What do we Mean by Sales Value Variance?

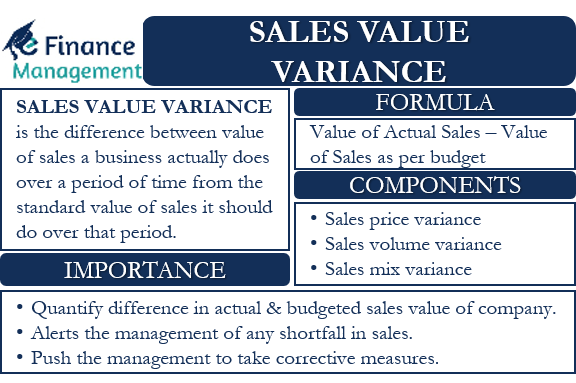

Variance is a statistical measure of how much a data set is spread over. It measures the gap between a variable and the mean of the data set and within the variables themselves too. Sales Value Variance is the difference between the value of sales a business actually does over a period of time from the standard value of sales it should do over that period. Or simply put, this variance is the difference between the actual sales vis-à-vis the budgeted/projected sales. Businesses measure value in terms of money. Every business makes projections or a budget of the amount of sales it should achieve for a particular period. The basis for such a budget can be historical trends, market conditions, production capacity, pricing, marketing and promotion, market competition, technological innovations, evolving consumer tastes, and preferences, etc.

Sales value variance arises when the sales value figures of the business varies from the projections or budgeted sales figures. We measure it for a particular period of time. The choice of the time frame depends upon the management. They may calculate it bi-monthly, monthly, or even bi-annually, as per their wish and requirement. Sales value variance can be both favorable and unfavorable. Favorable variance is when the actual sales value figures for the period exceed the budgeted sales value figures. On the other hand, unfavorable sales value variance occurs when the actual sales value figures fall short of the projections or budget.

How do we Calculate Sales Value Variance, and What are its Components?

Sales value is the amount of money something will make when it is sold in the market. We calculate Sales value variance with the help of the following formula:

Sales Value Variance = Value of Actual Sales – Value of Sales as per budget

There are three different components of Sales Value Variance that affect the sales value:

Sales Price Variance

There may be a variance in sales value because of differences in pricing that may arise at the time of actual sale. The actual price realized may be higher than the standard price, resulting in a favorable price variance. Also, it may be lower than the standard price, which will result in an unfavorable price variance.

Also Read: Sales Price Variance

The formula for calculation of Sales price variance is:

SPV= Actual quantity of Sales x( Price of actual sales – Budgeted price of sales)

For example, let us take the case of a mobile phone manufacturing company. It sells 10000 units of a mobile phone model A for $500 in the market on an average over a month. A new competitor enters the market and floods the market with a similar comparative mobile phone with a selling price of $475. The sales of mobile phone model A starts dipping. In order to maintain the same sales volume levels as before, the company is forced to lower the price of model A to $475. Thus, the SPV in this is as follows:

SPV= 10000 units x ($475 – $500)= $25000 unfavorable.

Sales Volume Variance

Companies do budget and plan for the volume of sales over a particular period of time. Sales volume variance is the variance or difference between the actual sales volume for a particular time period and the budgeted sales volume for that period. A difference in sales volume will automatically result in a difference in sales value for that period.

Favorable sales volume variance occurs when the actual sales volume is higher than the sales volume as per the budget. Unfavorable sales volume variance is the opposite, where actual sales volume is lower than the budgeted sales volume over a period of time.

We calculate Sales Volume Variance with the help of the following formula:

SVV= Actual Selling Price x (Quantity of actual sales – Quantity of sales as per the budget)

Let us understand this variance with the help of an example. Company XYZ Pvt. Ltd. is a manufacturer of household garments. As per the historical sales figures, the company estimates to sell 5000 units of shirts in the month of April 2021 @$20 per shirt. But suddenly, a global pandemic spreads across markets, resulting in a large dip in demand and hitting its sales badly. The company manages to sell only 2000 units of the shirts for that month. Therefore, the SVV for the month of April 2021 is:

SVV= $20 x (2000 units – 5000 units)

= $60000 unfavorable.

Also Read: Sales Volume Variance

Sales Mix Variance

Companies usually manufacture and sell a wide variety of items across different product lines. The margins also vary from one product to another. Also, the percentage of each product out of total sales also varies. The combined mix of different products that a company sells is known as the sales mix. Sales mix variance is the difference between the actual sales mix that a company sells and the sales mix as per the budget or forecasts. Like others, this variance can also be favorable or unfavorable. Sales mix variance results in a variation in the sales value a company generates over a period of time.

We calculate sales mix variance with the help of the following formula:

SMV= {Actual units a company sells x (Actual sales mix percentage – Sales mix percentage as per the budget)} x Contribution margin per unit as per the budget

Also, read Sales Quantity Variance

What is the Importance of Sales Value Variance Analysis?

Sales Value Variance is an important metric that helps to quantify the difference in actual sales value that a company generates from its budgeted value. It alerts the management of any shortfall in sales from the sales projections in case it is unfavorable. Favorable variance also tells that there is untapped potential in the market and scope for improvement in its budgeting. The results can push the management to take corrective measures, which otherwise it could have ignored.

The components of Sales Value Variance are connected and interrelated with each other. For example, in order to increase the volumes or quantity of sales of a product facing tough competition in the market, the company can opt for discounts or a price cut for the product. This step of the management will result in an unfavorable Sales price variance but a favorable Sales volume variance for the company. It will also affect its Sales mix variance. Hence, the management should be careful while making such decisions and go for the option that results in an overall favorable Sales Value Variance for the company.

Refer to Variance Analysis Formula with Example for various other types of variances.