Leveraged Recapitalization: Meaning

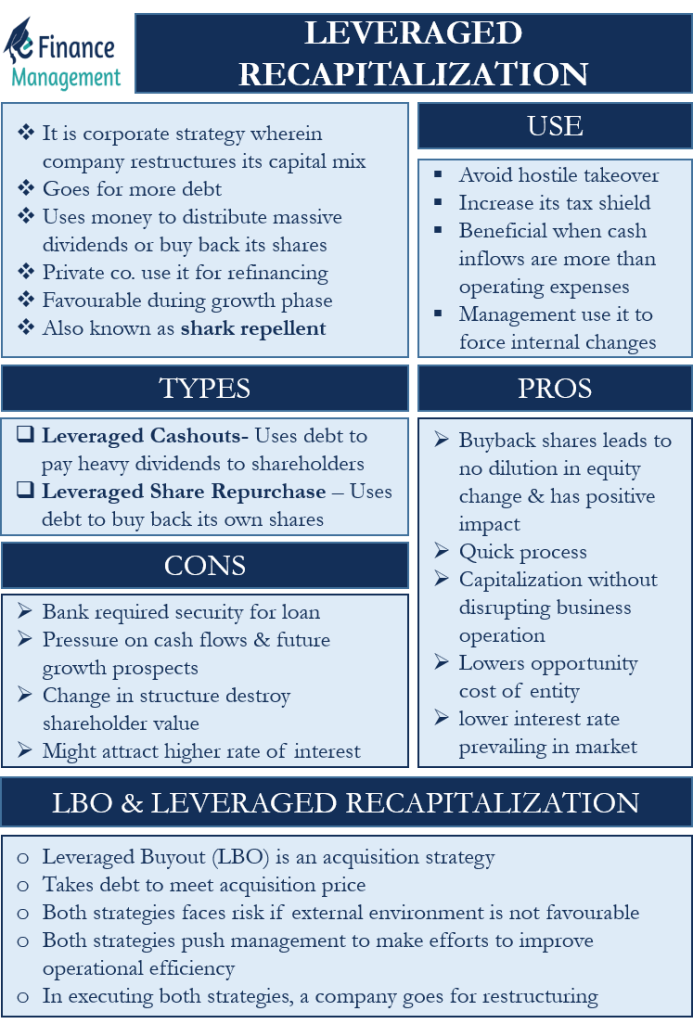

Leveraged Recapitalization is a corporate strategy wherein the company restructures its capital mix. As part of a restructuring, the company goes for more debt and thus arranges for additional cash. The firm does not use the money for a new or existing project but instead uses the money to either distribute massive dividends or buy back its own shares. So, such a recapitalization changes the capital structure of a company, i.e., lowers the equity and increases the debt. The fresh debt being arranged can be in the form of senior or mezzanine debt. Generally, privately held companies use this strategy for refinancing.

Such a strategy primarily prepares a firm for a period of growth. This is because such a strategy leverages debt, which is favorable to the company during the growth phase. A firm can use it proactively to deploy debt to boost performance and, in turn, shareholder value. That remains the ultimate objective of the corporates.

The firm sometimes uses this strategy to thwart or fend off any hostile takeover bid. This is because adding more debt would make the firm less appealing to the potential bidder. That is why we also call this strategy a ‘shark repellent.’

How the market will respond to the news of an entity using such a strategy depends largely on if the firm is defensive or proactive. Also, whether or not such a strategy enhances the market value of a company depends on how the market perceives the level of risk in the company’s new capital structure (after using this strategy).

Also Read: Recapitalization

Leveraged Recapitalization was very popular during the second half of the 1980s. However, most of such transactions were used as a defense to discourage hostile takeovers.

Types of Leveraged Recapitalization

Depending on the use of such a strategy, we can divide the leveraged recapitalizations into two types:

Leveraged Cashouts (LCO) – It involves using debt to pay heavy dividends to the shareholders.

Leveraged Share Repurchase (LSR) – It involves the use of debt to buy back the shares. The buyback will effectively increase the earnings per share due to a reduction in the total number of outstanding shares. Further, increased EPS will eventually, in the normal course, increase the traded price of the shares, even if the PE remains the same.

Uses of Leveraged Recapitalization

A company can use such a recapitalization for a variety of reasons:

- As said above, it is a popular strategy to avoid a hostile takeover. A target company becomes unattractive if it takes on new debt, and that too for non-productive purposes.

- A company can also use it to increase its tax shield. The interest payment on the debt lowers the net income of a company. And this reduces the tax liability of the company. To effectively plan and take maximum benefit of the tax shield, we can arrive at the debt-equity mix by using the Modigliani-Miller model. The general rule is more the amount of debt, the lower will be the tax liability. Such a strategy is more useful when a firm makes a big profit or has massive cash reserves.

- This recapitalization strategy also makes a company more financially leveraged. Financial leverage proves beneficial when the cash inflows are more than the company’s operating expenses.

- Management intentionally used such a strategy to create crises with the objective to force internal changes in the company.

Advantages and Disadvantages

These are the advantages of such a recapitalization strategy:

- If the firm uses the new debt to buy back its own shares, it increases its ownership. Thus, it helps an entity retain ownership control. Because despite the rise in the debt, there is no change in the equity quantum and no equity dilution. No dilution or change in the control has a positive impact on the shareholders.

- It is a relatively quick process as the owners usually just have to negotiate with the bank.

- An entity can do this capitalization confidentially, and that too without disrupting the business operations.

- Using a debt to buy back shares or pay old debt lowers the opportunity cost of an entity. This is because the company will now not have to use its own profits to pay the old debt or buy back its own shares.

- It will also allow the entity to take advantage of the lower interest rate prevailing in the market.

Below are the disadvantages of this type of recapitalization:

- Banks will require security or personal guarantees for extending additional loans.

- Mezzanine and senior debt will increase the financial reporting requirements for the company.

- Taking on more debt can put pressure on the cash flows and future growth prospects.

- If a company takes on a huge debt, it will change its capital structure. This could risk the company’s growth prospects and may destroy the shareholder value.

- Additional loans, looking to the financial status of the company, may attract a higher rate of interest as compared to what is prevailing in the market.

Leveraged Buyout and Leveraged Recapitalization

Leveraged Buyout (LBO) is an acquisition strategy. In this strategy, a company takes on more debt to meet the acquisition price. Both (LBO and Leveraged Recapitalization) the strategies result in a similar structure and significantly up the financial leverage. Thus, in both strategies, companies face risk if the external environment is not favorable. Also, entities become more vulnerable to sudden shocks or a recession.

Talking about the positives, both types of strategies push the management to make efforts to improve operational efficiency. This is because improving operational efficiency can help the company in meeting interest and principal commitments. Or, we can say that the management strives hard to ensure it meets all its debt and principal commitments without compromising its growth.

Generally, after executing both strategies, a company goes for restructuring, where it sells assets (useless) to lower the debt amount. Unlike LBOs, a company going for leveraged recapitalization remains a public company.

Final Words

Leveraged Recapitalization is a corporate finance strategy that has several uses, including creating a tax shield and preventing hostile takeover. Such a strategy changes the capital structure of a company by adding more debt and thus, makes it more leveraged. On the other hand, such a strategy could prove risky if the company is unable to meet its commitments (interest and principal) due to external or internal factors. How the market or the investors view, this strategy depends primarily on how they assess the risk level with the company after executing this strategy.