Budgeting is the projection of income and expenditures that one expects an organization to earn and incur over a given period of time, usually one year. It requires continuous evaluation and control to ensure that the company’s finances are managed correctly. Other than institutions or companies, a budget can also be drawn up for an individual, individual branch, or unit of that company or any department that earns and spends money. The importance of the budget is that it becomes a reference document and thus helps in planning the activities of the organization or individual. A company can prioritize its expenditure according to the limited financial resources it has at its command. Thus this document also helps in the proper allocation of resources as per the priorities.

The budget has many variants which have a direct link with the requirements as well as the purpose. More so, the budget types can be in accordance with the person or entity- unit, department, company, or individual. Further, for an entity or business organization, one budget may not suffice, and it may require a number of budgets. Some of them are the annual operating budget, performance budget, rolling budget, master budget, program budget, financial budget, operating budget, etc. Also, there are four key methods that companies use to create a budget. These are the traditional budgeting method, the incremental budgeting method, the zero-based budgeting method, and the activity-based budgeting method.

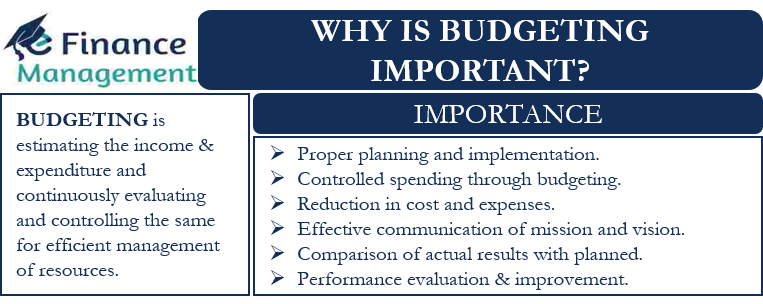

- Why is Budgeting Important?

- Proper Planning and Implementation

- Control Expenditure

- Prepares for Future Emergencies

- Resource Utilization

- Reduction in Costs and Expenses

- Employees Involvement

- Tool for Comparing Actual and Planned Results

- Helps identify Strengths and Weaknesses

- Proper Allocation of Funds

- Helps to Set Priorities

- Evaluations and Improvement Of Performance

- Increase Performance through Internal Competition

- Conclusion

- Frequently Asked Questions (FAQs)

Why is Budgeting Important?

Proper budgeting is crucial for the success of any company. This is equally important and crucial for individuals too. The most important reasons that make budgeting important are:

Proper Planning and Implementation

Budgeting helps to turn the general ideas and plans of the management into concrete, goal-oriented plans. Each individual and entity is different and may have its own specific needs and requirements. Budgeting chalks out the specific actions necessary to implement the budget in reality by way of forecasting. This is done according to the unique circumstances of each organization. It helps to set a direction that leads to a coordinated effort of each individual and each department toward realizing the common business goals.

Also Read: Limitations of Budgeting

Read more on Budgeting vs. Forecasting.

Budgeting also helps strengthen the company’s financial goals and find ways to keep them on track. And of course, all of these are linked and need to be executed and achieved within a certain time frame. It can’t be indefinite. Pressure to achieve more in a pre-defined timeframe often leads to effective and rapid implementation of plans or budgets.

Control Expenditure

Budgeting is a roadmap of expenditures that the company can make according to the available resources or capital in hand. It is, therefore, a means of planning and controlling expenditure, as budgeting provides clear numbers or figures about the amount of money the company has. Furthermore, budgeting helps to estimate revenue over the budget period. It can plan its expenditure accordingly and ensure that it does not overspend or make commitments to spend money that the company does not have.

Prepares for Future Emergencies

Budgeting directs the company’s scarce resources into activities that align with the organization’s strategic objectives. It ensures that the company does not run out of money during the budget period for these important activities. Budgeting also helps ensure the proper availability of resources for emergencies as well as future projects. It prepares a company well in advance for crisis situations that can come from nowhere.

Resource Utilization

A budget helps to control wasteful expenditures in an organization. Because resources are scarce in any company, hence, their allocation in the best possible manner is necessary for maximum returns. The budget guides the best possible utilization and allocation of resources. Moreover, it helps to maintain harmony between various departments of the business. Each department has a pre-determined share of the budget allocated to it. And it helps to take care of any daily arguments between them because of resource allocation.

Also Read: Why are Budgets Useful in Planning Process?

Also, read Budget Control

Reduction in Costs and Expenses

Budgeting is an effective tool to help a company reduce wasteful spending. It shows which expenditures are not important at the present time and can be postponed. Matching available resources with revenue sources often drives management to draw up cost-cutting plans. It pushes them to find ways to improve cash flow to increase profits, which ultimately leads to higher returns on investment.

Employees Involvement

The process of budgeting starts with top-level management. It goes down to the lower-level managers and staff in the managerial hierarchy. During budgeting, many companies prefer a bottom-up approach too. Whatever methodology the entity uses, it affects everyone. The budgeting process and communication involve a large number of persons and departments of the organization. The involvement gives all the members a sense of ownership and belongingness to the process. They can see through the mission, vision, and goals of the organization effectively, as they are themselves part of the planning and implementation process. This results in higher motivation of employees. They know in which direction they need to make maximum efforts and pursue strategies for effective goal realization.

Tool for Comparing Actual and Planned Results

A budget becomes a tool to compare the actual results a company achieves over the budgetary period from what was expected or budgeted for. The comparison with actual results can trigger the areas and reasons for the deviations to the Management from the planned course of action. It can focus on important areas that require immediate attention and control. The results will help them assess where they are going wrong. Also, they will know if they need to make a change in the current strategy. A continuous evaluation of budgetary results will alert management to correct or rectify the path they are on in case of need. Also, this will help to minimize the impact of wrong and catastrophic decisions. And thus, the management can do enough damage control through constant monitoring and suitable course correction.

Helps identify Strengths and Weaknesses

The budgeting process – planning, monitoring, and comparing, helps to identify the areas of the organization’s strengths and weaknesses. Management gets a clear picture of what priorities should be set in the next budgetary period once the results have been reviewed. Also, the budget results can provide an impetus to search and explore new avenues for generating income/ reducing expenses or timelines. Normally, this happens when the budgeting results are not up to the mark or do not meet expectations. This makes budgeting in an organization very important and useful.

Proper Allocation of Funds

A budget sets targets for revenues and expenditures and helps to keep a check on both of them. Also, the management can channel funding in the right direction as per the budget provisions. The formulation of proper strategies becomes possible as per the budget provisions. The management can also decide whether to go for capital expenditure or not as per the availability of financial resources by looking at the budget.

Helps to Set Priorities

A budget helps channel resources across various departments as per the top management’s priorities and goals. They are in the best position to decide which department should get the maximum chunk of the budget allocation to grow. For example, there are times when the top management will feel that the products of the company have become obsolete and hence, are losing out to the competition. Hence, they may prefer to allocate a bigger portion of the budget to the research and development department to develop new and better products. This will help the company get back on track and be ahead of the competition again.

Evaluations and Improvement Of Performance

Budgeting serves as a benchmark that needs to be achieved. Furthermore, the actual results can be very useful in assessing the performance of managers and employees. A budget helps to create accountability in managers for their own performance and the results of their department. Rewards can be awarded to departments that exceed budget expectations. Those that have not been able to achieve budget goals must reassess and take corrective action. In addition, there may be cases of prolonged deviations and below-average performance. Management may consider imposing penalties or shuffling the members of the department.

Increase Performance through Internal Competition

Budgeting provides a platform for various managers and departments to come together. They fight for an appropriate distribution of the scarce resources of the company. They know in advance what capacity constraints exist, how many resources they have available, and what they have to do with them for the best possible results. The scarcity of resources leads to a sense of competition between individuals and departments. This leads to improved performance, better teamwork, and the best possible results for the organization. And that makes a win-win situation for all.

Conclusion

Proper budgeting is the backbone for the success of any business organization. Of course, it is equally important that the entity chooses the right budgeting process for achieving its objectives. This will depend upon various factors such as the size of the company, age and management experience, market conditions, availability of historical data, etc. A company without a proper budget means that it is not taking a specific direction toward its long-term goals. Therefore, it is important to implement a budget to steer the company in the right direction and lead it to success. The budget is like a navigator compass that the ships use while sailing.

Frequently Asked Questions (FAQs)

Budgeting is beneficial because, firstly, it helps to keep an eye on all expenditures. Secondly, it also ensures the availability and allocation of resources, and lastly, it helps management to plan and implement it properly to achieve the organization’s objectives.

Yes, budgeting helps communicate the mission and vision among the organization’s employees. It also helps to communicate the planned vs. actual performance and steps to improve the performance.