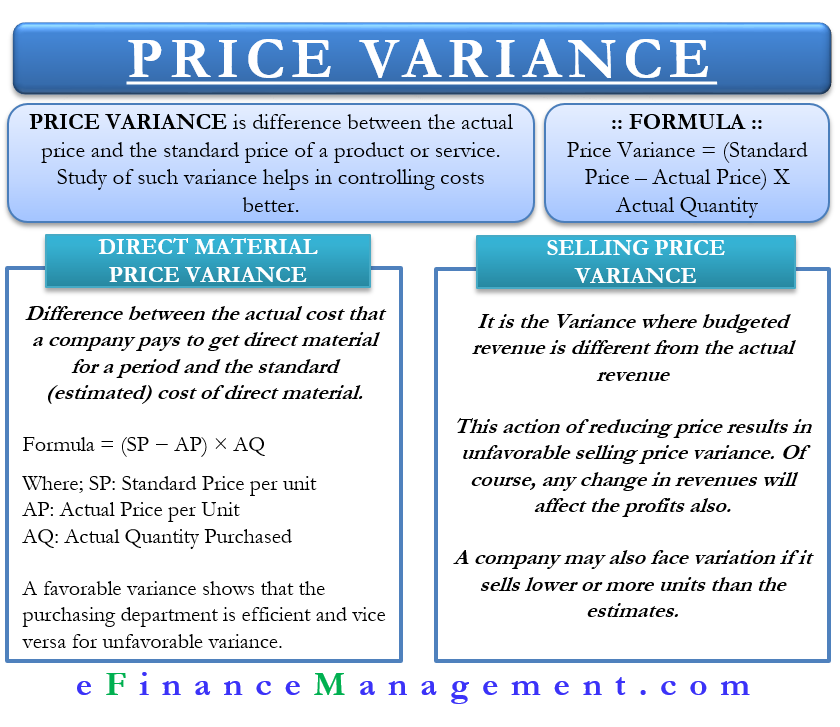

Price Variance is the difference between the actual price and the standard price of a product or service. It can be for both cost and revenue. This means this variance can be due to the cost that the company pays for purchasing raw materials and the price it charges for its products and services. Studying such a variation helps a business to assess and control its cost and revenue better.

Price Variance Formula

To calculate the price difference, we subtract the actual price from the standard rate and then multiply the resultant number by the total product count. There is a simple formula to calculate the price variance, and it is,

(Standard Price – P) ×Q.

Here P is the actual price, and Q is the exact quantity.

Based on the formula, an unfavorable price variance would mean that the company’s actual costs have risen, and the company had to pay more money to buy its raw materials. On the other hand, a favorable variation would suggest that the real costs have come down, and the company had to spend less.

Importance

This concept is vital in cost accounting for evaluating the effectiveness of the company’s annual budget exercise. For the preparation of the budget, the standard price is the one that the management estimates to pay. There is always a price variance in the budget as the team prepares the budget months before the actual purchase of the raw materials.

Also Read: Material Variance

For Example, Company ABS, at the start of the first quarter, estimates that it would require 1,000 units of an item in the second quarter costing $4. On the 1,000 units, Company ABS would get a 20% discount, bringing the total cost to $3.2 ($4*(1-20%)).

However, at the end of the first quarter, the management realizes that it would only need 800 units. Now, it would only get a 10% discount, bringing the cost to $3.6. In this case, the price variance per product is $0.40 ($3.6 – $3.2).

A point to note is that a company may achieve a favorable price variance only by making a bulk purchase. But, this may raise the company’s inventory cost, thus, wiping the benefits gained from a favorable variance.

The operating plan of a company also determines whether or not a company has a favorable or unfavorable variance. For instance, if the purchasing department of a company insists on buying in small quantities, it may result in unfavorable price variance.

Direct Material Price Variance

One can easily apply the price variance concept to all types of costs, such as labor costs, overhead costs, direct materials costs, and more. Let us understand how we can apply the idea to direct material costs. The point is if you can use the concept for one type of cost, you can easily apply it to other kinds of costs too.

Direct material price or rate variance is the difference between the actual cost a company pays to get direct material for a period and the standard (estimated) cost of direct material.

Following is the formula to calculate this variance:

Direct Material Price Variance = (SP − AP) × AQ. Here SP is the standard price per unit of the direct material. AP is the actual price per unit of the direct material. And AQ is the exact quantity of the direct material that a company purchased.

For a quick calculation, use Material Price Variance Calculator.

This variance helps to know the efficiency of the Purchase Department when it comes to purchasing direct material at a low cost. A favorable direct material price variance would mean the purchasing department was able to buy the raw material at more economical rates than the estimated value.

A point to remember is that a favorable direct material rate variance may not always be a positive thing for a company. It could be possible that the purchasing department gave the order for lower quality material to achieve a lower cost. Thus, the direct material rate variance must be looked at in combination with the direct material quantity variance. If the raw material is of low quality, it will result in an unfavorable direct material quantity variance.

Selling Price or Revenue Variance

As said above, the price variance concept is not just for the cost. We can also apply it to revenue or selling price too.

The revenue variance is where the budgeted revenue is different from the actual revenue. It could be due to a change in the actual selling prices as against estimated ones while preparing budgets.

For Example, Company ABC estimates the revenues and profits for the next year (2020) based on the number of units they will produce and the selling price. After the first quarter of 2020, the company realizes that the customers are not willing to pay the rates they estimated because a competitor has dropped the price of their product. Now Company ABC also lowers the rate of their product. This action of reducing price results in unfavorable selling price variance. Of course, any change in revenues will affect the profits also.

In the above case, the variance was due to the change in selling prices. A company may also face variation if it sells lower or more units than the estimates.

Final Words

Depending solely on the variance number to conclude is not at all right. A manager should go into the details to determine the real reason for the difference. For instance, the sales variance (above) could be due to inflation. It can also be that the selling prices were too high, resulting in lower sales.

Read Variance Analysis for more details.

Frequently Asked Questions (FAQs)

There is a simple formula to calculate the price variance, and it is,

(Standard Price – Actual Price) × Actual Quantity

Price Variance is the difference between the actual price and the standard price of a product or service. It can be for both cost and revenue.

This concept is vital in cost accounting for evaluating the effectiveness of the company’s annual budget exercise.