What is Total Return Swap?

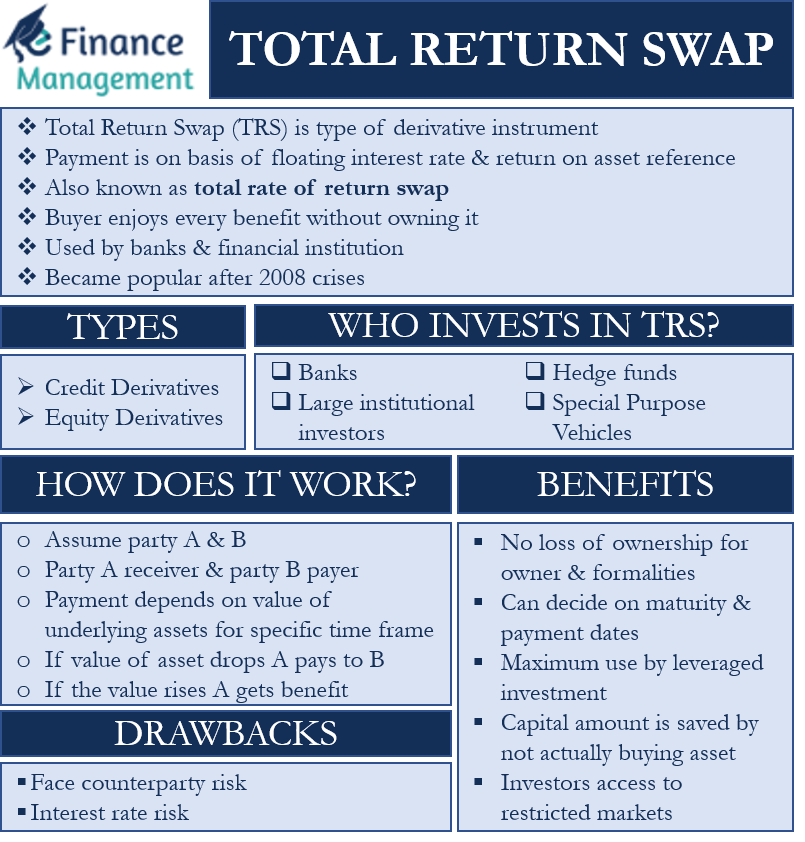

A Total Return Swap or TRS is a type of derivative instrument. In this, one party pays the money on the basis of a floating interest rate and receives the payment on the basis of the return of the reference asset. The reference asset could be a bond, equity index, basket of securities, and more. We can say that the parties need to make payments to each other on the basis of the performance of the underlying asset or instrument. Another name for this swap is the total rate of return swap.

The best part of such a swap is that a holder or buyer enjoys all the benefits of this or in other words, gets the exposure to any asset or instrument, without actually owning it. The holder, however, will continue to remain exposed to the price and default risk. Moreover, the other party gets a protection cover against any likelihood of value decline in the asset. And the other party gets protection against the decline in the value of the asset. This results in greater flexibility and reduces upfront capital to carry trade.

Banks and other financial institutions use such swaps for managing their cash outlay with minimum cash outflow. Such swaps, however, have become more popular lately following the increase in regulations after the 2008 financial crisis.

Types of Total Return Swap

The total return swaps are of two types:

Credit Derivatives

In this type of TRS, the underlying asset is debt, such as a bond, loan, MBS (Mortgage-Backed Securities), and more. Such TRS helps a party to minimize its credit risk.

Also Read: Types of Swaps

Equity Derivatives

In this, the underlying asset is equity, an index, or a basket of equities. The total return in this type of derivative depends on the change in the price of the asset, dividends, commissions, and more.

Who Invests in Total Return Swaps?

Initially, such swaps were mainly between commercial banks. And, in most cases, one bank that has already exhausted its balance sheet size would transfer its assets to another bank, whose balance sheet still has some room to accommodate assets.

Now, many large institutional investors take part in the TRS. These institutional investors could be commercial banks, insurance companies, investment banks, govt., pension funds, and more. In addition, SPVs (Special Purpose Vehicles), including REITs, can also participate in the TRS market.

Presently, hedge funds and SPVs are the biggest players in the TRS market. They use these swaps for leveraging balance sheet arbitrage. For instance, a hedge fund that wants exposure to a specific asset can lease it from big institutional investors, such as investment banks. This would allow the hedge fund to leverage its investment and earn a return from the asset without owning it.

On the other hand, institutional investors would be able to earn additional income in the form of regular LIBOR-based payments. They also get protection against the drop in the value of the asset.

How does it Work?

In a TRS, there are two parties – the payer and the receiver.

Let us assume those parties to be A and B. Party A, which is the receiver, gets the money from Party B, which is the payer. The payment is always linked or depends on the rise in the value of the underlying asset. And that too over a specific time frame. And, Party A needs to make a payment to Party B if the value of the asset drops during that time frame. We call such an investment a synthetic investment.

In a TRS, the party receiving the return will get any income that the asset generates during the contract period without actually owning the asset or basically without any major investment. Moreover, for any rise in the value of the asset, the same party will get the benefit. So, the return to the receiver would be interest income (if any) plus any rise in the asset’s value.

In exchange, the receiver needs to pay the owner of the asset the base interest rate, such as LIBOR-based interest, during the contract period. Though the first party (receiver) does not get exposed to the risks related to the asset, it gets exposed to the credit risk associated with the asset. For instance, if the price of the asset drops during the contract period, the receiver will have to pay the owner of the asset an amount equal to the value that the asset loses.

So, we can say that the asset owner (or payer) gets protection from the receiver for any decline in the asset value. In return, the payer agrees to give the receiver all positive returns from the asset. The receiver, in exchange, promises to pay regular payments on the basis of a floating interest rate.

Example of Total Return Swap

Assume two parties A and B enter into a one-year TRS contract, where A is the receiver and B is the payer. The underlying asset, in this case, is the Standard & Poor’s 500 Index, and the principal amount is $10 million. B’s payment will depend on the LIBOR rate plus a margin of 2%.

After the end of the year, suppose the LIBOR rate is 2.5% and the S&P 500 rises by 10%. In this case, A will get 10% and pay 4.5% (2.5% plus 2%). So, the net income for A will be: $0.55 million [10 million * (10% less 4.5%)]

Now suppose the S&P 500 drops by 10% after one year and the LIBOR rate is the same at 2%. In this case, A will not get anything, rather will have to compensate B for the drop in the value of the underlying asset. So, B will get 10% plus 4.5%. The total return for B will be: $1.45 million [$10 million * (10% + 4.5%)]

Benefits and Drawbacks of TRS

Most benefits of TRS are in regards to operational efficiencies. These benefits are:

- The receiver does not have to worry about any formalities that are there with the transfer of ownership.

- The owner of the asset does not have to give up the asset ownership.

- Both parties can decide on the maturity date and the payment dates.

- The maturity date of the TRS contract does not need to be the expiry date of the underlying assets. That means the TRS can expire even before the expiry of the underlying asset. But TRS has to have validity only up to the expiry period of the underlying asset.

- It allows the receiver to make maximum use of their investment by going for leveraged investment.

- The receiver does not have to part away with a significant amount of capital to buy the asset.

- It could give investors access to restricted markets.

Following are the drawbacks of a TRS contract:

- Parties in a TRS contract face counterparty risk. If the value of the underlying assets continues to drop, the receiver may default on its commitments if it does not have adequate capital. Such a risk gets magnified in the case of hedge funds because of their high secretive nature and their treatment of such assets as off-balance sheet items.

- Parties are also prone to interest rate risk. The payment from the receiver depends on LIBOR. Thus, any upward or downward movement will result in a change in the payment for the payer.

Final Words

A Total Return Swap is a popular derivative instrument. It allows an investor to earn a return from an asset without actually owning it. And, on the other hand, it gives the asset owner protection from any downward movement in the asset price. Also, it ensures a steady stream of income for the asset owner depending on the floating interest rate.