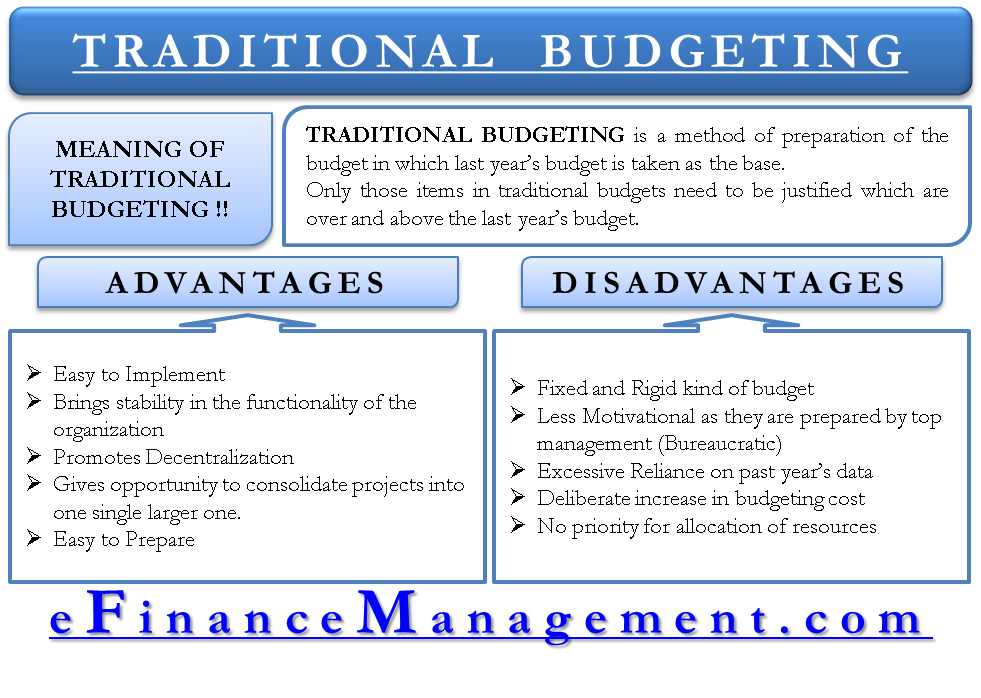

Meaning of Traditional Budgeting

Traditional budgeting is a method of preparing the budget in which last year’s budget is taken as the base. The current year’s budget is prepared by making changes to the previous year’s budget by adjusting the expenses based on the inflation rate, consumer demand, market situation, etc. Past year’s revenues and costs form an integral part of the current year’s budget. Only those items in traditional budgets need to be justified, which are over and above the last year’s budget.

This budgeting method differs from the zero-based budgeting method but is quite similar to the incremental one.

Advantages of Traditional Budgeting

The traditional budgeting method has various advantages as well as disadvantages. Let us have a look at its advantages first.

Implementation

It is easy to implement. Moreover can be prepared faster as not many changes are required in the previous year’s budget. This saves a lot of time and effort of managers.

Stability

This is an old budget preparation method, and most organizations are used to it. This brings stability to the functioning of an organization, as the financial activities are done with coordination, and everyone knows what needs to be done.

Decentralization

This budgeting helps in promoting decentralization in the organization, like in the case of banks. Any branch situated away from its headquarters can prepare a budget on its own and can make changes within the allowed limits.

Consolidation

The Traditional budget method gives the opportunity to consolidate various projects together into a single larger one. This helps improve the performance of those underperforming projects before they were clubbed with a good performing working project.

Ease of Preparation

These budgets are easy to prepare as they take the previous year’s budget as a base. Only changes are required to be made in last year’s budget as per the need of the current year’s budget requirements.

Disadvantages of Traditional Budgeting

After looking at the advantages, let us see some disadvantages of Traditional Budgeting:

Fixed and Rigid

Traditional budgets are fixed and inflexible. Once prepared, these budgets cannot be changed. Many factors like a new competitor in the market, change in policy, change in market conditions, etc., may take place, yet the budget stays the same.

Lesser Motivation

Traditional budgets are prepared by the top management by making a few changes to last year’s budget. Therefore, it promotes bureaucracy. So other people in the organization feel ignored or unimportant. This acts against the motivation of the employees of the organization.

Also Read: Zero Based Vs. Traditional Budgeting

Excessive Reliance

Traditional budgets rely excessively on past-year budgets, which can prove fatal at times. If the past budgets are prepared with inaccuracy, the same would be carried forward to the current year’s budget and years to come. This would lead to the preparation of incorrect budgets for the organization, which can harm the company’s growth in the long run.

Deliberate Inflation

Managers may deliberately increase their budgeting costs and request the top management to allot them the increased cost without justifying such expense.

No Priority for Allocation of Resources

In traditional budgeting, the resource allocation depends on past levels. It does not prioritize any project that should be ranked higher according to its importance to the organization’s survival. This affects the profitability of the business.

I like one send me more