What is the Product Extension Merger?

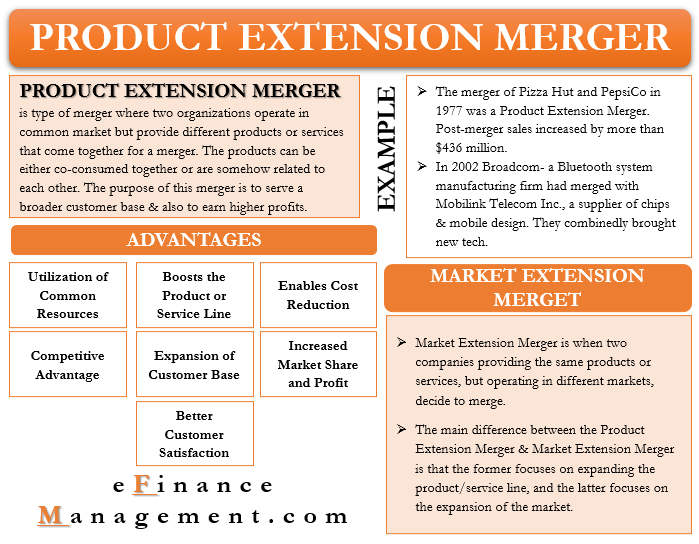

Product Extension Merger is a type of merger where two organizations operate in a common market but provide different products or services that come together for a merger. The set of products or services provided by both organizations are either co-consumed together or somehow related to each other. It is also known as Congeneric Merger.

Why Product Extension Merger Takes Place?

Companies generally initiate mergers to get an added advantage of synergy. In the case of a Product Extension Merger, the organizations whose products or services are co-consumed together, are similar or are linked together come together for a merger. Products or Services provided by both organizations are not entirely the same but are operating in the same industry. The purpose of this merger is to serve a broader customer base & also to earn higher profits.

This type of merger adds a new product or new service to the existing product/service line of the organization. As a result, post-merger, the organization provides an augmented range of products or services to an extended customer base.

Generally, the original identity of products or services stays the same in this merger, but at times it might be possible that this type of merger creates an entirely new product or service.

Also Read: Conglomerate Merger

Advantages of Product Extension Merger

Boosts the Product/Service Line

Product Extension Merger expands the product line for both entities. It combines the products or services in such a way that it creates an attractive set of deliveries. These augmented products/services boost sales.

Cost Reduction

Product Extension Merger allows both organizations to use each other’s operational efficiency and resources. Sharing of operational tools and manpower helps in cutting down additional costs.

Better Customer Satisfaction

A satisfied and happy customer is a boon for the organization. In a product extension merger, since similar products have come together in a single bucket, it becomes easy for customers. Customers experience a complete set of products or services under one roof. Therefore, it becomes easier for the customers to connect with the organization for all their requirements instead of looking for many vendors for all those different products and services. It will increase the satisfaction level of the customer and extend stability within the organization.

Expansion of Customer Base

Product Extension Merger directly or indirectly expands the customer base. The target audience may sometimes differ due to the nature of the products and services provided by both organizations. However, it more or less caters to the same industry segment, so similar products could be targetted to the same customer base, which eventually gives the company an expanded addressable customer base without much effort.

Also Read: Motives of Mergers

As a result, this merger helps both the organizations to indirectly cater to an additional set of customer bases, thus collectively expanding the customer base.

Increased Market Share and Profit

The pre-requisite of the merger is the expectation of an increase in market and share and reduction of operating costs that leads to increased profits. Post-merger, both organizations cater to a broad audience. As a result, the market share of the combined entity increases, thereby giving the advantage of economies of scale and generating higher profits. This type of merger not only increases the market share but also boosts the profits.

Competitive Advantage

The synergy flowing from the merger gives a tough competition to rivals. The combined entity provides an augmented product/ service to the expanded customer base and thus earns a higher market share. Hence, it becomes easier to stand with competition.

Better Utilization of Common Resources

Since merged originations operate in a common market, they often tend to interlink their production process, supply chain, or distribution channels. Thus all these things collectively boost operational efficiency and also reduce costs.

How Market Extension Merger is Different?

Market Extension Merger is when two companies providing the same products or services, but operating in different markets, decide to merge. It might be possible that one organization is supplying goods or services to a niche market while the other organization is providing goods or services to a medium-income segment. In such cases, the Market Extension Merger takes place to expand the customer base.

The main difference between the Product Extension Merger & Market Extension Merger is that the former focuses on expanding the product/service line, and the latter focuses on the expansion of the market. The former achieves synergy by adding new products, while the latter achieves synergy by adding a new market base/ target audience.

One of the essential differences is, in the case of a Market Extension Merger, both the organization provides the same set of products. On the other hand, in the case of a Product Extension Merger, both organizations may not offer the same products and services. These products could be linked or co-consumed together but are not the same.

Example of Product Extension Merger

- The merger of Pizza Hut and PepsiCo in 1977 was a Product Extension Merger. Pizza & Soft Drinks, like Pepsi, are not the same products but cater to the same industry. Thus to expand its soft drink reach, Pepsi merged itself with Pizza Hut by making Pizza Hut its subsidiary. Post-merger sales increased by more than $436 million.

- In 2002 Broadcom- a Bluetooth system manufacturing firm had, merged with Mobilink Telecom Inc., a supplier of chips & mobile design. In the above case, both the organizations operated in the same industry but provided different products. As a result, post-merger, they had achieved synergy by bringing a new technology that complemented each other’s products.

Conclusion

Product extension Merger is one of the popular types of mergers. It adds new products to the organization’s product line and also expands the market share and profitability. However, all such decisions depend on several factors, and the merger can’t be a sure-shot solution. Every situation is unique and needs detailed analysis and due diligence on various factors affecting the operational requirements of that particular industry segment and the target market. Moreover, it also requires a proper plan also in place for a smooth merger.