Adjusted Trial Balance: Understanding the Concept

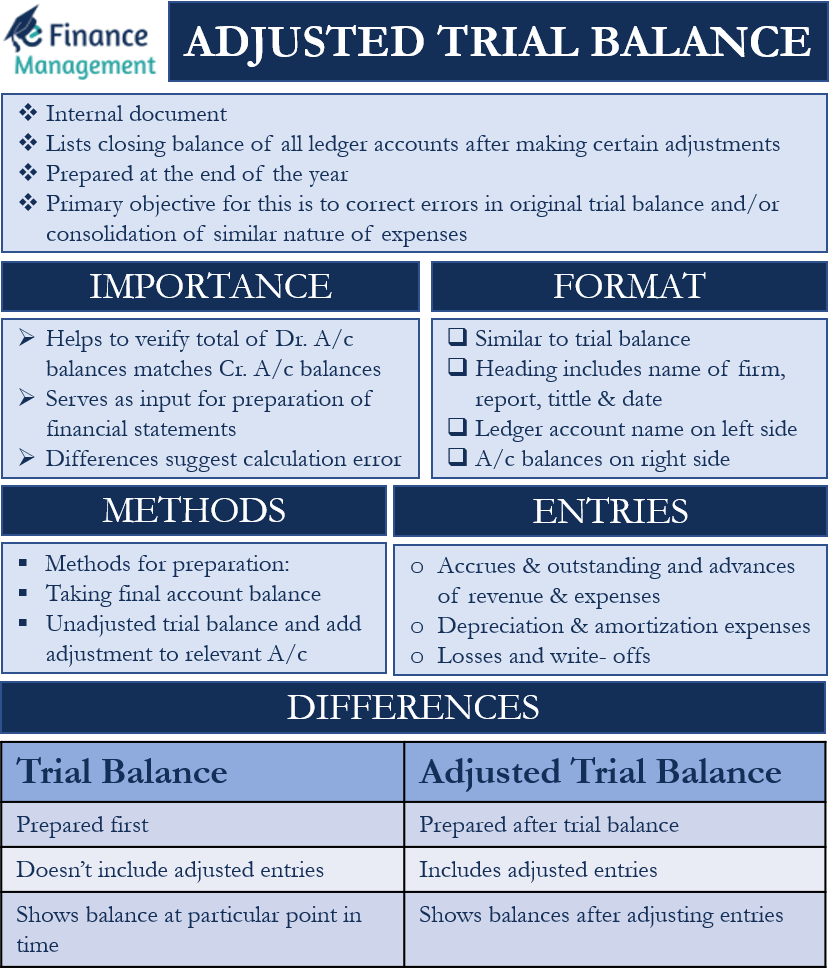

Adjusted Trial Balance is an internal document that lists the closing balance of all ledger accounts after making certain adjustments (if any) to those accounts. Or, we can say it is a trial balance that accountants prepare after posting the adjusting journal entries. Or, it is a trial balance that accountants prepare at the end of the year so that it reflects all adjustments during a year before the finalization of annual accounts.

There are lot many items for which final adjustment entries need to be passed at the year-end. These could be for accrued revenues, accrued expenses, deferred revenues, deferred expenses, depreciation or amortization expenses, write-off or write back, and so on. The primary objective of preparing such a document is to correct the errors in the original trial balance and/or consolidation of similar nature of expenses. The primary objective apart from is to bring or prepare the financial statements of the entity in compliance with the accounting frameworks, such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Let us not miss one important point here. While a trial balance and, for that matter, an adjusted trial balance is the starting point to initiate the preparation of annual financial statements. However, this trial balance is not part of the usual financial statements.

Purpose of Adjusted Trial Balance

Adjusted TB primarily serves three purposes:

- It helps verify that the total of debit account balances matches the credit account balances. As per accounting principles, totals of trial balances (of both sides -debit and credit) should match. If not, then the totals of the balance sheet will also not match.

- It serves as an input for preparing financial statements, especially the income statement and balance sheet.

- If there is any difference in the debit and credit column, it suggests an error in the calculations or in posting entries into the ledger accounts.

Format of Adjusted Trial Balance

The format of adjusted TB is very similar to the trial balance. For instance, it carries a heading that includes the name of the firm, report title and date. The name of the ledger accounts comes on the left side, and the account balances (debit or credit) comes on the right side.

A point to note is that the order in which the accounts list in the adjusted TB is also usually the same as they appear in the balance sheet and income statement. The order generally followed by the accountants is – assets, liabilities, equity, income, and expenses.

Such a type of presentation makes the financial statements more organized and easier to relate to. Moreover, it makes it easier for the managers to evaluate the impact of every adjustment on the financials.

Once an accountant lists all the account balances (after adjustments), they total the debit and credit columns. The total of both columns should match as we discussed above. If they are not, it means there is some error (or errors) in posting the adjusting journal entries.

Generally, preparing the adjusted TB is the last step before preparing the financial statements.

Methods to Prepare Adjusted TB

For the preparation of adjusted trial balance, there are mainly two ways.

The first way is the same as accountants prepare a trial balance. This means taking final ledger account balances (after posting adjusting entries).

The second method uses the unadjusted trial balance and adds the adjustments to the relevant accounts. Such a method is a quick way to prepare adjusted TB as only a few adjustments need to be made.

Also Read: Trial Balance

Nowadays, many software is available that makes it very easy to prepare adjusted TB, such as AccountEdge Pro, QuickBooks Desktop, Sage 50cloud accounting, etc.

Adjusted Trial Balance Entries

As said above, there are mainly the following types of entries that adjusted TB records:

- Revenue earned but not yet recorded. For example, accrued interest, accounts receivable, and more.

- Expenses incurred but not yet recorded in the books. For example, salaries and wages payable, interest payable, and more.

- Paying an expense before it is due. For example, prepaid rent, prepaid taxes, and so on.

- Depreciation and amortization expenses.

- Anything to do with any losses and write-offs like bad debts, etc.

Difference Between Trial Balance and Adjusted Trial Balance

There are primarily two differences between Trial Balance and adjusted TB:

- Accountants first prepare the trial balance and then the adjusted TB.

- TB does not include adjusting entries, including accrued expense, prepayment, depreciation, etc. Adjusted TB consists of all such entries.

- Trial balance lists the closing balances of the ledger accounts at a particular point in time. On the other hand, adjusted TB lists ledger account balances after posting the adjusting entries.

Example of Adjusted Trial Balance

Below is the trial balance of Company A as on 31st December, 2020.

| Item | Debit | Credit |

| Debtor | $75000 | |

| Rent | $25000 | |

| Salary | $15000 | |

| Cash | $20000 | |

| Sales | $95000 | |

| Purchase of Raw Material | $50000 | |

| Furniture | $20000 | |

| Loan from Bank | $70000 | |

Creditors | $40000 | |

| Total | $205000 | $205000 |

After the preparation of the trial balance, there were a few more adjusting entries. The salary due the staff is $25,000, and prepaid rent is $10,000.

Adjusting entry for outstanding salary will increase the balance in the salary account, and we will create a new outstanding salary account. The prepaid rent reduces the rent balance and increases the cash balance.

Now, let’s prepare an adjusted trial balance to account for the adjusting entries.

| Item | Unadjusted | Adjusting Entries | Adjusted TB |

| Debtor | $75,000 | $75,000 | |

| Rent | $25,000 | ($10,000) | $15,000 |

| Salary | $15,000 | $25,000 | $40,000 |

| Cash | $20,000 | $10,000 | $30,000 |

| Sales | ($95,000) | ($95,000) | |

| Purchase of raw material | $50,000 | $50,000 | |

Furniture | $20,000 | $20,000 | |

| Loan from Bank | ($70,000) | ($70,000) | |

| Creditors | ($40,000) | ($40,000) | |

| Outstanding Salary | ($25,000) | ($25,000) | |

| Total | $0 | $0 |