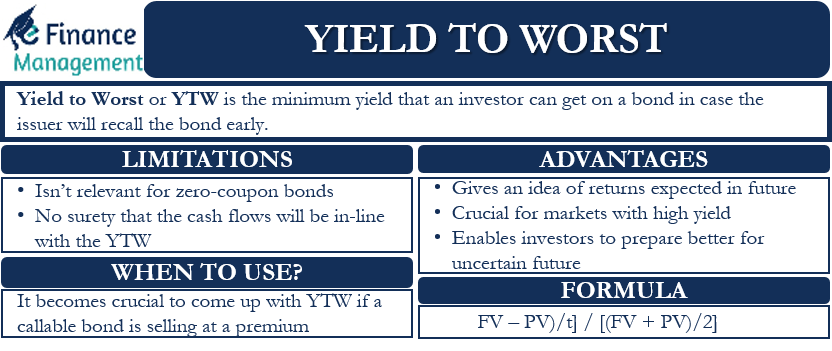

The Yield to Worst or YTW is the minimum yield that an investor expects to get on a bond when there is no probability of default by the issuer of the bonds. Or where the issuer does not default. Such a yield gains importance and makes sense when the issuing company repays the bond early. Or where the put option is part of the terms of issuance of such bonds.

For instance, the yield to maturity on a bond is 4.5%. But if the bond gives a right to the issuer for early redemption, and the issuer recalls the bond early, then the yield would be definitely lower than the YTM. And, thus yield to worst would be lower, say 3%. Though there is no guarantee that the issuer will recall the bond, but this is a risk that investors must consider while making an investment.

Calculating YTW gives investors an idea about their inflow in the worst-case scenario. Thus, it allows an investor to prepare to hedge such potential risks. While making investment decisions, the investor can weigh his options based on this minimum yield or YTW.

Understanding Yield to Worst

One can estimate YTW by considering all the scenarios when a bond may be retired earlier than the due date. Usually, in the case of a callable bond, the issuer does give a few dates on which it can redeem the bond. The YTW, however, is the yield assuming the issuer redeems the bond at the earliest possible date.

Callable bonds are good for the issuer but not for the investors. This is because if interest rates go down, then the issuer may decide to redeem the bonds early and issue new bonds at a lower interest rate.

Along with yield to maturity (YTM) and yield to worst, there is another important concept, and we call it yield to call (YTC). YTC is the return that an investor realizes if an issuer recalls the bond on the pre-defined call date/period. YTC may or may not be higher than YTM, depending on if the issuer redeems the bond at a premium or discount. In contrast, YTW will always be less than YTM.

Calculating Yield To Worst

The calculation of yield to worst is the same as one calculates the yield to maturity. The only difference is that YTW considers years until callable dates, while YTM uses years until maturity. In other words, to calculate YTW, we need to calculate YTM for the earliest callable date. Several calculators are available online to calculate YTW.

Formula to calculate Yield to Maturity = / [(FV + PV)/2]

Here

C = coupon or interest amount,

FV = face value of the bond,

PV = present value of the bond, and

T = term of the bond.

So, to calculate YTW, we change the t to the period when the issuer recalls the bond.

Another formula to calculate YTW is:

YTW = Risk-Free Rate plus Credit Risk Premium

Let us consider a simple example.

A bond with a face value of $1,000 has a 5-year term and offers a 5% coupon rate. It is an accrual bond, meaning compound interest types, where interest earned is added back to the principal and earns interest as well. It is a callable bond, and a company can call it back at the end of each anniversary year.

If an investor keeps the bond for a full five-year term, then he or she would get $1,276.30 at the end of the term. And, if the issuer recalls the bond on the first anniversary itself, the investor would just get $1,050. This includes $1,000 for principal and $50 for one-year interest. So, the YTW will be on the basis of $50.

Here is another example:

Mr. A buys a $1,000 par value bond at $1,100. It has a coupon rate of $60 and has a maturity of 10 years. Also, the bond is callable in 2 years. Using the YTM formula, we get the YTM as 4.72%.

But, if the bond is called back after two years at par value, Mr. A will earn just $20. Or, he would get two years of interest $120, less $100 more than he paid to buy the bond. So, using the same YTM formula, while replacing t by 2 years (the callable period), we get YTW as 0.93%.

When To Use YTW?

It becomes crucial to come up with YTW if a callable bond is selling at a premium. Generally, bonds sell at a premium if the interest rate they offer is more than the interest rate from other similar risk investments. This may encourage the issuer to redeem its bonds earlier and then reissue new bonds at a lower coupon rate.

Thus, in such a scenario, YTW gives investors a better idea of the annual yield to expect. Usually, bond issuers offer both yields to maturity and YTW when they issue a callable bond.

Advantages and Limitations of Yield to Worst

Following are the advantages of calculating Yield To Worst:

- YTW give investors an idea of the minimum return they can expect in the future when the issuer may recall the bonds at the first available opportunity.

- Calculating YTW is crucial for markets with high yield or where bonds trade more than the face value i.e., at a premium.

- It enables investors to prepare better for the uncertain future and be clear about the expected return.

Following are the disadvantages of YTW:

- Calculating YTW is not relevant for zero-coupon bonds because these bonds do not give regular interest. Moreover, such bonds are normally issued and trade also at a high discount to their par value.

- Even if the calculation of YTW is accurate, there is no surety that the cash flows will be in-line with the YTW number. If there are multiple call dates, the issuer may skip the first one and may decide to go with any other dates and so on. Or the issuer may not go at all, considering the small differentrial in the interest rates, their current cash flow status, their current strength to issue fresh bonds, etc.

Final Words

The YTW concept came after investors felt the need for an upgrade of the YTM and YTC concepts. However, the YTW is not as popular because of many reasons, including uncertainty of cash flow over longer durations. Yet, many see YTW as a crucial measure of credit risk.