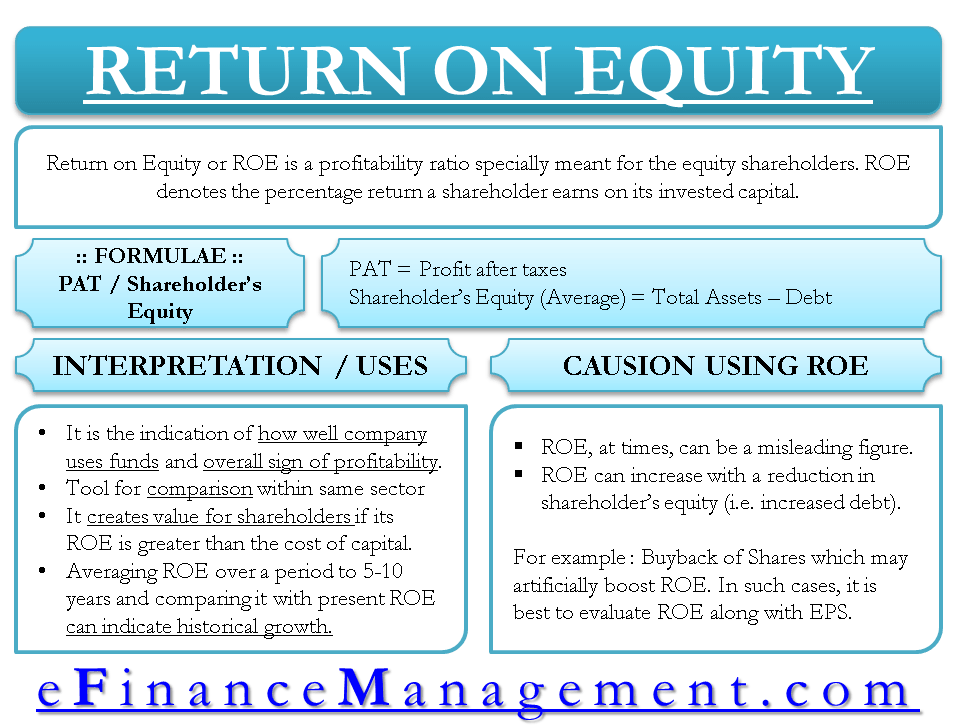

Return on Equity or ROE is a profitability ratio specially meant for the equity shareholders. It is expressed in percentage (net profit/shareholder’s fund * 100). ROE denotes the percentage return a shareholder earns on its invested capital. We can also call it return on invested capital.

ROE Formula

Return on Equity = Profit after Tax / Shareholder’s Equity * 100

Profit after Tax: The numerator is the profit after deducting the costs, depreciation, tax, and dividends given to preference shareholders (but before deduction of dividends paid to common equity holders).

Shareholder’s Equity: Shareholder’s equity can be calculated in various ways. Firstly, average shareholder’s equity, i.e., the average of the opening equity at the start of the financial period and closing equity at the end of the financial period. Secondly, if new shares are issued or brought back during the year, the weighted average of the no. of shares and their respective investment value per share can be used.

Looking at a company’s income statement, the assets of any company are financed by either debts or equity or a combination of both. Thus,

Shareholder’s Equity = Assets – Debt

Thus, return on equity can also be expressed as Profit after Tax / (Total Assets – Debt) * 100.

Read more about other types of PROFITABILITY RATIOS

Illustration Showing ROE Calculation

Below is a sample of financial figures for ABC Co. Ltd. for FY 2011-12.

All figures are in USD,

| Particulars | Amt. |

|---|---|

| Net Profit after Tax | 18,000 |

| Shareholder’s Equity | 60,000 |

| Current Liabilities | 10,000 |

| Non-current Liabilities | 40,000 |

| Total Assets | 110,000 |

Return on Equity = 18,000/60,000*100 or 18000/(110000 – 40000 – 10000)*100

= 30%

The above illustration demonstrates how return on equity is calculated. Here, for every dollar invested by investors in the equity of ABC Co. It generates a 30% return. This means that for every dollar of the investment amount, the creation of assets is 30 cents.

Interpretation and Uses of ROE

- Return on equity indicates how well a company uses shareholder funds, and it is also an overall sign of profitability.

- ROE can be a great tool to compare companies within the same sector/industry.

- A company creates value for shareholders if its ROE is greater than the cost of capital. If ROE is less than the cost of capital, the investors do not gain anything by investing in the company. On the other hand, there is always a risk of the company going bankrupt. Thus, any investor looking to invest in a company can use this ratio to analyze the estimated return.

- A comparison of changes in ROE from the beginning of the period to the end of the period can also be a good indicator for investors. Averaging ROE over a period of 5-10 years and comparing it with present ROE can indicate historical growth.

Caution While Using ROE Ratio

ROE, at times, can be a misleading figure. ROE can increase with a reduction in shareholder equity. If ROE increases due to a drop in equity which ultimately results in an increase in the company’s debt, it will expose the company to greater risk. For example, a company may issue a buyback of its shares which may artificially boost ROE. Thus, investors need to exercise caution while using the ROE ratio. In the case of buyback or issue of new shares, it is best to evaluate ROE and EPS, which can give a clearer picture of earning from equity.

Learn more about EPS

A more holistic version of ROE is the DuPont analysis, which gives the exact reason for a change in ROE value.