What is a Flexible Budget Variance?

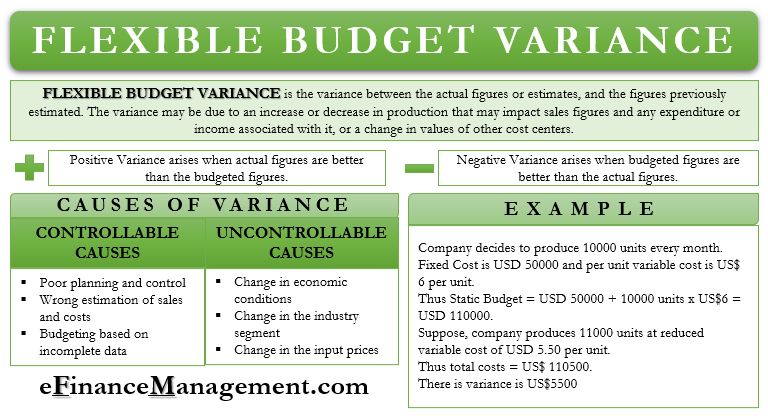

A flexible budget is a financial plan with scope for change in the value of its key parameters. It is according to the level of activities undertaken by the organization over a defined period. On the other hand, a static budget is a financial plan without any scope for change. For example, if a company decides that it will supply 10000 units of a product per month and no more or less, it is a case of a static budget. Flexible budget variance is the variance between the actual figures or estimates and the figures previously estimated. It is of use to commercial organizations, government, and even individuals.

A flexible budget is estimated with regards to the cost of production, sales, expenditure, etc. The actual figures may vary from the values initially calculated due to several factors. It can be due to an increase or decrease in production that may impact sales figures and any expenditure or income associated with it or a change in values of other cost centers. Also, there may be intangible factors in play, such as the implementation of better technology or an increase in the efficiency of the workers that may affect budgeted numbers.

Flexible budget variance can result in a positive or a negative figure. When actual figures are superior over the budgeted ones, it is a positive or favorable budget variance. On the other hand, if the real numbers fall short of the budgeted or estimated numbers, it will signify a negative or unfavorable budget variance. In simple words, it will be a loss for the company.

Causes of Flexible Budget Variance

There can be several factors that may result in a variance vis- a vis the flexible budget. Moreover, these factors can be controllable or uncontrollable for the organization. Details of these factors are:

Controllable Factors

Poor Planning and Control

A company may face significant deviations from its budgeted figures because of poor planning and control of its key activities. Sales and other activities that affect cost drivers may not work the same as originally planned.

Wrong Estimation of Sales and Costs

Revenue estimation from sales and service activities could be wrong. Moreover, variations are possible in the fixed and variable costs of the business. For example, production numbers may vary from estimates, the sales team may underperform, or there may be a rise in labor charges, etc.

Budgeting based on Incomplete and Incorrect Data

The management may have failed to gather all related data or may have even relied on inaccurate data from the past. And therefore, budgets could have been made based upon the available, incomplete details.

These all are controllable factors and are internal to the organization. These can be controlled or rectified by proper planning and implementation by the management team.

Uncontrollable Factors

Change in Economic Conditions

A change in the economic conditions affects organizations and their performances. An economic recession (or slowdown) can severely bring down the sales numbers. It will be the opposite case in the case of a sudden boom in the economy.

Change in the Industry Segment

There may be a sudden change in the demand-supply status of the company’s products. Increased competition in the industry segment in which the company operates.

Change in the Input Prices

There can be a change in the input prices and raw materials for a company due to a sudden surge in demand or a supply bottleneck. Moreover, due to the change in labor laws and minimum wage regulations, the cost of labor also increases.

Besides the above, there are many more factors that can vary during the budget period, like operating regulatory changes, taxation changes, import or export restrictions, interest rate changes, dumping duties, quota restrictions, currency rate variation, etc. And all these factors are beyond the control of the organization. Hence, forecasts of the management can go wrong and lead to variances in the budget.

Refer to the Variance Analysis Formula with an Example for various other types of budgets.

Example

Let us suppose that a company ABC Pvt. Ltd. decides to produce 10000 units of a product every month. A portion of the expenditure incurred on the production will be fixed in nature, comprising expenses such as essential components, salaries, etc. There will be variable expenditure too associated with the product that will change with the number of products produced. These expenditures can be in the form of packing and distribution expenses, transportation charges, etc.

In our example, let us suppose that the fixed expenditure every month is US$ 50000. The variable expense per unit of the product is US$ 6 per unit. Thus, the company has a total static budget of US$ 50000 + 10000 units x US$6= US$ 110000.

Our company has adopted a flexible budget and manages to produce 11000 units of the product in a particular month. Thus, the budget increases to US$ 116000.

But the company manages to save some of the variable expenditure amounts due to economies of scale and reduction in input costs with increased output. It brings down the per-unit cost to US$ 5.50. Therefore, the company’s actual cost of production= is US$50000 + 11000 units x US$ 5.50= US$ 110500.

This difference of US$5500 between the flexible budget and the actual cost of production is the flexible budget variance. Since it is a saving for the company, it is a favorable flexible budget variance. In case the company faces a loss with a change in output, it will be an unfavorable budget variance.

Importance of Flexible Budget Variance

Benchmark for Evaluation

A static budget is a pass now. The budgets are usually made for one financial year during that period, and there may be several changes that affect the actual operations. Hence, a flexible budget approach is preferable, and every company should try to benchmark existing operations around this to reflect the dynamic real-world situation. In case the output or results differ from the budgeted figures, the management should consider a relook into its budget and its preparation process. The flexible budget variance will throw triggers and cautions about the area, requiring proper attention and improvements. It is more critical in case of regular unfavorable budget variance over a while. The management is responsible for the results, and hence, this will help management in taking timely corrective action and paving the way for overall improvement.

RELATED POSTS

- Fixed Budget – Meaning, Benefits, Drawbacks, and More

- Cost Variance – Meaning, Importance, Calculation and More

- Fixed Overhead Spending Variance – Meaning, Formula, Example, and More

- Variance Analysis

- Price Variance – Meaning, Calculation, Importance and More

- Static Budget – Meaning, Importance, Benefits and More