Inventory Cost as Expense

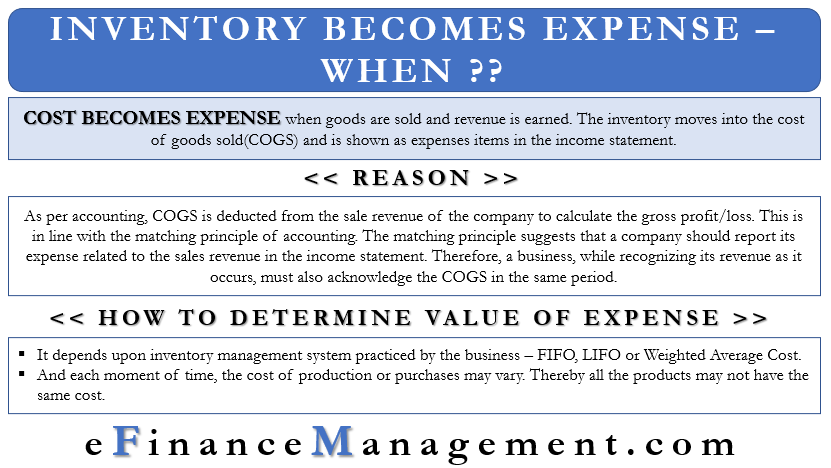

The cost of the inventory becomes an expense when a business earns revenue by selling its products/ services to the customers. The cost of inventories flows as expenses into the cost of goods sold(COGS) and appears as expenses items in the income statement.

When a business sells its product/service, the cost of the product is calculated by aggregating the cost of inventory and other expenses incurred to make it ready for sale. These costs include holding costs, ordering costs, etc. Thus, the company records the cost of the product as the cost of goods sold (COGS) in the income statement or profit and loss statement.

Accounting for Inventory Cost as Expenses

Business usually incurs a high cost at the various stages to produce the goods for selling to the customers for ultimate consumption. All those costs sum up as the cost of goods sold(COGS). To calculate gross profit, deduct COGS from the sales revenue of the company. COGS as a deduction from the sales revenue is in line with the matching principle of accounting. The matching principle suggests that a company should report its expense related to the sales revenue in the income statement. Therefore, while recognizing its revenue as it occurs, a business must also acknowledge the COGS in the same period. It is for offsetting the expenses from the sales revenue to determine the profit or loss.

A business usually manufactures products or buys products/services for retailing and distribution. Therefore, for retailers, the product cost is the cost price or the purchase price of the product unless they incur any more specific costs to bring the product to the saleable condition. Hence, usually, the inventory account reflects the cost of the product purchased until sales take place.

Also Read: Inventory Costing

Understanding through Example

On a personal level, suppose you receive your salary paycheck for $500 and deposit it in your checking accounts. Then, this deposit amount will remain as an asset in your bank account till you spend it. In other words, there are no expenses until you spend this amount. And it will continue as an asset.

Likewise, in the commercial world, until a business sells its products, there is no cost of the product. Moreover, no adjustment can happen in the inventory account to show as cost of goods sold. No transfer can take place as inventory cost or as the cost of goods sold to the income statement.

How to Derive the Inventory Cost as Expense?

As we know, a business continues to make production or purchases as per the supply requirements. So inventory build-up happens at various points of time though it is a continuous affair. And each moment of time, the cost of production or purchases may vary. Thereby all the products may not have the same cost. Therefore, we need to derive the cost of goods sold for the quantity sold to be taken as an expense.

It depends upon the inventory costing method practiced by the business. The accounting entries happen following that system. Following are the three methods that a business organization generally uses for inventory costing and recording the costs:

Thus, these methods help valuation the inventory taken out of the inventory account.

Some Exception

Ideally, if a business has no sales of products or services, it cannot have the cost of goods sold. The purchase or acquisition cost related to the products/service is recorded in the inventory account. It reflects in the balance sheet as the current assets. But in some circumstances, some cost is attributable to the cost of goods sold even if there are no sales. These costs may be the periodic cost that does not directly relate to products or services.

For example, some production-related cost such as rent occurs, even when there is no production of goods/services or situation like a union strike. In these circumstances, the business may report these costs as COGS even if a business reports no sales for the year.

Frequently Asked Questions (FAQs)

When a business sells its product/service, the cost of the product is calculated by aggregating the cost of inventory and other expenses incurred to make it ready for sale. Thus, the cost of the product is recorded as the cost of goods sold (COGS) in the income statement or profit and loss statement.

Inventory is recorded under the heading of Current Assets on the asset side of the balance sheet.

a) Cost of conversion

b) Cost of purchase

c) Both

c) Both the cost of conversion and cost of purchase are included in inventory cost.