What is Master Budget?

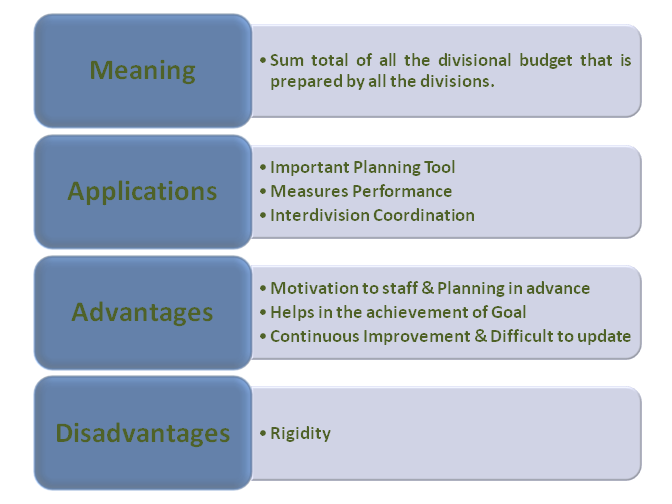

All the functional divisions of the organization prepare the budget for the particular division. The master budget is the sum total of all the divisional budgets that all the divisions prepare. Further, it also includes the financial planning, cash-flow forecast, budgeted profit and loss account, and the organization’s balance sheet. It is the goal of the organization to reach a level in a particular period. Normally the master budget is prepared for a year.

Sometimes, it may be misunderstood that the master budget is one large budget of the organization. However, it is not the case. Master Budget is the summary of the divisional budget. It is a continuous financial plan.

Steps to Prepare Master Budget

A master budget is divided into two parts:

Operating Budget

Sales Budget

The sales budget is the foundation of the master budget. All the procurements, staff requirements, and administration costs are based on sales. First and foremost, the number of units to be sold and the price per unit is derived. On the basis of that, the value of sales is calculated.

The sales budget is prepared based on considering the following factors:

- Market demand estimation

- Production capacity or an infrastructure facility

- Current supply facility

- Industry analysis

Market demand and production capacity are determined with the help of the Marketing division and production division, respectively.

Production Budget

The production budget is mainly based on the sales budget. However, the following factors shall be considered;

- Inventory at the beginning of the year

- Inventory to be maintained at the end of the year

- Number of units manufactured

- Buffer stock to be maintained throughout the year

The production budget is divided into further three parts:

- Direct material budget

- Direct labor budget

- Manufacturing overhead budget

If the company is not having a manufacturing unit, we require a number of units to purchase instead of the production budget.

Cash Budget

For all the divisional budgets, the organization requires cash. It needs to ensure that it does not run out of cash during the year due to poor planning in preparation for the budget.

Also Read: Types of Budget

On the basis of the sales and production budget, it is derived what is the expected receipts and what are the expected payment. The receipt and payment cycle of the customer and supplier need to be analyzed. At this stage, the organization decides whether external borrowing is required or not.

All the administration expenses, such as interest on borrowing, staff costs, office rent, legal expenses, office supplies, etc., are to be considered while preparing the cash budget. Some factors also are dependent on the sales budget, such as the CEO’s salary based on performance or the performance bonus to sales staff.

Keep reading Cash Budget

Financial Budget

Capital Asset Acquisition Budget

The plant, machinery, and equipment require periodic maintenance and replacement. If the sales target is higher than the previous period, new plant and machinery also need to be introduced. Therefore, careful planning of the capital asset has to be done. A financial budget is an integral part of a Master Budget.

Read more on Capital Expenditure Budget

Budgeted Income Statement

On the basis of the above budgets, the budgeted income statement is prepared. The budgeted Income statement includes the following;

| Particulars | Amount |

| Budgeted Income | – |

| Less: Budgeted Expenses | – |

| Budgeted profitability | – |

Budgeted Balance Sheet

The budgeted balance sheet is prepared once the Budgeted Income Statement is prepared. The budgeted balance sheet indicates the following:

|

Particulars |

Amount |

| Budgeted Assets | |

| Plants & Machinery | – |

| Equipment | – |

| Accounts receivables | – |

| Inventory | – |

| Total Assets | — |

| Budgeted Liabilities | |

| Share Capital | – |

| Retained Earnings | – |

| Accounts payable | – |

| Income tax payable | – |

| Short term loans | – |

| Long-term loans | – |

| Total Liabilities | — |

All the divisional budgets are interrelated. A mistake in preparation for any budget leads to a mistake in the master budget. Hence, it is recommended to prepare a budget that is ambitious but achievable and not a fairy tale.

Also Read: Operating Budget

Also, read Operating Vs. Financial Budget

Applications of Master Budget

Important Planning Tool

The master budget is considered one of the most important planning tools for an organization. While planning, top-level management discusses the overall profitability and the asset and liability position of the company. For which the master budget is being used.

Measures Performance

The master budget measures the performance of the organization as a whole. It helps in departmental control and setting in departmental accountability. It helps in improving efficiency.

Interdivision Coordination:

The master budget is used for interdivisional coordination amongst the divisions of the organization. It helps and ensures that coordination with the other divisions is properly made.

Advantages of Master Budget

Motivation to Staff

The master budget serves as a motivation tool on the basis of which the employees can compare the actual performance with the budgeted performance. It helps staff get job satisfaction and a good contribution to the growth of the business.

Summary of the Divisional Budget

A master budget works as a summary budget for the overview of the business owners and the management. It indicates how much the organization is earning and what expenses are incurred as a whole.

Planning in Advance

The master budget identifies the unusual problems in advance and fixes the same. For instance, one of the company divisions is not performing well, and the expenses incurred exceed the set budget limit. This results in the lower profitability of the company.

Helps in the Achievement of Goal

The organization has short, medium, and long-term goals. A master budget helps in achieving the long-term goal of the organization. All the resources of the organization are channelized and controlled for the optimization of the profit.

Continuous Improvement

It is a continuous process. Each year the organization prepares such a budget, and it works as a tool of analytics. The variances are identified and worked upon for better results on a continuous basis.

Disadvantages of Master Budget

Rigidity

The divisional staff is forced to achieve the target despite having practical difficulties in achieving the same. It is because of the pressure from the top management. This leads to low revenue estimates and higher expense estimates. Managers may not consider new opportunities for the growth of the organization.

Difficult to Update

This budget is not easy to modify. Adding, altering, or deleting small changes requires many steps in the entire budget. It includes lengthy descriptions and charts. Hence, a master budget cannot be easily understood as a layman’s.

Read more about other Types of Budgets.

Quiz on Correspondent Banking

I appreciate the author Mr. Sanjay Bulaki Borad of this huge knowledge.