What is Incremental Budgeting?

Incremental Budgeting is a type of budgeting method that uses either the previous year’s budget or the actual results to prepare the new budget. Under this method, a company makes marginal changes to the previous year’s budget or the actual results to come up with a budget for the current period.

Though incremental budgeting is a simple approach, most professionals don’t recommend it. Such a type of budgeting is suitable for companies with fixed funding needs or with little changes.

The Theory of Budgetary Incrementalism (by Aaron Wildavsky in the 1960s) is the basis of incremental budgeting. The theory assumes that department heads are responsible for the budget process and that the budget is revised annually with an increment. This theory remained popular until 1984.

Why go for Incremental Budgeting?

Management goes for incremental budgeting if it does not want to spend too much time preparing budgets. Also, businesses go for this approach if they don’t feel the need to carry out a thorough re-evaluation of the operations.

One can say that lack of competition in the segment is one major reason inspiring companies to go for this approach. Since there is no competition, a company doesn’t feel the urge to do anything extra. So, it continues with a similar budget.

How to Prepare Incremental Budget?

There is no fixed formula to arrive at the incremental budget. However, there is an approach that is followed. The approach for this budgeting starts with an assumption that the expenditures incurred in the previous year will be the starting point of estimates for the current year.

The budget used for the current fiscal year becomes the base for working on the forthcoming year’s budgetary allocation. The management assumes that all departments will continue to operate at their current level of expenditure, and cases, where any additional amount is required, will be added to arrive at the next year’s budgeting estimates—cases where lesser expenditure may cause the budget reduction from the current year base amid certain assumptions.

Incremental Budgeting: Pros

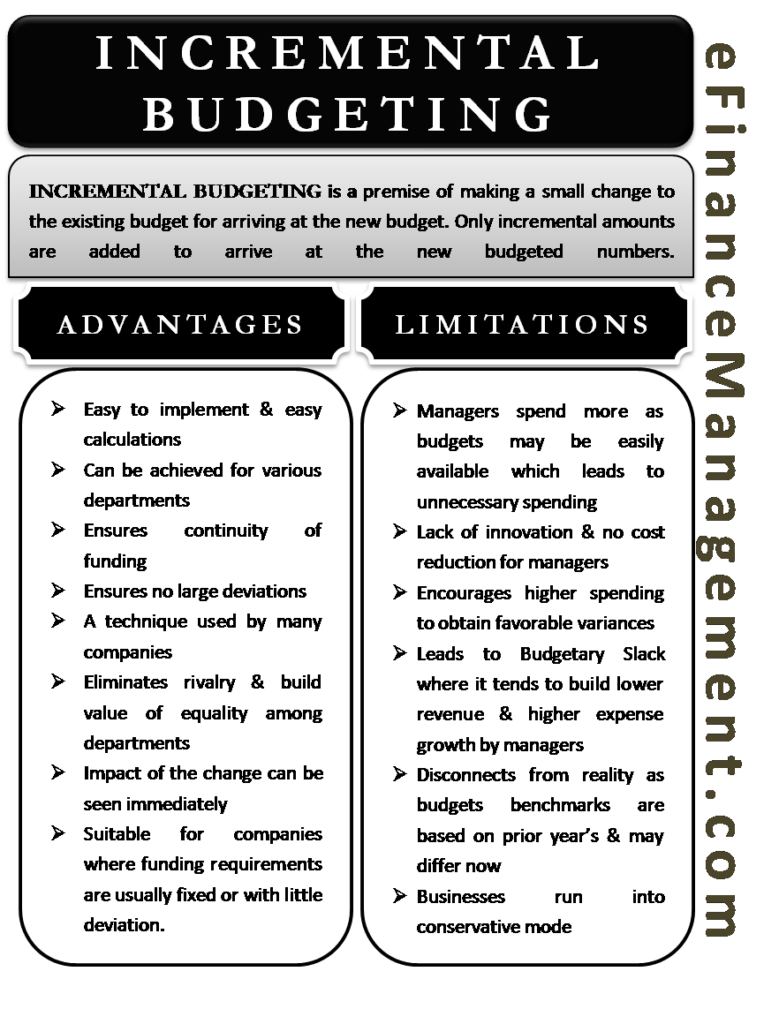

The following are the advantages of incremental budgeting:

- Easy to implement without any complex calculations.

- Ensure the continuity of funds for different departments without detailed analysis.

- Gradual changes in budgets lead to small deviations and hence maintain stability in year-on-year budgets.

- Creates value of equality and harmony among departments as they are assigned similar increased amounts from previous amounts.

- The impact can be seen immediately.

- Suitable for companies with fixed or slight deviations in funding requirements.

Incremental Budgeting: Cons

The following are the disadvantages of incremental budgeting:

- Assumes marginal differences only, but in reality, it can have major changes as well.

- Managers may lead to unnecessary spending due to budget without thinking much.

- Assuming that working shall remain the same leads to a lack of innovation.

- Encourage higher spending to maintain a budget for next year.

- Enables management for a budgetary slack scenario, where expenses and losses are overestimated, and income and profits are underestimated.

- Based on the prior year’s benchmark and not on projected requirements.

- Perpetual allocation of resources to departments based on budget leads to uneven distribution, causing wastage or deprivation of resources.

Conclusion

To sum up, one can say that incremental budgeting though very easy to compute and implement, comes with larger limitations. It may lead a company to get into a non-innovating conservative mindset which may not suit companies in all industries.

Also Read: Budgeting Examples

For companies that have steady budgets which seldom change over the years may very well opt for an incremental budget. However, it would be appropriate to undertake a complete assessment of funding requirements as in the case of more advanced budgeting techniques like zero-based budgeting and then arrive at the budgetary allocations in today’s dynamic industry scenario.

See Budgeting Examples for example of incremental budgeting.

commendable

I like how you said that an incremental budget would allow you to ensure that there are no large deviations from the original plan. Getting a budget analysis would be good though because you would be able to get more ideas about where to save money and where it is that you might be able to move money around and put it into more important places. Keeping as much money in your pocket as possible while still doing the most you can with it is the whole point of this kind of thing.