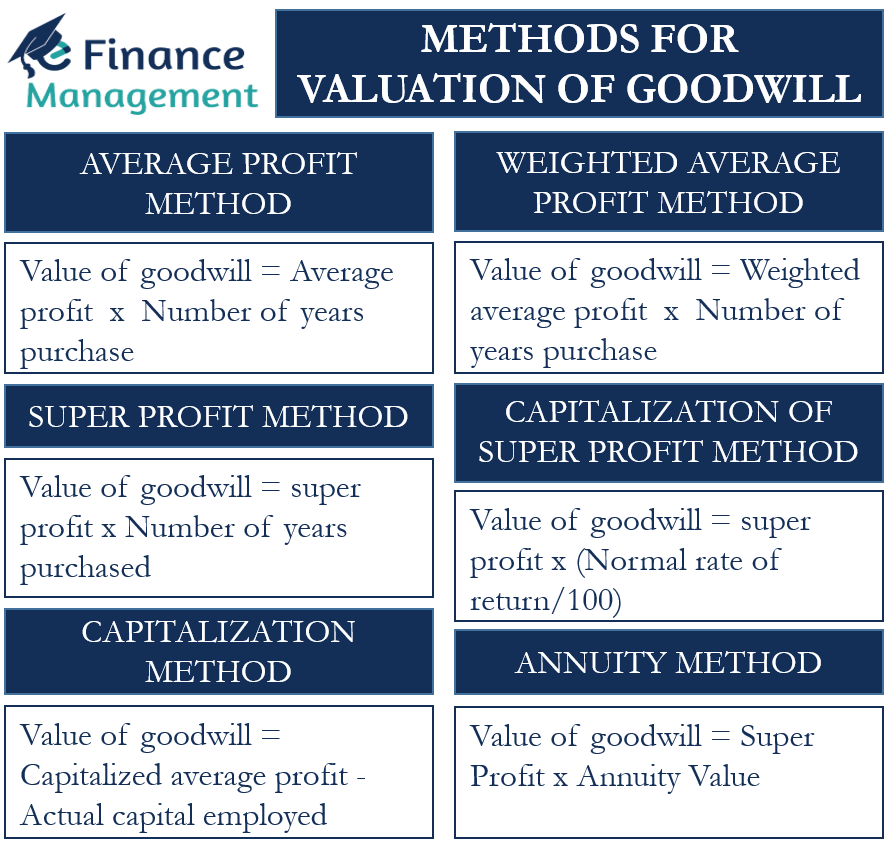

There are many ways for the valuation of goodwill. As we already know, the amount of goodwill is predicted or assumed because goodwill is an abstract item. We usually pay or receive money towards goodwill transactions. Except in the case of purchases, basically, the company or the entity does not make any direct investment to raise the goodwill. This is the perceived value of the brand/company based on its market performance, quality, and sustainability. Nevertheless, we can evaluate its value using different accounting methods of goodwill valuation; the methods for valuation of goodwill are:

- Average Profit Method

- Weighted Average Profit Method

- Super Profit Method

- Capitalization Method

- Capitalization of Super Profit Method

- Annuity Method

To better understand these various ways, let us discuss in detail all goodwill valuation methods one by one and see how the goodwill of the firm/company is calculated.

Average Profit Method

As the name itself suggest, in this method, the profit of the last few years is taken into consideration, then the sum of the profit is divided by the number of years to get an average profit. Now the question is how to know how many years profit should be considered and up to which year? So the answer to this question is that it depends on the parties, i.e., the buyer and the seller. Based on past performance and sustainability of future, agrees that how many years of profit should be taken to value the goodwill. The formula therefore is :

Average Profit = Total Profits For All Year / Number Of Years

To know the value of goodwill, we will now multiply the average profit by the number of years purchased, as agreed between the parties.

Formula for Average Profit Method

Value Of Goodwill = Average Profit x Number Of Years Purchase

Example: Average Profit Method

Let us see the example to know more about the valuation of goodwill

A Ltd. decided to purchase the business of B Ltd on 31/03/2021. The profit of B Ltd for last 3 years are as follows. And the parties decided that 3 years average profit should be the value of the goodwill.

Also Read: Accounting for Goodwill

| Year | Profit |

|---|---|

| 2018 | 4,00,000 |

| 2019 | 5,00,000 |

| 2020 | 10,00,000 |

The following additional information is given is provided.

An income of Rs. 2000 which cannot be expected in the future in the year 2020

Loss by fire was Rs. 1500 in the year 2019

Insurance premium of Rs. 3000 not paid (assumed in all the years)

| Particulars | Total Amount | |

|---|---|---|

| 2018 | ||

| Profits | 100,000 | |

| – Income not expected in future | 2,000 | 98,000 |

| 2019 | ||

| Profits | 5,00,000 | |

| – Loss by fire | 1,000 | 4,98,000 |

| 2020 | ||

| Profits | 4,00,000 | |

| Total profit | 9,96,500 | |

| Average Profit | 9,96,000/3 | 3,32,000 |

| – Insurance Premium | 3,000 | 3,29,000 |

Value of Goodwill = Average Profit x Number of Year Purchase

= 3,29,000 x 3

= Rs.9,87,000

Weighted Average Profit Method

This method is used when there is a rising trend in the profit as it is compared to trends and is assigned weights according to the trends. Here, the profits are multiplied by the number of weights assigned to them, and then they are summed up to get the weighted average profit. These weights are nothing but just numbers like 1,2,3,4 etc. The person who is evaluating the value can assign the weight as per their wish, but generally, the weights are assigned in ascending or descending order from the highest profit to the lowest.

Weighted Profit = Profit Of Year 1 x the Weight for Year 1+ Profit Of Year 2 x the Weight for Year 2, etc., and so on for each year of purchase.

Weighted Average Profit = Total Of Weighted Profit (profit*weights) / Number Of Years

Now, we will multiply this weighted average profit calculated above to the number of years purchased to get the value of goodwill.

Formula for Weighted Average Profit Method

Value Of Goodwill = Weighted Average Profit x Number Of Years Purchase

Example: Weighted Average Profit Method

The example of the following method of valuation of goodwill is given below. And the parties decided that goodwill value would be 3 years weighted average profit.

S.M Ltd has the following profit in the years mentioned below

| Year | Profits |

|---|---|

| 2018 | 10,00,000 |

| 2019 | 8,00,000 |

| 2020 | 13,00,000 |

Determine the value of goodwill using the weighted average profit method.

| Year | Profits | Weight | Weighted Average Profit Method |

|---|---|---|---|

| 2018 | 10,00,000 | 2 | 20,00,000 |

| 2019 | 8,00,000 | 3 | 24,00,000 |

| 2020 | 13,00,000 | 1 | 13,00,000 |

| Total Weighted Average | 57,00,000 |

Weighted Average Goodwill = 57, 00,000 / 3 = Rs.19, 00,000

Value of Goodwill = Weighted Average Profit x Number of Year Purchased

= 19,00,000 x 3

= Rs.57,00,000

Super Profit Method

In this method, the super profit calculation is done by deducting the normal profit from the average profit. The normal profit is based on the normal rate of return, and the super profit is the estimated profit in excess of the normal profit, or we say that super-profits are extra profits, i.e., more than normal profit. In stock market language, we can denote this as Alpha. The average profit is the adjusted profit. If there are some expenses and income to be adjusted, then it has to be added or deducted as per the requirement. If there is no excess/super profit above the normal levels of profits, then there will be no goodwill.

Also Read: Goodwill Calculator – Super Profit Method

Normal Profit = Capital Employed x (Normal Rate of Return / 100)

Super Profit = Actual or Average Profit – Normal Profit

Formula for Super Profit Method

Value Of Goodwill = Super Profit x Number Of Years Purchased

Example: Super Profit Method

Some of the examples of this method of valuation of goodwill are given below

Pharma Ltd wants to evaluate the value of its goodwill based on 3 years purchase of super-profits. The following information is given:

Capital Employed – 100,000

Normal Rate of Return – 10%

Average Profit – 50,000

Normal Profit = Capital Employed x (Normal Rate of Return / 100)

= 100,000 x 10/100

= Rs. 10,000

Super Profit = Actual or Average Profit – Normal Profit

= 50,000 – 10,000

= Rs. 40,000

Value of Goodwill = Super Profit x Number Of Years Purchased

= 40,000 x 3

= Rs. 1,20,000

Use Goodwill Calculator – Super Profit Method for quick calculation.

Capitalization Method

This method is used when normal profits are higher than the actual profit. Firstly we capitalized on the value of the business and then evaluate the value of goodwill.

Capitalized average profit = Average profit x 100/ Normal Rate of Return

Actual Capital Employed = Total Assets (Do not include non-trade investment, goodwill & fictitious assets) – Outside Liabilities

Formula for Capitalization Method

Value Of Goodwill = Capitalized Average Profit – Actual Capital Employed

Example: Capitalization Method

It can be further explained with the help of an illustration

XYZ Ltd is able to earn a profit of Rs. 85,000 with a capital investment of Rs. 7,00,000, and the normal rate of return is 10%. Determine the value of goodwill with the capitalization of profit method.

Capitalized Average Profit = Average profit x 100/ Normal Rate of Return

= 85,000 x 100/ 10

= Rs. 8,50,000

Value of Goodwill = Capitalized Average Profit – Actual Capital Employed

= 8,50,000 – 7,00,000

= Rs. 1,50,000

ABC Ltd. has the following information available, on the basis of this information calculate the amount of goodwill.

Average Profit – Rs.50,000

Sundry Assets (with non-trade investment of Rs. 35,000) – Rs. 4,50,000

Sundry Liabilities (excluding the firm’s capital) – Rs. 2,50,000

Normal Rate of Return –20%

Capitalized Average Profit = Average Profit x 100/ Normal Rate of Return

= 50,000 x 100/ 20

= Rs. 2,50,000

Actual Capital Employed = Total Assets – Outside Liabilities

= 4,15,000 (4,50,000-35,000) – 2,50,000

= Rs. 1,65,000

Value of Goodwill = Capitalized Average Profit – Actual Capital Employed

= 2,50,000 – 1,65,000

= Rs. 65,000

Capitalization of Super Profits

After the calculation of the super profit of other firms now, the firm, company, or organization needs to know how much capital they will require to earn a profit equal to the other firms. This is a kind of method used to know the profits of the competitors and work to increase our profits as much as our competitors and give them a tough fight in the market. The calculation is the same as in the Capitalization of Average profits, with the only difference being that instead of Average Profit, here we consider the Super Profits. It is calculated as follows.

Formula for Capitalization of Super Profits Method

Value of Goodwill = Super Profit x (Normal Rate of Return/100)

Example: Capitalization of Super Profits Method

For further understanding, let us see the example of valuation of goodwill as per super profit method.

Mohan & Sons Co. wants to know their goodwill with the following information.

Capital Employed – 30,00,000

Normal Rate of Return – 12%

Average Profit – 5,10,000

Determine the value of goodwill with Capitalisation of super profit method

Normal Profit = Capital Employed x (Normal Rate of Return / 100)

= 30,00,000 x 12/100

= Rs. 3,60,000

Super Profit = Actual or Average Profit – Normal Profit

= 5,10,000 – 3,60,000

= Rs. 1,50,000

Value of Goodwill = Super Profit x (Normal Rate of Return/100)

= 1,50,000 x 100/12

= Rs. 12,50,000

Annuity Method

This method of goodwill considers the ‘time value of the money.’ Annuity refers to the series of continuous cash flows of equal amounts that occur in every period over a particular time. It can be determined by the annuity table or the formula below.

Annuity Value = (1+r) n -1/r (1+r) n

Formula for Annuity Method

Value of goodwill = Super Profit x Annuity Value

Example: Annuity Method

Let us see some examples for a better understanding

Surya ltd has an average profit of Rs. 60,000, and the capital employed of the company is Rs. 3,00,000 with the expected normal rate of return at 15% and expected to maintain super profit for 6 years. Determine the value of goodwill using the annuity method by taking the present value of annuity Rs. 1 for the upcoming 6 years at 10% interest is Rs 4.46

Normal Profit = Capital Employed x (Normal Rate of Return / 100)

= 3,00,000 x 15/100

= Rs. 45,000

Super Profit = Actual or Average Profit – Normal Profit

= 60,000 – 45,000

= Rs.15,000

Value of Goodwill = Super Profit x Annuity Value

= 15,000 x 4.46

= Rs.66,900

Final Words

Thus there are several methods available and practiced to determine the expected value of goodwill. The goodwill is ultimately paid to earn greater than normal profits/volume etc. Any of these methods could be used for the purpose, which could apply to the industry and situation. The important point to note is that this is an indicative value, exact value can never be calculated as the past may not necessarily repeat in exactly the same way. So, finally, the value is decided through mutual discussions and acceptance. This mathematical calculation remains a reference point at best.

Your content is great. Thank you sir for sharing this article.