What is the Accounting Cycle?

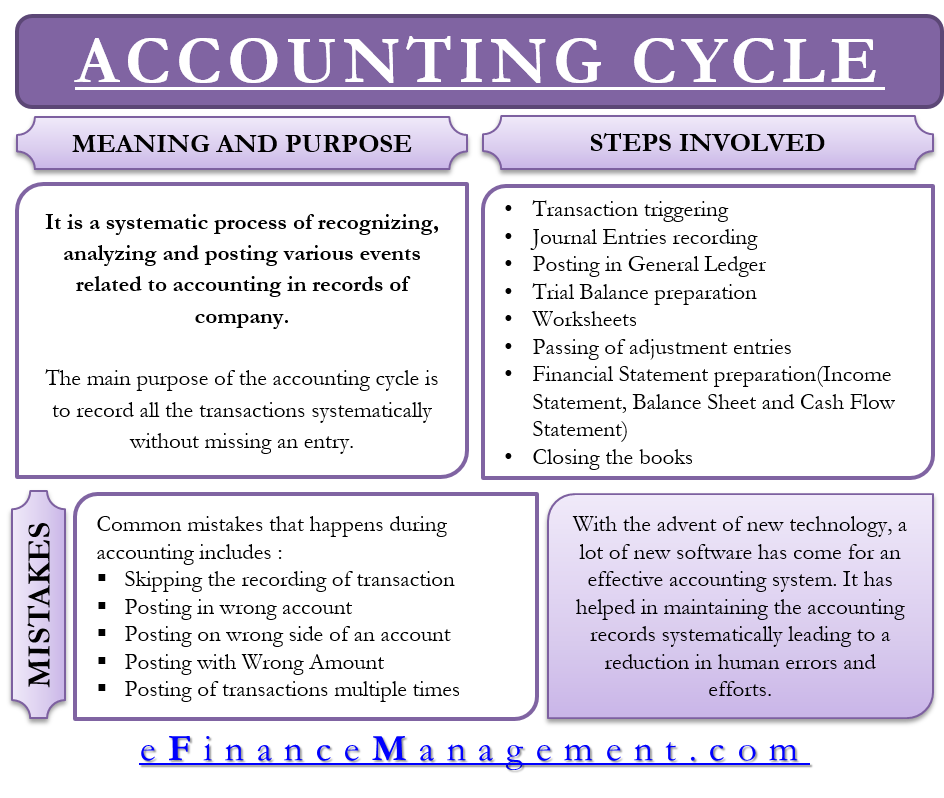

The person maintaining the accounting cycle defines it as a systematic process of recognizing, analyzing, and posting the various events related to accounting in the records of the company.

The accounting cycle initiates with the occurrence of the transaction and ends with its recording in the necessary statements of the company. The accountant maintains the records related to the accounting of the company in the general ledger and trial balance. It basically reflects the historical events and transactions related account.

Thus it is a holistic approach beginning with when the transaction takes place, recording it in relevant documents, and closing the accounts by the end of the accounting year. Here, the role of a bookkeeper is very crucial in maintaining the records of the accounting cycle.

Purpose of Accounting Cycle

The main purpose of the accounting cycle is to record all the transactions systematically without missing an entry. It leads to the accuracy of all financial records. The accountant prepares the financial statements considering accounting records and cycles.

Also Read: What is Accounting Period?

So it acts as a stepping stone or base for financial statements.

Process of Accounting Cycle

The accounting cycle involves a systematic process. It begins when an accounting transaction occurs in a company, and the need arises for its recording. Hence, the accounting cycle begins with recording transactions and posting its journal entries in the general ledger. With the completion of the posting of entries in the general ledger, the accounting person prepares an unadjusted trial balance.

The main aim of the trial balance is to confirm the total debits with total credits. After these adjusting entries are made to make certain corrections. On completion of posting adjusting entries, an adjusted trial balance is prepared, followed by financial statements.

Read more about What is Debit and Credit.

Steps Involved in the Accounting Cycle

The accounting cycle involves a systematic process which is as follows.

- Transaction

- Journal Entries

- Posting in General Ledger

- Trial Balance

- Worksheets

- Adjusting Entries

- Financial Statements

- Closing the Books

- Transaction

The accounting cycle starts when the transaction takes place. Until and unless you have any transaction, the accounting cycle will not start. It includes all the financial transactions like paying interest or receiving interest, revenue, or expenses.

Journal Entries

Once the transaction takes place, it is important to record it. So the next step in the accounting cycle is to record the transaction in the journal of the company in sequential order. Debiting and crediting one or more accounts since debit and credit balance should be the same

Posting in General Ledger

After doing the journal entries of the transaction, the accountant posts entries to an individual general ledger where one can summarize all the transactions related to that account. These general ledgers are graphically represented in T accounts.

Trial Balance

At the end of the accounting period, the accountant prepares the trial balance from the journal ledger, which helps calculate the total balance of an individual account.

Worksheets

The rule is that the debit balance should tally with the credit balance. If it does not tally, it is crucial to identify the errors and rectify them to tally the balances. The accountant uses worksheets to execute this.

Adjusting Entries

After completing the worksheets, the accountant posts adjusting entries for accruals and deferrals in the accounts.

Financial Statements

The accounting person prepares the financial statements like the income statement, cash flow statements, and balance sheet after the final correct balances,

Income Statement

The most important item in the income statement is the revenue from sales. The concerned person deducts all the operating expenses from sales value to find out the operating profit. Then, from the operating profit, they deduct other expenses to find out the net profit of the year.

Balance Sheet

The balance sheet records the assets and liabilities of the company. It is important that the balance of assets aligns with the balance of liabilities.

Cash flow Statement

The cash flow statement is important as it records all the cash-related items. There are major three activities that come under the preparation of a cash flow statement, namely operating activities, financial activities, and investing activities.

Closing the Books

In the end, the accountant closes accounts related to revenue and expenses. For such purposes, they pass closing entries. Preparation of the financial statements and recording, analyzing, and summarizing all the transactions come under the purview of closing the books. They reflect the position-specific to the accounting year. The concerned person makes the accounts nil for the next accounting year. Further, a new accounting year will start, and the accountant will repeat all the steps related to the accounting cycle mentioned above.

To understand the accounting cycle effectively, it is important to have basic knowledge of main accounting principles like the matching principle, revenue recognition principle, and accrual principle.

Mistakes Conducted during the Accounting Cycle

It is very crucial to account all the money coming into or going out of a company. And hence balancing is critical in the accounting cycle. However, on account of some errors, while recording the transaction, the trial balance does not get tally. So the concerned person of accounting adjusts the trial balance to match the debit and credit balance.

Some of the reasons that lead to account imbalance are:

- Skipping the recording of a transaction

- A wrong account is used to post a transaction

- Posting the transaction on the wrong side, i.e., debiting instead of crediting and vice versa

- The transaction with the wrong amount

- Entries are posted multiple times

If these errors are taken care of, the balance will always get tally

When the Accounting Cycle is Taken into Account?

Accounting period is the base for starting and completing the accounting cycle. After this, the financial statements are prepared. The financial year and the period during which the entities are required to submit their financial statements to reporting authorities are taken as the basis for maintaining the accounting cycle.

Computerized Accounting System

With the advent of new technology, a lot of new software has come for an effective accounting system. It has helped maintain the accounting records systematically, leading to a reduction in human errors and efforts.

Also read – Best Accounting Software – How To Choose

Conclusion

Thus, the accounting cycle is a systematic process acting as the base of all the financial statements. It basically provides all the accounting information to prepare financial statements. Moreover, it becomes very important to maintain it on a regular basis, which starts with identifying the transaction and ends with closing the books. It is a cycle comprising of predefined steps, and it repeats in the same sequence every year.

Thus it is a holistic approach beginning with when the transaction takes place, recording it in relevant documents and closing the accounts with the end of the accounting year. Here, the role of a bookkeeper is very crucial in maintaining the records of the accounting cycle.

Thanks

Thus it is a holistic approach beginning with when the transaction takes place, recording it in relevant documents and closing the accounts with the end of the accounting year. Here, the role of a bookkeeper is very crucial in maintaining the records of the accounting cycle.

Thanks

Thanks for sharing the useful information on the Accounting Cycle where it helped me to understand the basic concepts of the accounting cycle and its process and purpose and all the steps involved in the accounting cycle