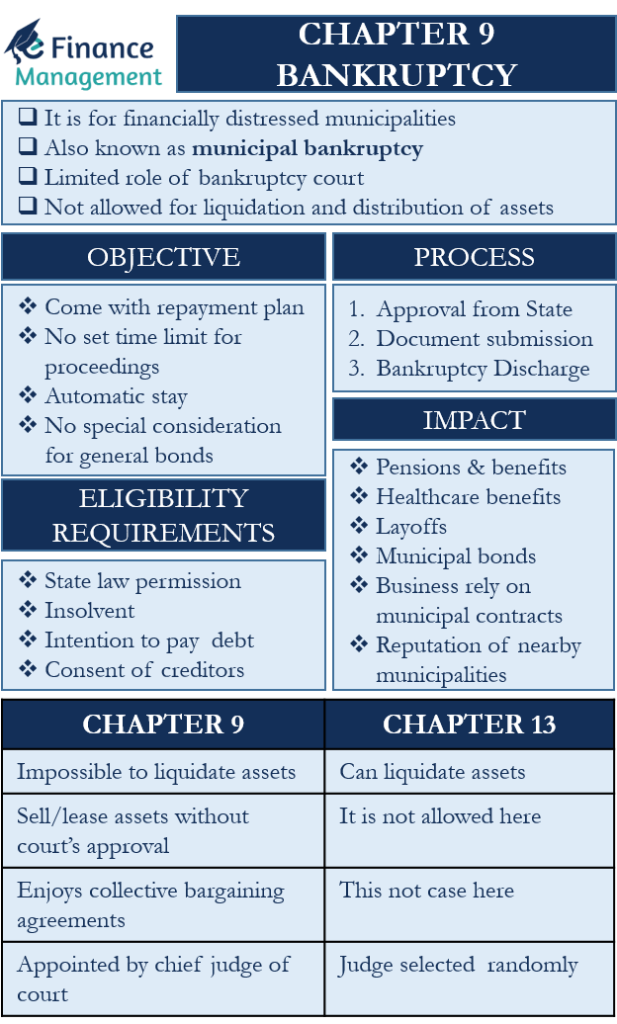

Chapter 9 bankruptcy protection is for financially distressed municipalities. This bankruptcy protection helps municipalities struggling financially to come up with a plan that is agreeable to the creditors to resolve the debt. Such bankruptcy protection can assist almost all types of municipalities, including townships, municipal utilities, school districts, counties, and more. This is also known as ‘municipal bankruptcy.’ This way, it allows the municipality to reorganize its debt and continue to serve the residents.

Chapter 9 bankruptcy is very different from other types of bankruptcy protection. In other types of bankruptcies, the creditors can force the entity to go for liquidation, attach and sell the assets. However, this is not possible in the case of municipal bankruptcy because there is no such law that can give a right to the creditors to call for liquidation and distribution of the assets of the municipalities to the creditors.

Unlike other types of bankruptcies, the bankruptcy court’s role is very limited in the case of Chapter 9. In such a bankruptcy, the court focuses mainly on approving the debt plan, as well as overseeing the execution of the plan.

Objectives of Chapter 9 Bankruptcy

The primary objective of this bankruptcy is to allow the municipality to come up with a repayment plan. The plan could include lowering the principal or interest rate or raising the term of the debt, or all. Additionally, the plan could also include getting a new loan to pay the previous debt.

Also Read: Chapter 11 Bankruptcy

Moreover, municipal bankruptcy proceedings do not have a set time limit. And the bankruptcy proceedings can carry on for a few months to a few years. The time period is actually linked to the complexity of the bankruptcy and the quantum of outstanding debt. Similar to other types of bankruptcies, this bankruptcy also triggers an automatic stay. This means as soon as the municipality files for bankruptcy, all collection actions against the municipality come to a halt or remain suspended.

A point to note is that there is no special consideration for the general obligation bonds from the municipality. This means the municipality can not pay the principal or interest on such bonds during the bankruptcy case. It can, however, offer a restructuring of such bonds under its bankruptcy plan. But, if there are special revenue bonds, the municipality may pay them even while the case is pending, provided special revenues are available.

Who Can File?

As discussed above, only municipalities have the right and they only can file for this bankruptcy. There are, however, a few more eligibility requirements that a municipality needs to meet to file for this bankruptcy:

- The state law should permit or authorize the Municipality to file for bankruptcy.

- The municipality needs to be insolvent.

- It should have intentions to execute a plan to pay the debts.

- It should have the consent of the creditors. Or, at least it should be able to prove that it made genuine efforts to negotiate with the creditors for an agreed settlement. Or, it was impractical to negotiate, and there is a reason to believe that a creditor may make efforts to get a preference.

Chapter 9 Bankruptcy Process

Approval from State

A municipality may not always have the authority to declare bankruptcy. They need to meet the eligibility requirements and get approval from the state. Usually, every state has its own process regarding this. For instance, some states give permission to the municipality to declare bankruptcy on their own.

Also Read: Bankruptcy – Chapter 13

And some states stress on municipalities to follow certain processes before filing for bankruptcy. For instance, states can ask the municipality to go for pre-bankruptcy activities, including negotiating with creditors. After the municipality meets those requirements, it can go for filing bankruptcy. If a municipality is unable to meet the state’s requirements, it will have to fight an objection to its Chapter 9 filing.

On the other hand, some states do not permit this bankruptcy at all.

Submission of Documents

After a municipality gets approval from the state, it can file for bankruptcy with the federal government. The filing will automatically trigger the automatic stay. At the same time, the municipality needs to come up with a plan to repay its debt. And, of course, the municipality needs to submit all the relevant documents for the purpose to the bankruptcy court.

Though the judge does not have the same level of powers in this bankruptcy that they have in other types of bankruptcies, they can still decide if the filing from the municipality is improper. A court may declare the filing improper if there is a valid objection from the creditor, the municipality was not insolvent, if the court believes the municipality has better options available, or if it has not gotten the proper approval from the state.

Bankruptcy Discharge

A municipality gets a bankruptcy discharge once the court confirms the plan. And, if there is a need, the municipality needs to deposit the funds or property with the disbursing agent that the court appoints.

Examples of Chapter 9 Bankruptcy

Orange County, California, filing for Chapter 9 bankruptcy in 1994 is a popular example of this bankruptcy. Heavy borrowing and risky investments forced Orange County to file for bankruptcy.

In 2011, Jefferson County, Alabama, filed for this bankruptcy protection primarily due to a terrible investment in a local sewer system. The county had about $4 billion in debt, and it had to negotiate with over 4,000 creditors.

Detroit, in 2013, became the biggest U.S. city to file for bankruptcy. The city had the biggest municipal debt, estimated to be between $18 billion to $20 billion (to over 100,000 creditors).

How does Chapter 9 Bankruptcy Impacts Society?

Municipal bankruptcy has the following impact on the society, including municipal employees, businesses, employment, and more:

- Pensions and benefits of the public employees may go down or end fully.

- Municipal employees may need to spend more to get the healthcare benefits.

- Hiring may stop, and there could be layoffs as well.

- A drop in the value of municipal bonds could lead to big losses for investors.

- Businesses that rely on municipal contracts may incur losses.

- The reputation of nearby municipalities may downgrade.

- Businesses may shift investments to other locations.

Chapter 9 vs. Chapter 13 Bankruptcy

The primary difference between the two is that Chapter 9 is for municipalities. And Chapter 13 bankruptcy is for households and individuals.

Another big difference is that it is almost impossible to liquidate assets under municipality bankruptcy. This is due to the fact that liquidating municipality assets would be in violation of the Tenth Amendment of the Constitution. In contrast, the court can liquidate the assets in case of Chapter 13 bankruptcy.

Moreover, a municipality can sell or lease its assets without approval from the court, even when its bankruptcy case is pending. Chapter 13 bankruptcy does not allow the selling or leasing of assets.

Moreover, municipalities do enjoy some power regarding collective bargaining agreements if it impacts the pensions and benefits of public employees. Additionally, municipalities also get the power to levy taxes as well as raise revenues during the bankruptcy.

In other types of bankruptcies, the bankruptcy judges are generally randomly selected. But, this is not so in municipal bankruptcy cases. Here the judge is appointed by the chief judge of the court of appeals for the circuit.

Final Words

Chapter 9 bankruptcy is not very common, and in fact, such cases are dropping. For instance, 2012 saw the highest number of bankruptcies, i.e., 20. The number has been dropping consistently since, and in 2020, there were just 4 municipal bankruptcies. Still, there is no denying that a municipal bankruptcy has far-reaching social and economic impacts with ripple effects.