As the name suggests, a fixed budget remains fixed even when there is a change in the business activity. Or, we can say it is a financial plan that doesn’t get a modification with the variations in the business activities. We also call it a static budget.

Such a budget depends on a set volume of revenues, expenses, and production levels. This budget makes it easy for the company to plan its operations as it has a set volume of revenues and expenses.

However, the fixed budget may not hold much relevance in the real world. This is because businesses witness a significant variation in activities than what they initially estimate. Thus, the budget is likely to be very different from the actual numbers. Because of this difference, there is a big variation between the budget and actual numbers.

Example of Fixed Budget

Suppose Company A pays a sales commission on the total sales. Company A prepares a fixed budget and estimates total sales of $500,000, and thus, fixes a commission of $50,000. Now, even if the actual sales are more or less than the estimates, the sales commission figure in the budget will not change.

On the other hand, if Company A prepares a flexible budget and thus, fixes the commission at 10% of sales. Now, the commission amount would vary as per the sales amount. If the actual sales are $500,000, then the commission amount will be $50,000. And, if the sales are $400,000, the commission amount will be $40,000.

Fixed Budget Variance

Variance is basically the difference between the budget and the actual results. This variance plays a crucial role in measuring the performance of a business. A company using a fixed budget must focus on reducing this variance year after year.

It should compare the variance of one budget period with the last one, to check if its estimates are getting better or not. If not, the company should try to change its estimation methods. Also, the company must review its past revenue and expenses to come up with a better budget.

Advantages and Best Suited For

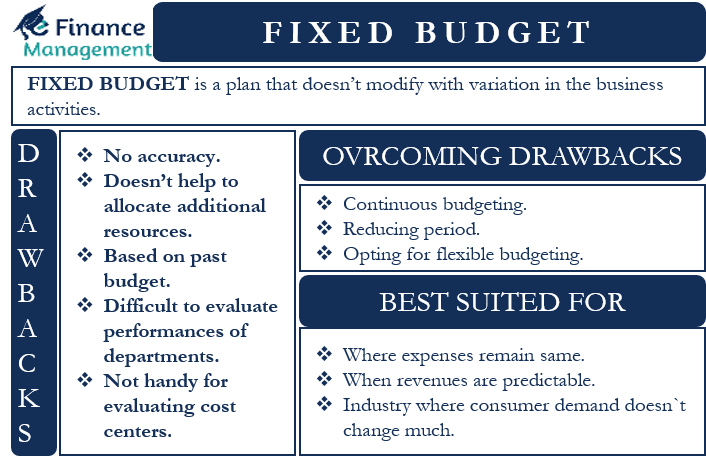

There are a few scenarios when the fixed budget aligns closely with the real numbers. These are:

- When the expenses are big and remain the same over time.

- When the revenues are predictable.

- If a firm enjoys monopoly power, and thus, cost and revenues get very predictable.

- Suppose a firm exists in an industry where consumer demand doesn’t change much. Or the change is very predictable. Utility companies are a good example.

Such a budget offers a few advantages as well. They are very easy to prepare and thus, give time to companies to focus on their core operations. Another advantage is that a company doesn’t need to make the changes every month.

Also Read: Flexible Budget Variance

Moreover, such a budget makes it very easy to track the budget as the amount remains the same. One major advantage of such a budget is that it is easy to implement as the company doesn’t need heavy software and staff for its maintenance.

Drawbacks

Following are the drawbacks of using such a budget:

- Estimates are not accurate as it is very hard to correctly predict the demand and industry trends.

- It doesn’t help when there is a need to allocate additional resources to keep up with the rise in demand.

- This budget is based on past budgets. So, it gets tough for a new firm to prepare such a budget.

- Since estimates are not accurate, it gets extremely difficult to evaluate the performance of the departments.

- Such a budget is not handy when evaluating the cost centers. For instance, if a cost center gets a massive budget but spends well below it. The cost center will get an appreciation for spending less than the estimate. But, the lower expenditure could be the result of fewer sales. Similarly, if the revenues are more than the expectations, the cost center will have to spend much more than the budget. This will result in a massive variance even when the cost center was only working to catch up with the more demand.

How to Overcome Drawbacks?

There are a few ways that can help a company overcome the shortcomings of a fixed budget. These ways are:

Continuous Budgeting

We can combine a fixed budget with continuous budgeting. In this, a company adds a new budget period as soon as the last budget period gets over. This way, the budget gets the latest projections along with the full-year budget.

Reduce the Period

Reducing the period of a budget can also help in making the budget more accurate. For instance, a budget for a period of three months will have less time to diverge from the estimates than a budget for six months or a year.

Flexible Budget

A flexible budget is a very good alternative to a fixed budget. It addresses all the drawbacks of a fixed budget so as to make budgeting more accurate. In a flexible budget, we can adjust the budget numbers to reflect the changes in the business activity. Moreover, management can easily alter a flexible budget as per the needs of a business. Along with the past data, the flexible budget also includes the estimates of future realistic situations.

However, it is more complex in comparison to the fixed one. Also, it takes comparatively more time to prepare. Despite these drawbacks, a flexible budget suits all kinds of businesses, be it a big, medium or small, or micro-enterprise.

Final Words

Even though a fixed budget has its advantages and we can overcome its drawbacks, its usage is very less in the real world. Moreover, many regard it as an ineffective tool to control costs. Such a budget suits only a few types of companies, such as those having monopoly power or operating in an industry with predictable demand. That is why most companies prefer to go with a flexible budget.

Read more about other Types of Budgets.

A good explanation that makes it easy to understand for students who never had business-related knowledge.Please