Understanding DSCR

Debt Service Coverage Ratio or DSCR indicates the ability of the company to service its debt obligations from earnings generated from its operations. The debt obligation includes principal, interest, Hire Purchase, or Deferred Payment Guarantee installments.

According to the simple definition of DSCR, a ratio greater than 1 implies that a company would be able to service its debt obligations comfortably, including principal as well as interest from operating income generated in a year. On the other hand, a ratio of less than 1 might appear unfavorable as it would imply that surpluses of one year are insufficient to meet all the immediate debt obligations of the company.

Debt service coverage ratio is usually used by lenders to see if the borrowers are capable of repaying their debt obligation. It is also helpful to analyze the amount of debt that a company should ideally have. Or what maximum amount of loan should a financial institution sanction to the borrowing company.

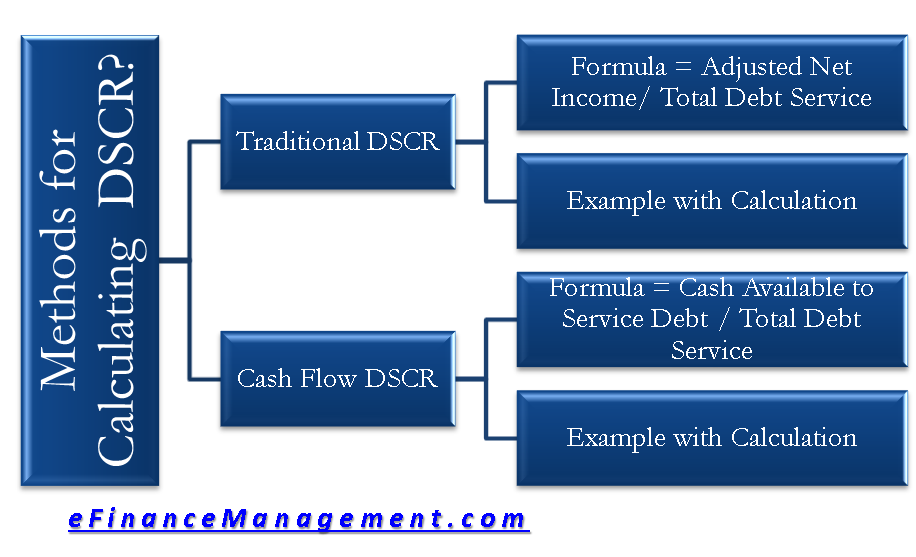

There are many methods to calculate DSCR, but two are especially common. We will discuss both these methods in the following paragraphs in detail:

Traditional DSCR

In this method, adjusted Net Income is taken into consideration while calculating the DSCR. Following is the formula of traditional DSCR:

Formula of Traditional DSCR

Traditional DSCR = Adjusted Net Income for the year/ Total Debt Service Obligations for the year.

Where

Adjusted Net Income = Profit after tax + Noncash expenses or – Noncash income + interest expenses + Depreciation -Dividends Paid

Total Debt Service = Quantum of long-term debt payable in the year + Interest expenses

Let us look at an example for a better understanding

Example –

Following is an excerpt from the annual reports of a family-owned company –

| For the year ending 31/12/2005 (Amounts in USD) | |

| Profit After Tax | 555 |

| Depreciation | 211 |

| Interest Expense | 243 |

| Dividends distributed | 75 |

| Current portion of long-term debt payable in the year | 245 |

| Net Cash Income from operating cash flow | 162 |

| Changes in Working Capital | -928 |

Calculation of Traditional DSCR

| NET INCOME CALCULATION | |

| Profit After Tax | 555 |

| +Depreciation (Noncash expense) | 211 |

| +Interest Expense | 243 |

| -Dividends Paid | (75) |

| Adjusted Net Income (A) | 934 |

| TOTAL DEBT SERVICE CALCULATION | |

| Current portion of long-term debt payable in the year | 245 |

| + Interest | 243 |

| Debt Service (B) | 488 |

| DSCR (A)/(B) | 934/448 = 1.91 |

As the DSCR is 1.91, it means the company has generated an operating income of almost twice its debt in one year, which is very healthy. It can easily pay off its debt.

Also Read: Debt Service Coverage Ratio (DSCR)

Cash Flow DSCR

As the name suggests, this method considers the net income generated from operating cash flow to calculate the DSCR. The formula for this method is:

The formula for Cash Flow DSCR

Cash Flow DSCR = Cash available to service debt/ Total Debt Service

Notice here the denominator (Total Debt Service) stays the same as the traditional DSCR, but the numerator changes.

So, cash available to service debt = Net Cash after Operations + Interest Expense – Dividends

Net Cash After Operations = Adjusted Net Income (As per Traditional) Add / Less Changes in Working Capital

Let us calculate cash flow DSCR for the same previous example:

Calculation of Cash Flow DSCR

| CASH AVAILABLE TO SERVICE DEBT CALCULATION | |

| Adjusted Net Income (A) | 934 |

| Changes in Working Capital | -928 |

| Cash available to service debt (A) | 6 |

| or, | |

| Profit After Tax | 555 |

| Changes in Working Capital | -928 |

| Depreciation | 211 |

| Net Cash Income | (162) |

| +Interest Expense | 243 |

| -Dividends | (75) |

| Cash available to service debt (A) | 6 |

| TOTAL DEBT SERVICE CALCULATION | |

| Current portion of long-term debt | 245 |

| + Interest | 243 |

| Debt Service (B) | 488 |

| DSCR (A)/(B) | 6/448 = 0.01 |

This method may show that the DSCR of 0.01 means that the company has no cash to service its debt. This may mean that the company is financially unhealthy, but that is not always the case.

Difference between 2 Methods and its Implications

- Simply speaking, the traditional DSCR considers net income, whereas cash flow DSCR considers operational cash flow. We can say that cash flow DSCR is a much more stringent metric as it considers only the liquid cash available to service a company’s debt. This doesn’t mean the company doesn’t have money to service debt; it means that maybe the money is invested in places like inventory, accounts receivable, etc., which operating cash flow doesn’t consider.

- As a metric, both traditional DSCR & cash flow DSCR is valid, but it is important for an analyst to decide which one they want to use based on their purpose of analysis. For example, a growing company may have very low cash flow DSCR as in order to increase sales, its current income may be invested in keeping high levels of inventory, which is not currently liquid but can be converted into cash easily if need be. If an analyst is analyzing such a high-growth company, he has to consider these factors and then conclude about a company’s ability to service debt.

Finally, it is always pressed during a discussion of fundamental analysis that no ratio should be considered in isolation. The same goes for DSCR, it should never be considered as a measure by itself. A holistic look at all liquidity, activity, leverage & coverage ratios will give a deeper & clearer understanding of the company’s financial health & future growth prospects.

Excellent & Systematic way of explanation with Simple Example.