A company is a legal entity that is formed by an association of people for the conduct of business activities to make profits. The two main types of companies are public limited companies and private limited companies. Before highlighting the differences between private vs public companies, let us learn what are these.

What is a Public Company?

A public limited company is a company that is listed on a recognized stock exchange of a country. Its shares can be bought or sold by the general public. It means that the general public becomes the shareholders of the company and are the owners and have a proportionate claim to the assets and profits of the company.

What is a Private Company?

A private company is not listed on any stock exchange, and hence, its shares are not traded publically. A small group of people generally hold their shares. They make the bulk of the contribution to the company’s capital. Also, the rewards in the form of profits are shared within the group only. It is also known as a privately held company.

Differences between Public vs Private Company

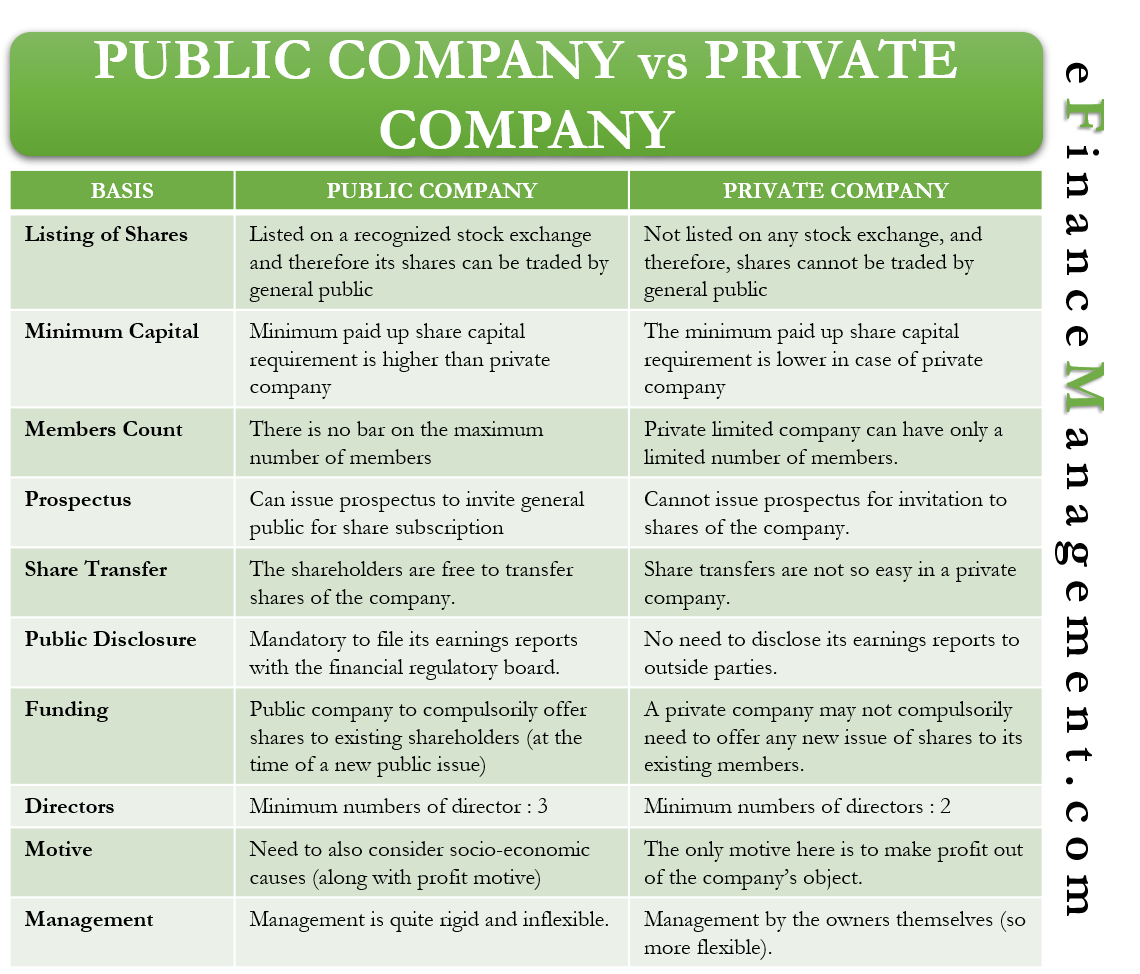

The main differences between a public company and a private company are:

Paid-up Capital

The minimum paid-up capital requirement of a public company is higher than that of a private company.

Number of Members

A private limited company can have only a limited number of members. But there is no such upper limit on the number of members in a public company.

Also Read: Privately Held Company

Issue of Prospectus

A public company can issue a prospectus to invite the general public for subscribing to its shares. While a private company cannot issue a prospectus inviting the general public to subscribe to its shares.

Transferability of Shares

Transferring shares is not so easy in a private company. But, in a public company, shareholders are free to transfer the shares anytime as per their choice and will.

Reporting Requirements & Regulations

A public company offers its stock to the public at large, it comes under the regulations umbrella of the Securities & Exchange Commission (SEC). Thus the regulations applicable to such companies are very stringent. In case of any discrepancy in compliance, the SEC keeps an eye on such public companies. This is not the case with privately held companies. Privately held companies are independent and have a greater level of freedom when it comes to regulatory requirements.

Public Disclosure and Scrutiny

A public company with shares trading on a recognized stock exchange mandatorily needs to file its earnings reports with the financial regulatory board of the respective country. It may be monthly, quarterly, or annually (as required by the regulatory board). Also, public companies go through intense scrutiny from the public, investment analysts, and even the press. And all these people can attend its annual general meetings.

Also Read: Corporation

A private company need not disclose its earnings reports to outside parties as they do not trade on any stock exchange. Also, they are free from the scrutiny of the press or the general public.

Sources of Funds

There are fairly fewer sources of funds available to a private company. A private company can only approach private investors (angel investors/ venture capitalists) to raise equity capital. However, they may face a scarcity of funds as they have limited resources at their disposal for raising further funds. In contrast, a public company can sell a block of its authorized share capital in the stock market to raise equity capital.

Moreover, the debt available to a privately held company is limited to bank loans and other forms of loans. On the other hand, a public company can raise the debt by issuing debentures, bonds, commercial papers, etc., for sale in the market.

Size

Public companies are always large companies with substantial market capitalization and usually have millions of dollars in revenue. On the other hand, privately held companies can be small or large in size. It can be the small mom-and-pop store around the street or a corporate giant such as Mars Incorporated.

Valuation

It is much easier for a market analyst or an investor to value a public company. The reason is a lot of data about a public company is readily available from financial reports, proxy statements, technical data of the stock price, historical data, etc.

On the other hand, the valuation of a privately held company is extremely difficult. Chiefly due to the limited availability of information on a privately held company. To process the company’s valuation, an analyst has to ask for all the data from the organization’s management.

Appointment & Requirements for Directors

In the case of a public company, a minimum of three directors are essential, and they have to go through several formalities. Also, they are ineligible to vote or take an active part in any discussions with regard to a contract in which they have any interest. All such restrictions are not there for the directors of a private company. Also, the minimum number of directors for their functioning is two.

Structure

A public company can only have the structure of a corporation. Corporations whose shares are traded publically have a board of directors to manage and advise the company. Conversely, a privately held company can be in any form of business such as a sole proprietorship, partnership, limited liability partnership, private limited company, etc.

Motive

The main motive of a private company is to make profits. Thus, their interest is only in those economic activities that provide excellent and steady return prospects. The ultimate motive in the case of public companies also remains to earn profits and maximize the shareholder’s wealth. However, since they have to face public scrutiny, they also have to work for socio-economic causes along with profit-making objectives.

Autonomy of Management

Management of a public company is very rigid and inflexible as they have to abide by the government’s rules, regulations, and policies. There are red-tapism and delays in decision-making sometimes. It may result in a loss of business. A public company has to constantly justify each of its decision to market at large. This makes any decision-making process lengthy and complicated for the management of a public company. Moreover, the level of control over the company also reduces as they can’t take high-risk decisions without an effect on share prices.

On the other hand, private companies are managed by the owners themselves or managers elected by them. The elected representatives are answerable only to very few people and have few rules and regulations to follow. Hence, decision-making and implementation are swift. Also, private companies reward innovative practices and ideas, which act as a booster.

Availability of Information

A lot of data about any public company is available publically. This is mainly because the disclosure requirements for a public company are higher than for a privately held company. Apart from the primary data, that is, financial statements, a lot of secondary information is also available about a public company, including historical stock price data, technical & fundamental reports, other analyst reports, etc. All this data helps investors make investment decisions.

On the other hand, a privately held company is completely opaque, there is absolutely no information available publically sensibly so because the public doesn’t need information about a privately held company.

Conversion between the Public and Private Company

The main motive for the conversion of a private company into a public company is the need for more capital or funds in most cases. A business needs funds to expand its production and market and make more investments in fixed capital and human resources. A shortage of money may hinder growth as private companies have limited avenues for raising capital. Therefore, a private company can opt to go public. After conversion as a Public company, it can conduct an initial public offering (IPO) and raise funds from the general public by way of the issue of shares.

A public company can also convert into a private company, but the process is much more complicated. It is so because suddenly, it will do away with all the public disclosures and scrutiny. Such companies can hire an appropriate PE (Private Equity) firm that can buy most of the outstanding shares of the company. The PE firm will then have to ask the regulatory body of the country to delist the company from the stock exchange.