Temporary Account: Definition

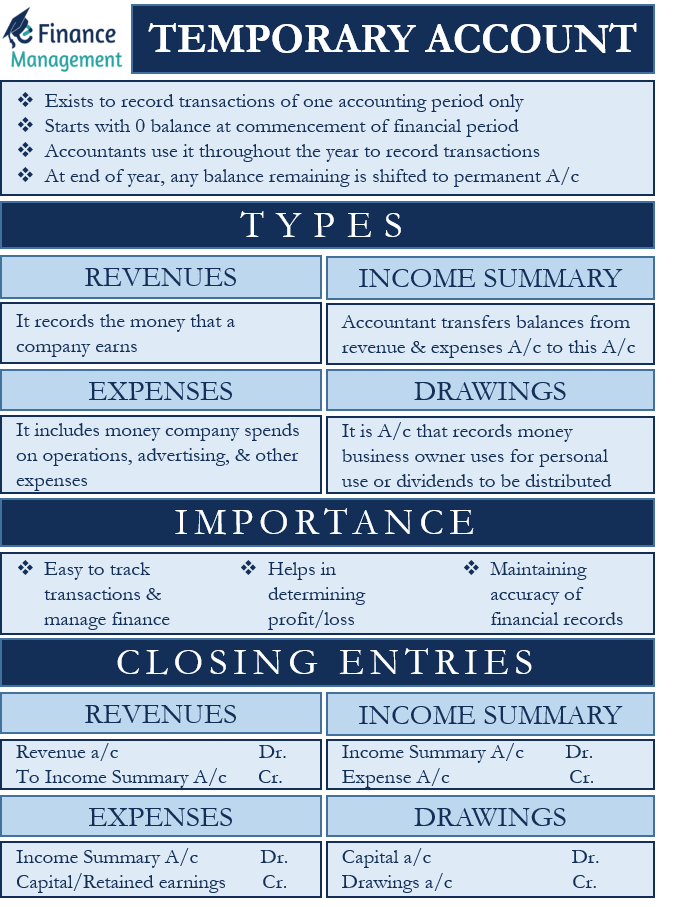

Temporary Account, as the name suggests, is an account that exists to record the transactions of one accounting period only. Such an account starts with a zero balance at the commencement of a financial period. Accountants use it throughout the year to record transactions. And, at the end of the year, any balance remaining is shifted to permanent accounts with the help of a closing entry. From next year, they (temporary accounts) are ready to be used again with zero balance at the start of the accounting year.

In simple words, we can say that these are the accounts of the items on the income statement, including revenue, expenses, etc. We usually know these accounts as ‘Nominal Accounts.’

Such accounts are ledger accounts that usually record the transactions that can impact the profit or loss during a year. Thus, these accounts help in the preparation of income statements. Usually, the balance in these accounts increases during a year. A drop in the balance is rare.

At the end of an accounting period, any balance in these accounts is moved to the retained earnings account. This process of transferring the account balance is referred to as closing an account.

Also Read: Closing Entries

Depending on their accounting norms, a company can maintain these accounts either year-to-year, quarterly, or monthly.

Types of Temporary Account

Primarily there are four types of temporary accounts. Most of the line items that a company uses fall under these types of temporary accounts. Following are the types of temporary accounts:

Revenues

It records the money that a company earns. To close this revenue account, an accountant needs to post a debit entry for the total revenue balance. And a corresponding credit entry needs to be posted to the income summary account. A few examples of this account are discount income account, short-term investments, etc.

Expenses

It includes the money that a company spends on operations, advertising, as well as other expenses. An accountant transfers the closing balance in this account to the income summary account by crediting the expense account. A corresponding debit entry is made to the income summary account. Salaries expense account, purchase account, etc. are a few examples of expenses accounts.

Income Summary

An accountant transfers the balances from the above revenue and expenses account to this account. This account helps in the calculation of net income. Suppose an accountant transfers $10,000 from the above Revenue account and $3,000 from the above Expense account; it would result in a net income of $7,000 in the income summary account.

An accountant also needs to transfer this net income into a permanent account as income summary is a temporary account as well. The balance in the income summary account is transferred to the capital account by posting a credit entry to the capital account and a corresponding debit entry to the income summary account.

Drawings or Dividends

It is the account that records the money a business owner uses for personal use. It is not exactly a temporary account because we don’t transfer its balance to the income summary account. Instead, we transfer its balance to a capital account by crediting the amount to it. For instance, if the drawings account has a balance of $2,000, then the accountant needs to debit $2,000 from the drawings account and give a credit of $2,000 to the capital account.

Importance of Temporary Account

The objective of maintaining such accounts is to make it easy to track the transactions, manage the finances of a firm, as well as help, determine the profit or loss that a business is making. It helps in maintaining the accuracy of the financial records as well.

For example, assume a firm makes revenue of $20,000 in year 1 and $15,000 in year 2. If there were no temporary accounts, then the company would carry over the year 1 balance to year 2. Thus, the revenue balance at the end of year 2 will be $35,000. Such a figure doesn’t give accurate information about the revenue that a company made in year 2. Moreover, it could complicate taxation issues as well.

Thus, to avoid such issues, it gets crucial to maintain temporary accounts. Such accounts can help separate the economic activities of one year from another, resulting in accurate financial numbers.

Closing of Temporary Account

It is compulsory to close all the temporary accounts. To close the temporary accounts (revenue and expenses account), we need to pass the journal entries of transferring the balance in these accounts to another temporary account, called the income summary account. Also, we need to post the relevant journal entries for transferring the balance.

To close the revenue account, the journal entry will be:

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Revenue A/c Dr. | xxxx | |

| Income Summary A/c | xxxx |

To close the expense account, the journal entry will be:

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Income Summary A/c Dr. | xxxx | |

| Expense A/c | xxxx |

After closing these accounts, we need to prepare the income summary account using the closing balance of the other temporary accounts. We need to transfer the balance of the income summary account to the capital account, as well as post the journal entry for the same.

To close the income summary account, the journal entry will be:

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Income Summary A/c Dr. | xxxx | |

| Capital/Retained Earnings A/c | xxxx |

Finally, we need to close the drawings account. We need to move the balance of this account to the capital account or the retained earnings account.

To close the drawings account, the journal entry will be:

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Capital A/c Dr. | xxxx | |

| Drawings A/c | xxxx |

How is it Different from Permanent Account?

Unlike temporary accounts, permanent accounts continue to record transactions forever. These accounts are never closed as they continue to use the balance of the previous years. Moreover, such accounts may continue to exist throughout the life of the company.

Assets, liabilities, retained earnings, and equity are a few examples of such accounts. Another name for these accounts is real accounts.

Final Words

Temporary accounts prove very useful in ensuring the accuracy of financial records. Moreover, they help determine the profits or losses and give an idea of the accounting activities in a financial year. Thus, it becomes extremely crucial to correctly classify an account as temporary. This is because any error on this part could reduce the company’s asset base.