APIC: Meaning

In accounting terms, APIC stands for Additional paid-in Capital. And it is an additional amount the investors are ready to pay above the par value of the stock. Therefore, the Issuance of APIC share capital occurs at the time of Initial Public Offerings (IPO) or Follow on Public Offer (FPO). In other words, it is a difference between the bidding values per share, bids made by the investors, and the par values per share, set by the issuing company. Thus it acts as an additional cash flow for the company, which the company in the primary market directly collects.

APIC is also known as Contributed Capital or Contributed Surplus. And the share price of APIC is not concerned with the market price of shares trading in the secondary market. Moreover, it is a fixed price, the decision for which takes place at the time of IPO or FPO of the company. Therefore, the creation of APIC share capital easily occurs every time the company issues new equity shares. And the company can also reduce the same by repurchasing the share capital already issued.

Companies, at times, intentionally keep the par value at a record low. Therefore, due to good market sentiments about the issuer company, the investors bid for higher prices, which ultimately gives birth to Additional Paid-in Capital. And it is recorded under the head ‘Stockholder’s Equity’ on the Liabilities side of the Balance Sheet. Moreover, the Issuance of Additional paid-in Capital can be done for both equity shares and the company’s preference shares.

Working of APIC

At the time of the Public Issue, the company decides on a par value for its stocks. Because statutory rules also provide for that the company issuing the shares has to decide and set the par value of each equity or preference share. The prospective investor often bids for a higher price than its par value. Moreover, several times even the issuer company also offers its shares at higher prices than the par value of those shares. This is how the generation of Additional Paid-in Capital occurs due to the difference between the par value and bidding value.

The current market price of a stock in the secondary market has no connection with APIC’s share price. Offer and collection of Additional Paid-in Capital take place directly with the company. In the case of already trading securities, the trade takes place between two different investors without the involvement of the issuing company. However, the difference paid between the investors does not add to APIC in the company’s books. It actually becomes the investment cost or sale value for the investors. It does not affect any way the books of the company.

Thus it is a profit earning opportunity for the company at the time of IPO or FPO process in the primary market only.

Example

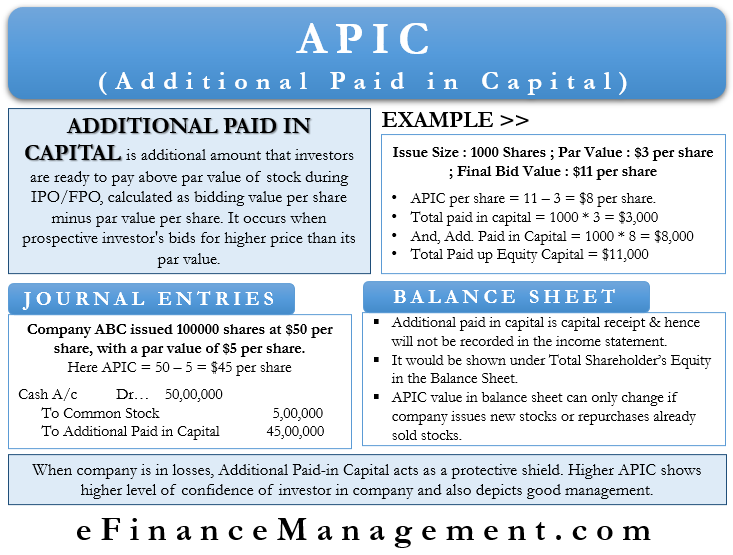

Total Issue Size: 1000 shares

Par Value: $3 per share

Bidding Values: $7, $9 and $11

Final Bid Accepted Value: $11

APIC per share = Final Bid Accepted Value – Par Value

= 11 – 3

= $8 per share

Thus Paid-in Capital of the company would be $3000 (1000*3), and the Additional Paid-in Capital of the company would be $8000 (1000*8). This makes a total issue size of 1000 shares for $11 per share and a total paid-up Equity Capital of $11000.

Additional paid-in Capital’s Accounting Process

Journal Entry of APIC

A ledger account is created for both Paid-in Capital/Capital Stock Account and Additional paid-in Capital in accounting books. While passing the Journal Entry of Additional paid-in Capital/Paid-in Capital over Par Value, the other two ledger accounts are affected, i.e., Cash Account and Common Stock Account.

Let’s take an example:-

Company ABC has issued 100000 shares at $50 per share, with a par value of $5 per share. In this case, Additional paid-in Capital would be $4500000 (50-5).

Also Read: Equity Share and its Types

Thus the Journal Entry would be as follows:-

| Particulars | Debit ($) | Credit ($) | |

|---|---|---|---|

| Cash A/C | Dr | 5000000 | |

| To Common Stock A/C | 500000 | ||

| To Additional paid-in Capital A/C | 4500000 |

As shown above, Cash Account would be debited by $5000000 as Cash received towards the issuance of equity stock. While Common Stock Account or Paid-in Capital Account would be credited with $500000, showing the par value of the stock, and Additional paid-in Capital Account will get credited by $4500000, premium amount, or the amount received over and above the par value of the stocks issued.

APIC in the Balance Sheet

Additional paid-in capital is not recorded in the Income statement at all. It is a capital receipt and not part of the operating activities. Hence, it is recorded in the Balance Sheet under the heading of Total Shareholder’s Equity. The Total Shareholder’s Equity continuously fluctuates because of changes in retained earnings due to profits or losses of the business during the year. But it cannot impact APIC directly or indirectly. It can only change if the company issues new stocks or repurchases the already sold stocks; moreover, if that money is used for the purpose and provided in the relevant rules of the company law applicable to the business entity.

Let’s understand the functioning of APIC in the Balance Sheet.

| Particulars | Amount ($) |

|---|---|

| Total Assets | 185 |

| Current Liabilities and Non-Current Liabilities | 30 |

| Shareholder’s Equity | |

| Common Stock | 30 |

| Additional paid-in capital | 70 |

| Retained Earnings | 80 |

| Accumulated Income/Loss | (25) |

| Total Shareholder’s Equity | 155 |

| Total Liabilities and Shareholder’s Equity | 185 |

Importance of APIC

Additional paid-in capital may have a higher or lower portion of the company’s Shareholders Capital, depending upon the difference between the issue price and par value. It may even be higher than the Paid-in Capital of the Company. Before the accumulation of retained earnings, APIC was a major component of the Stock of the company. When the company is in losses and retained earnings are in the negative, Additional Paid-in Capital acts as a protective shield.

It is also important because it shows the confidence of investors in the company and also depicts the good management of the company.

APIC Vs. PIC

Paid-in Capital (PIC) is the minimum amount the investors have to pay to acquire the company’s stocks. It is mainly the par value of the issued shares. On the other hand, Additional paid-in Capital (APIC), as the name suggests, is the extra amount paid by the investors over and above the par value.

Both these are part of Shareholder’s Equity and are shown on the liability side of the Company’s balance sheet. The contribution of PIC in the company’s Equity is very minimal compared to the contribution of APIC, depending upon how much premium value the company has been able to collect from the investors. Both of them hold an inverse relationship with each other. Based on the per-share price of PIC, the computation of the per-share price of APIC takes place.

Conclusion

Additional paid-in capital (APIC) is an important part of the Shareholder’s Equity of the company. It shows the confidence of investors or their sentiments concerning the management and working of the company or prospects of the company’s business. As per the government mandate, the bidding price of shares should not go below the par value, and thus APIC acts as a savior in such a situation. Accounting of APIC is also straightforward and important for the company. Moreover, the company can also repurchase or sell APIC if required.