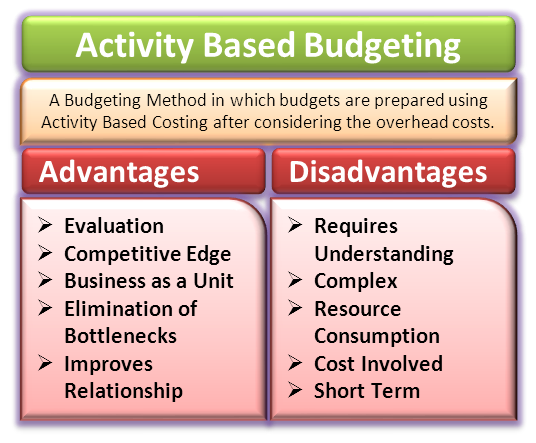

Activity-based budgeting is a budgeting method that uses activity-based costing while preparing budgets. In simple words, activity-based budgeting is a management accounting tool that does not consider the past year’s budget to arrive at the current year’s budget. Instead, it deeply analyzes and researches the activities that incur the cost. Based on the outcome of the study, the resources are allocated to an activity.

Need for Activity-Based Budgeting

Activity-based budgeting is carried out to bring efficiency to the activities of an organization. Budgets are prepared after justifying the cost drivers. Thus, it is activity-oriented and not function-oriented.

Let us now have a look at its benefits.

Advantages of Activity-Based Budgeting

Evaluation

Activity-based budgeting method evaluates each and every cost driver. It takes into consideration all the steps involved in an activity. It eliminates irrelevant and only the necessary activities form a part of the business.

Competitive Edge

Activity-based budgeting system eliminates all sorts of unnecessary activities, which helps the business to save its costs. The saved cost results in the production of goods and services at a lower cost than that of competitors. It also helps the organization gain a competitive edge in the market.

Also Read: Zero Based Vs. Activity Based Budgeting

Business as a Unit

This budgeting technique helps view the business as a single unit and not in the form of departments. The managers or top management prepare the budget for the business unit as a whole and do not keep in mind any single department as done in the case of other budgeting methods.

Elimination of Bottlenecks

The preparation of budgets under activity-based budgeting takes place after deep research and analysis. This study removes all the unnecessary activities of the business. By doing so, the business eliminates all sorts of bottlenecks associated with an activity and carries out its functions more smoothly.

Improves Relationship

An activity-based budgeting system helps improve the relationship between the organization and its customers. The main aim of this budgeting method is to eliminate unnecessary activities and serve the customers with the best quality at the best price. This enforces (indirectly) the employees of the company to serve the customers in the best way possible and ensure customer satisfaction. In turn, the relationship between the organization and the customers improves. Let us have a look at the disadvantages of activity-based budgeting.

Disadvantages of Activity Based Budgeting

Activity-based budgeting offers many advantages. However, like every process, this too has its disadvantages, as listed below:

Requires Understanding

Activity-based budgeting requires a deep understanding of various functional areas of the business. If the manager preparing the budget is incapable of understanding and evaluating business areas, it would lead to inaccurate budget preparation.

Also Read: Why is Budgeting Important?

Complex

Activity-based budgeting system is complex in nature. It requires research and analysis of various factors. This budgeting method comprises of estimation of demand and based on that, it estimates resources to be employed in multiple activities.

Resource Consumption

The process of budgeting in this method consumes a lot of resources for an organization. It needs to employ top officials for conducting numerous analyses. It is a very time-consuming task too. If the business employs these resources in other operational activities, they can give better returns.

Cost Involved

Implementation of activity-based budgeting requires trained employees. An amateur employee cannot handle this exercise effectively. So business needs to incur extra costs to train their employees. Moreover, the process requires the involvement of top management, so it proves to be costly too.

Short Term

Activity-based budgeting focuses on the short-term goals of the business. It does not take into account the long-term scenario of the business. Focusing more on short-term goals rather than long-term goals can prove to be very fatal for the organization.

thanks for this article, it has really helped me in my study as a student nurse.may God bless you.

olga.

Thank you

I have been absent for a while, but now I remember why I used to love this web site. Thank you, I will try and check back more often. How frequently you update your web site?

This site is very educating, it will help me with my assignment. Thank you.

This site is very inspiring and educating i recommend

it to all who see finance as the blood vein to economic growth..