Permanent Account: Definition

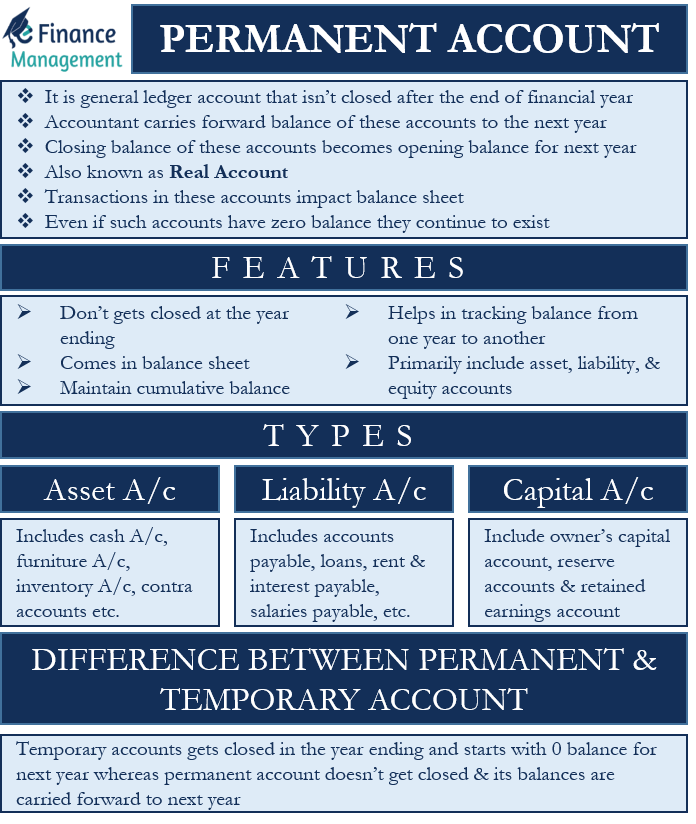

A permanent account is a general ledger account that isn’t closed after the end of a financial year. Instead, an accountant carries forward the balance in these accounts to the next year. The ending balance in these accounts becomes the opening balance for the next year. For instance, the closing balance of the inventory account becomes the opening inventory balance for the next year.

Another name for these accounts is real accounts. We can say that such accounts continue over the lifetime of the company.

Auditors usually give more time to such accounts during audits. This is because the transactions in these accounts impact the revenue or expense and, eventually, the balance sheet. Since these are usually balance sheet accounts, they help in determining the financial position of a firm at a specific point in time.

Features of Permanent Account

Following are the features of a permanent account:

- We don’t close these accounts at the end of the year.

- These accounts mainly come in the balance sheet.

- Such accounts maintain a cumulative balance.

- They help in tracking the balance in an account from one year to another.

- Such accounts primarily include asset, liability, and equity accounts.

Types of Permanent Accounts

Usually, all the line items in the balance sheet are permanent accounts, such as assets and liabilities. The only exception to this is the owner’s drawing account, which is a temporary account. Even for a non-profit organization, all the assets, liability, and net asset accounts are its permanent accounts. Following are the types of permanent accounts:

Asset Accounts

These accounts include cash accounts, furniture accounts, inventory accounts, and more. Moreover, contra-asset accounts, including Accumulated Depreciation, Allowance for Bad Debts, are also examples of permanent accounts.

Liability Accounts

It includes Accounts Payable, Loans, Rent and Interest Payable, Salaries payable, and more.

Capital Accounts

These include the owner’s capital account, reserve accounts, and retained earnings accounts.

Example of Permanent Account

Let’s consider an example to understand how a permanent account works.

Suppose the cash account had a balance of $10,000 at the end of 2020. This balance would be carried forward to next year, which would be the opening balance for 2021.

Now, if the company received $15,000 cash in 2021, then the closing balance will be $25,000. This again would be the opening balance of next year, i.e., 2022. This cycle will carry on as long as the company exists.

How is it Different from Temporary Account?

A retained earnings account is an excellent example to explain the difference between a permanent and temporary account. Retained earnings are permanent account, but it is closely linked with temporary accounts.

In every accounting period, the balances in the temporary accounts, including the revenue and expenses account, are moved to another temporary account, the income summary account. Then at the end of the accounting year, accountants close the income summary account and move its balance to the retained earning account.

Also Read: Closing Entries

Unlike temporary accounts, accountants don’t close the retained earnings account. Rather, the accountants carry forward the balance to the next year to keep track of the profit or loss of the earlier years.

So, this is the primary difference between permanent and temporary accounts. We always close temporary accounts at the end of an accounting year by passing closing entries, and next year, these accounts start with a zero balance. On the other hand, we carry forward the balance in a permanent account to the next accounting period.

Can They Have Zero Balance?

It isn’t important for such accounts to have a balance. Even if such accounts have no transactions in a year or their balance is reduced to zero, then also these accounts continue to exist.

However, an accountant can periodically review such accounts to determine whether or not there is a need for such accounts. Or, if possible, they can combine these with other accounts to reduce the number of accounts.