EBITDA coverage ratio helps in determining the capability of a firm to repay its loan and lease obligations timely and smoothly. Such a ratio is generally useful to evaluate the solvency of companies with high leverage. The idea of this ratio is that a firm should make enough money to maintain a profitable cash surplus while keeping its debt commitments.

It is a solvency ratio, and another name for this ratio is the EBITDA-to-Interest Coverage Ratio. Initially, bankers were the main users of this ratio. They generally used it at the time of leveraged buyout to determine if the new entity would be able to meet its debt commitments or not. Now, this ratio is also popular among analysts and investors to gauge the financial health of a firm.

Formula for EBITDA Coverage Ratio

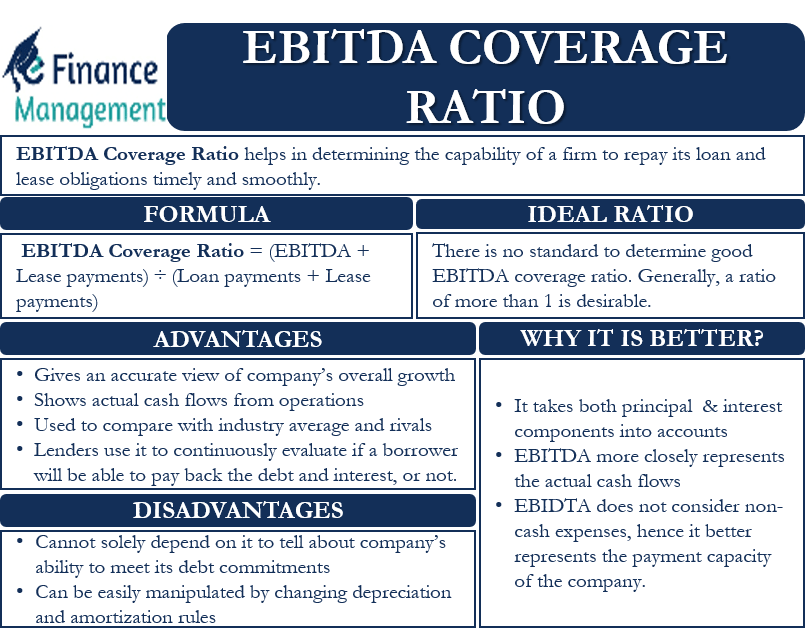

One simple way to calculate this ratio is to compare or map EBITA and lease payments against the sum of the loan and lease payments for the year under consideration. So, the formula for EBITDA Coverage Ratio is:

= (EBITDA + Lease payments) ÷ (Loan payments + Lease payments)

EBITDA, as usual, means the earnings before interest, taxes, depreciation, and amortization.

And the loan payment here includes both interest and principal payments. The lease payment figure should be the minimum lease payout.

We add back lease payments to EBITDA because when we calculate EBITDA, we subtract lease payments or charge the lease payments to the profit and loss account to derive the earnings. Hence, by adding it back, we get a firm’s ability and earnings before making such lease payments.

Also Read: Asset Coverage Ratio

The following example will help in better understanding the calculation for this ratio.

Company A has an EBITDA for a year of $550,000. Its loan and lease payments for the year are $250,000 (including $50,000 interest payment) and $50,000, respectively.

Now, putting the values in the formula, we get: ($550,000 + $50,000) ÷ ($250,000 + $50,000). The answer here is 2.

A ratio of 2 means that Company A would be able to meet its loan and lease payment commitments comfortably.

This ratio is also known as the Cash Flow Coverage Ratio.

EBITDA Coverage Ratio – Benefits and Drawbacks

Talking of its benefits, this ratio gives an accurate view of a company’s overall growth. Moreover, it also shows the actual cash flows that a firm generates from its operations. One can also use this ratio to compare it with the industry average and rivals. This would give a better idea of where the company actually stands. Also, this ratio comes very handily in the case of leveraged buyouts. Lenders also use this ratio to continuously evaluate if a borrower will be able to pay back the debt and interest or not.

Coming to drawbacks, one can not solely depend on this ratio to tell about the company’s ability to meet its debt commitments. Another drawback is that this ratio largely depends on EBITDA, but this profit number may sometimes fail to reflect the actual cash flows.

One can easily manipulate this ratio by changing depreciation and amortization rules. Also, when it comes to comparison, one must compare it with companies in the same industry and of the same size.

Also Read: Coverage Ratio and its Types

How Much is Good?

As such, there is no standard to determine what a good EBITDA coverage ratio is. Generally, a ratio of more than 1 is desirable as it suggests that the firm has enough funds to pay its debts and leases.

Also, a higher number is preferable to a lower one. This is because a higher number is a good indicator of a firm’s solvency in the long run. And a lower number suggests issues with the company in paying debt and lease commitments.

However, we should not forget that having a ratio of more than 1 is the guarantee that the firm will keep its commitments. It is only an indication that the debt and lease payments should not face any issues because this ratio does not consider any investment requirements, like the need to buy a fixed asset or an increase in working capital requirements, blockage of money with debtors, or in other areas.

Similarly, a ratio of less than 1 is not always bad. Usually, big manufacturing companies have high leverage and a low EBITDA coverage ratio. But, such companies do generate enough cash flows to meet their debt commitments.

So, though normally, a ratio of greater than one is considered good and reasonable. However, this ratio varies from industry to industry. For example, a law firm and a manufacturing firm would have very different ratios. This is because a law firm would have no or very little debt, while a manufacturing firm would have high debt.

Even if a firm has a high ratio, it should always make efforts to bring it down. One can better the ratio by lowering the debt and loan balances. Also, restructuring the debt to get a lower interest rate loan will help in improving the ratio.

One can also reschedule the debt to go for a longer period debt. This would help to reduce the monthly outflow. Increasing cash flows by boosting revenues and lowering overheads would also help in improving the ratio.

EBITDA Coverage Ratio – Why It is Better?

There are two other ratios used to judge the debt payment status of the company. These are Interest Coverage Ratio and Fixed Charge Coverage Ratio. However, a larger view is that the EBIDTA coverage ratio is a better indicator than those two other similar ratios. The Interest Coverage Ratio determines the ability of a firm to pay its interest commitment from EBIT (earnings before interest and taxes). And the fixed charge coverage ratio analyses a company’s ability to pay the non-principal debt from earnings before interest, taxes, and fixed charges.

On the other hand, the EBITDA coverage ratio takes into account both principal and interest components. Moreover, EBITDA more closely represents the actual cash flows. Moreover, since EBIDTA does not consider non-cash expenses, hence it better represents the payment capacity of the company. Since any firm pays its loans and leases from its cash flows, thus, this ratio gives a better picture of the solvency of a business.

Final Words

EBITDA Coverage Ratio is one of the best metrics to determine a firm’s financial stability and payment status. Moreover, this ratio is of most interest to the lenders who look to see that their borrowings are repaid timely. Since this ratio considers cash flows (and not operating profit), it gives a realistic picture of a company’s (borrowers) solvency. However, one should not solely depend upon it; instead, use other metrics to arrive at a decision.

Frequently Asked Questions (FAQs)

There is no standard to determine what a good EBITDA coverage ratio is. Generally, a ratio of more than 1 is desirable as it suggests that the firm has enough funds to pay its debts and leases.

The formula for EBITDA Coverage Ratio: (EBITDA + Lease payments) ÷ (Loan payments + Lease payments), where the loan payment here includes both interest and principal payments, and the lease payment figure should be the minimum lease payout.

The EBITDA coverage ratio is better because it considers both principal and interest components. Moreover, EBITDA more closely represents the actual cash flows.