What is a Stock Exchange?

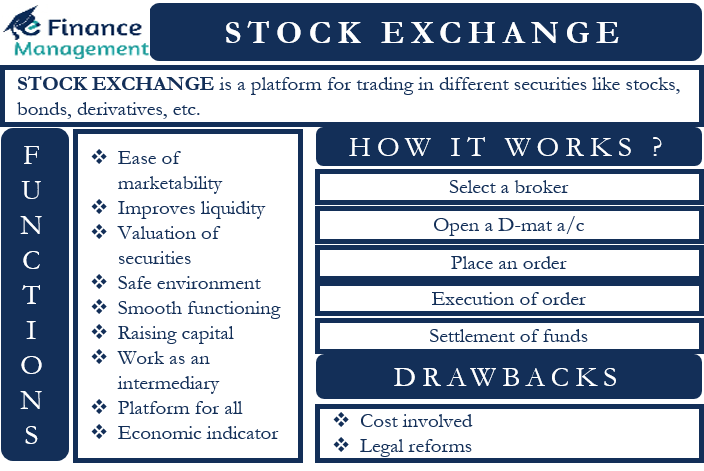

It is a platform where people can sell or buy different securities such as stocks, bonds, derivatives or options, futures, etc. Moreover, the shares of the company which is to be traded in any stock exchange should be listed on that particular exchange. So, for example, if you want to purchase shares of any company, then that company should be listed on the stock exchange. Or else you won’t be able to make the transaction. Therefore, any company willing to list its shares and arrange for public subscription enters the primary market through Initial Public Offering (IPO). Thru IPO, the company invites the public to subscribe to its shares and become shareholders of the company. Stock exchange helps to trade for securities. Further, it also helps to determine the prices of shares based on demand and supply.

The capital market has two active divisions:

- Primary Market

- Secondary Market

The primary market involves the issue of new securities. Whereas the secondary market deals with the buying and selling of those securities already listed and having public shareholding. The secondary market is also known loosely as the stock market or stock exchange, where routine trading occurs.

How does a Stock Exchange Work?

In the stock exchange, all the transactions happen amongst the shareholders and not with the company directly. Suppose a trader wants to trade in any particular stock, then he will have to buy the shares through a stock exchange platform. So, the trader will not purchase the shares from the company directly. But he will buy from the other shareholders who want to sell their securities floating in the market. A stock exchange provides the facility of buying and selling any commodity, bonds, options, etc. All the transaction recording takes place digitally and therefore is a seamless process without any obstacles.

These stock exchanges charge their fees for each trade and that is their primary source of income. Additionally, some of the stock exchanges have their certifications and courses through which they earn income. The other source of their income is the Membership Fee. All the trades can occur through an authorized member of that particular stock exchange. All these members are called the Brokers. And they earn brokerage from their clients for all the trades taking place thru them.

Steps involved in the trade of Securities

Selection of a Broker/Sub-broker

First and foremost, the trader/investor needs to select a registered broker because transactions can be done only through a broker/sub-broker. The broker could be an individual, company, bank, or any institution registered under that country’s securities commission or regulator to conduct the trading of securities.

Dematerialized or Demat Account

Trading in electronic form is the standard practice now. Hence, an investor/trade needs to open a D-mat account to trade in securities which will be held in his account in electronic form. A broker can help you in opening the same with any of the depositories.

Orders

You can place the orders online on your own, or you can instruct the broker offline about the transaction. The broker would issue a confirmation slip once the order is executed.

Execution of the order

The broker carries out the execution of the order. He then issues a contract note within 24 hours specifying all the details of the transaction made, including brokerage charges and money payable or receivable from the client.

Settlement of funds

The last step involves the actual transfer of securities and settlement of funds between the buyer and seller. As agreed upon, either on-the-spot settlement is done, or forward settlement takes place on some future date through the selected broker.

The stock exchange plays a crucial role in reducing the risks and speculations related to the securities market. Each exchange authorities have its own set of rules and system for smooth working and timely settlement of funds. Stock Exchange works as a clearinghouse for all transactions related to the transfer of securities and funds between the brokers. Brokers, in turn, carry out the settlement with their clients.

Functions of Stock Exchange

Ease of Marketability

Stock exchanges have their own rules that everyone needs to follow to carry out trade in a fair manner. It ensures the safety of the transactions, which take place a huge amount daily. Otherwise, the investors will be skeptical and won’t feel comfortable transacting in securities on the exchange. The stock exchange regulates the flow of transactions, thereby making the marketability of shares quite easier. One can divest and reinvest conveniently in this ongoing market.

Improves Liquidity

The main function of any stock exchange is to provide liquidity to its traders and investors as they know that they can convert their securities into cash anytime without any hassle. The sale of securities can be made with a single notification. So, the liquidity is enhanced with the availability of more cash.

Valuation of Securities

Securities of different companies can be valued at current market prices. These prices and their performance can further be tracked/compared via various indexes. Price determination and fluctuation occur in line with the demand and supply situation of the security/stock.

Safe Environment

The legal framework ensures the safety of transactions. In the US, the Securities and Exchange Commission (SEC) does the job of governing and regulating the stock exchanges. In India, the Securities and Exchange Board of India (SEBI) does this job of governing and regulating.

Smooth Functioning

The virtual medium of the stock exchange improves the quality of transactions. It leads to the smooth functioning of the securities market. Investors are encouraged to invest, considering the benefits it offers.

Raising Capital

Stock exchanges are an important means to raise initial capital through an IPO.

Work as an Intermediary

It is important to note that stock exchanges themselves don’t buy or sell securities on anyone’s behalf but only provide a marketplace/platform to carry out trade smoothly. The exchange also has a uniform system of payment and settlement, which makes it all the more hassle-free and reduces the risk of price movements in any share. They have their own integrated management information system in which all the necessary information is entered related to a particular trade. This helps the exchanges keep a record of all the transactions taking place and regulate it properly.

Platform for all

A stock exchange is a place for all kinds of participants like hedgers, investors, speculators or traders, etc. All these participants operate as per their interests. For example, a speculator will only trade in shares to influence the price movements in stocks, whereas an investor will invest in stocks for long-term investment. Many people make investments in the stock market with little financial knowledge without being fully aware of the mechanism of how it works. Stock exchange protects the investors from financial losses and ensures a fair medium of trade. They also regularly conduct Investor Awareness and Educational Exercises.

Economic Indicator

Stock exchanges are not only the marketplace for traders to buy or sell any security but also act as the barometer of the economy. It means that generally, the stock exchange works concerning the happenings in the economy. For example, if a construction company has won a contract, its shares will automatically go up and thus lead to a rise in its share price. Simultaneously if the economy is performing well, that means that more and more people will be willing to invest in the stock market. So if a stock exchange is not performing well, it automatically means that people are skeptical about the economy, and the economic conditions may not be good.

Drawbacks

Along with all these advantages that any investor enjoys, there are certain drawbacks that no one can escape from.

Cost Involved

There are certain costs in the process of listing any stock over the stock exchange, which may be quite high for companies having a smaller capital base.

Legal Reforms

Apart from this, there are various types of rules and regulations that traders need to follow that sometimes it becomes difficult or burdensome to freely carry out trade.

Final words

Stock exchanges are the most prevalent medium for day-to-day trading and making transactions in today’s world as the inclination towards the stock market is significantly increasing. It is becoming crucial to regulate these exchanges properly to ensure smooth and timely completion of transactions while protecting everyone’s interest. Some of the biggest stock exchanges are the New York Stock Exchange, London Stock Exchange, Tokyo Stock Exchange, etc.