OCF / Cash Dividends = 900000/50000 = 18

Capital Expenditure Coverage Ratio = OCF / Capital Expenditures = 900000/50000 = 1.8

CAPEX+ Cash Dividends coverage Ratio

= Operating Cash flows / (Capital Expenditures + Cash Dividends)

= 900000/ (500000+50000) = 900000/550000 = 1.64

Cash Flow Coverage Ratio

= Operating Cash Flows / Total Debt

= 900000/ (100000+50000+500000) = 900000/650000 =1.38

Analysis and Interpretation: Cash Flow Coverage Ratio

The aim of finding a cash flow coverage ratio is to analyze the liquidity position of the company. It determines whether the company has enough cash from its operations to meet its debt obligations. A ratio resulting in 1 or more than 1 is treated to be a good ratio. It suggests that the company’s cash flows through its operations are sufficient for paying off its debt.

The cash flow coverage ratio analysis is the main motive behind finding these ratios. Here, in the above example, all the ratios are more than one, which depicts that the company has a good cash flow to pay its debt. But if we dig a little deeper, we would find that Johnson & Co. may be very good at paying off its short-term debts as the short-term debt ratio is 9, which means its operating cash flow is nine times more than its short-term debt amount.

But when we see the capital expenditure coverage ratio, it is only 1.8 times, but that is still fine. Then we come to this ratio which is 1.38 times which means the operating cash flow is only 1.38 times the total debt of the company. In a stable business cycle, this might not be a sign of a problem, but in case of turmoil in the business, the company can pay its short-term debt easily but might find it challenging to pay the long-term ones.

Uses of Cash Flow Coverage Ratio

The importance of this ratio is different for different people.

Management of a Company

For the internal members of the business entity like the managing director or the CEO, it is a metric to understand whether they are in a good position to pay off their liabilities or not.

Banks

For the banks which will sanction loans to the company, calculate this ratio to find out the credibility of the business entity and the risk associated with repayment.

Investors

For the investors, it is the dividend factor that plays in the mind whether they will be paid the dividend on time or not, and for the creditors, again, whether their debt will be paid off on time or not and if there is a crisis what can be the scenario.

Shareholders

The shareholders also calculate this ratio for cash dividend payments as they are the last on the checklist when the business liquidates. If they find that the ratio is high, then the company might also distribute more dividends to the shareholders.

When this ratio is implemented with other financial calculations, it gives insights into the company’s earnings and how the earnings are utilized, and a lot of other facts and aspects.

Cautions

The shareholders of the company are more concerned about the dividends they would receive against their investment in the company. As they stand last in the line to get the return, they are also equally concerned to know about the cash flow coverage ratio because they can hope to get the dividends only when the cash flow from operations is sufficiently far in excess of the debt obligations and current liabilities.

Conclusion

The cash flow coverage ratio thus helps in understanding the ability of the company to pay off its debts, whether short-term or total debt, and even the dividend payments. It gives the investors, creditors, and financial institutions insight into the company’s earnings and whether the resources are optimally utilized or not to generate operating cash flow at its best.

Visit Coverage Ratio & its Types for details about other types of coverage ratios.

DEAR MR. SANJAY B. BORAD:

Congratulations for your very clear excellent explanation of key financial concepts and topics.

I´m subscribing to your blog today.

Good luck and thank you so much.

Best, Jose L. Valim

Sao Paulo – Brazil

Thanks, Mr. Jose Luiz Valim,

The pleasure is all ours for having you as our subscriber. We will keep coming up with more such topics with your support. If you have any suggestion for our website, you are most welcomed.

Thanks