A static budget or fixed budget is a type of budget where the value does not change despite changes in the sales volume. The budget does not change even if the activity levels change more than expectations, either way.

For example, suppose Company A follows a static budget and has a sales commission budget of $50,000. It means the sales commission for the year won’t be more than $50,000 even if the sales are $1 million, or $5 million, or any other figure.

On the other hand, if Company A follows a flexible budget, it would have a sales commission say at 2% or 5% or any different percentage of the sales. So, if the sales are $400,000, then with 2%, the commission will be $8,000. And, if sales are $800,000, then at 2%, the commission will be $16,000.

Static Budget – How it is Prepared?

As is usually the case, a company prepares the static budget before starting the budgetary period. The companies use the last year’s budget as the base to develop a fixed budget. A manager considers past expenses and estimates those expenses for the next year. For estimating, a manager finds possible changes and historical activity.

Moreover, a manager makes changes to the line items based on a fixed percentage or uses the rate of inflation and then adds to it a fixed percentage.

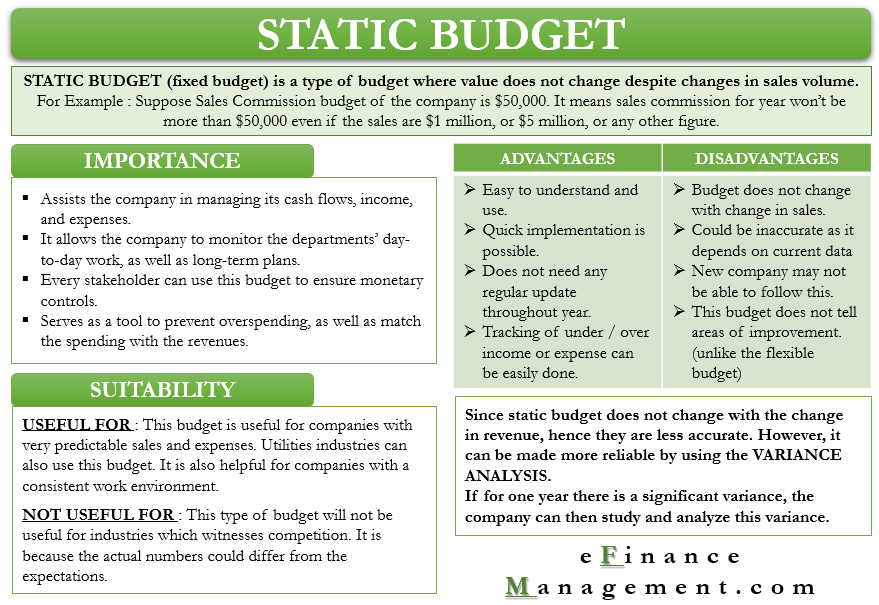

Importance of Static Budget

The following points highlight the importance of static budgets:

- It allows the company to plan its output and input. It, in turn, assists the company in managing its cash flows, income, and expenses.

- This budget acts as a blueprint. Thus, it allows the company to monitor the departments’ day-to-day work and long-term plans.

- Almost every stakeholder can use this budget to ensure monetary controls.

- It serves as a tool to prevent overspending and match the spending with the revenues.

Whom is it More Helpful?

Such an approach is useful for companies with very predictable sales and expenses, such as a monopoly situation. Also, utilities can use this type of budget. On the other hand, in industries witnessing heavy competition, adopting such a budget could backfire. It is because the actual numbers could differ from the expectations.

Also, they are more helpful for companies with a consistent work environment. We can even say that they help evaluate manager performance if the overall situation is practical. For example, if a city in which a company operates does not change its tax rates. It will allow the manager to make better assumptions and make an accurate budget.

Not Effective for Cost Centers

Using a static budget for evaluating the sales and cost centers is not always right. Suppose a cost department gets a big budget along with instructions that spending less than the budget would result in a reward. In case there is a drop in the sale, the cost of spending will automatically come down irrespective of the budget amount.

On the other hand, the same issue arises if the sales are more than expectations. The cost department will have to spend more than the budget allocation. It would result in unfavorable variances even despite no fault of the cost department.

So, we can say that the variances could be significant, especially for the faraway periods that are hard to predict. Thus, it is better to use a flexible budget in such cases as it allows the department to make adjustments as per the current situation.

For example, suppose Company A follows a static budget and expects sales and cost of goods sold (COGS) at $5 million and $3 million, respectively. However, the actual sales were $4 million, and COGS was $2.4 million. It means there was an unfavorable sales variance but a favorable cost variance.

If Company A follows a flexible budget, it would have set COGS at 60% of sales. In this case, the COGS would have automatically dropped to $2.4 million with the fall in sales. Or, there would be no variance for the cost of the goods sold.

Advantages and Disadvantages of Static Budget

Following are the advantage of the Static budget:

- They are easy to use and understand. A company can quickly implement it even if a manager does not have much experience.

- Such a budget does not need any regular updates throughout the year with the change in sales and costs.

- It allows the company to track if it is under or to overestimate its income and expenses.

Following are the disadvantages of the Static budget:

- The budget does not change with the change in sales and costs.

- It only depends on the current data and hence, could be inaccurate.

- Since they rely on data, a new company may not follow this budgetary approach.

- Even if a company finds under-performance, it can’t raise or drop funds.

- This budget in itself does not tell the areas for improvement. A company must use it and a flexible budget to analyze areas for improvement.

Variance Analysis

As said above, static budgets do not change with the change in revenue and costs. Thus, they are not accurate. A company, however, can make efforts to make it reliable with the help of variance analysis.

If for one year there is a significant variance, the company can then study and analyze this variance. The objective should be to minimize this variance in the coming years. Also, if a company knows there would be variance, it can adjust the budget for the same to make it as accurate as possible.

Read more about it at Static Budget Variance.

Static vs Flexible Budgets

A flexible budget allows the managers to adjust the sales based on expenses and other factors. Moreover, changes can be made in the middle of reporting periods.

Further, it also allows the management to adjust the costs based on sales. In all, it gives better overall control to the management. Moreover, they are relatively more accurate than fixed budgets.

There are drawbacks of the flexible budget as well. They are time-consuming and require managers to have extensive experience to implement them successfully. It is because handling flexible budgets need managers to know fixed or variable costs, as well as how expenses impact the revenue.

Read more about other Types of Budgets.

Combining Static and Flexible Budgets

To get better results, a company should use a combination of static and flexible budgets. It will help to lower the variance. In this technique, a company compares static and flexible budgets at the start of the year and actual results at the end of the year.

Such comparison gives management better control over the variance. By comparing the fixed and flexible budget at the start, a manager can know about the variances and thus, can make a corrective decision accordingly. And, then by comparing the budget with the actual result, the manager can determine the places where they went wrong and how to approach the budget next year.

Final Words

A static budget provides a basic outline or blueprint for the activities that a company needs to carry out in the next accounting period. A company must use a static budget if it has a certain degree of certainty about the sales and costs. However, for better results, a company must use a fixed budget and a flexible budget.