Unlevered Beta Definition

It is a risk measurement metric that compares the risk of a company without any debt to the risk of the market. In simple language, unlevered beta is a company’s beta without considering the debt. It is also referred to as asset beta because the risk of a firm after removing leverage is because of its assets.

Levered Beta Vs. Unlevered Beta

Beta or levered beta is a measure of a firm’s systematic risk in relation to the market. Systematic risk is the risk that affects the overall market. Beta does not take into account the unsystematic risk. Unsystematic risk specifically affects a stock, so it can be reduced by diversifying the portfolio.

Some industries or companies have a high level of debt on their balance sheet. This leverage makes their earnings volatile, and investment in this company becomes risky. Levered beta considers the risk of leverage and its impact on the company’s performance. So, levered beta is not an ideal measure to compare two companies with different debt proportions. In such a scenario, you will have to remove the effect of debt by “unlevering” the beta. Unlevered beta will facilitate a better comparison for such companies than levered beta.

Formula for Unlevered Beta

| Unlevered Beta | = | Levered Beta (β) —————————– 1 + [(1- Tax) (Debt/Equity)] |

Unlevered beta or asset beta can be found by removing the debt effect from the levered beta. The debt effect can be calculated by multiplying the debt to equity ratio with (1-tax) and adding 1 to that value. Dividing levered beta with this debt effect will give you unlevered beta.

Also Read: Why Do we Unlever and Relever Beta?

Pure Play Method

The capital asset pricing model (CAPM) can be used for publicly listed companies. Finding beta of projects or companies that are not publicly listed is not possible through CAPM due to the lack of data. The pure-play method is used in such cases. Unlevered and levered beta is used in this method to estimate the beta.

Formula of Pure Play Method

| Beta Company = Unlevered Beta [1+(1- Tax) Debt/Equity] |

Calculation of Unlevered Beta with Example

Let’s take an example to understand how it is calculated.

Company X is a non-listed private company. Here are some details available to you:

| Description | Company X |

| Total Debt | $ 2 million |

| Total Equity | $ 5 Million |

| Debt to Equity ratio | 40% |

| Tax rate | 30% |

You want to find out the beta for Company X.

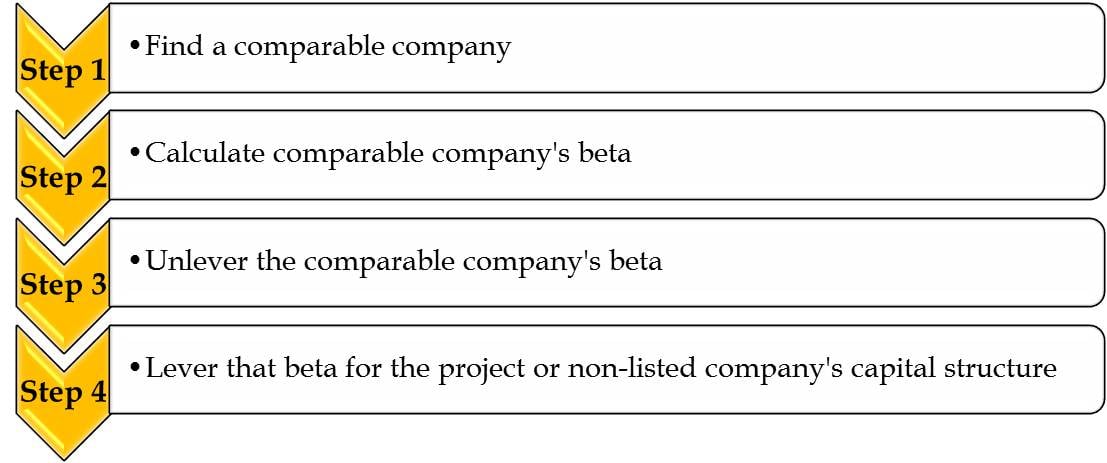

Stepwise Calculation of Unlevered Beta

Time needed: 10 minutes

Stepwise calculation of Unlevered Beta

- Find out a comparable listed company in the same industry.

Firstly, you need to find a comparable company similar in nature to Company X. Also, the comparable company must be publicly listed to calculate its beta. You found a Company A, which is very similar in nature to Company X. Company A is operating in the same industry, and it has the same product line and risk profile as Company X. So, you have collected the following data about the comparable company:

Company A (Comparable Company)

Calculated Beta – 1.2

Total Debt – $ 4 Million

Total Equity $ 8 Million

Debt to Equity Ratio = 50%

Tax Rate = 35% - Calculate the beta of the comparable company

The second step is to calculate the beta of the comparable company. Here, Company A has a beta of 1.2. Now, you will have to unlevered the beta of Company A. in simple language; you have to remove the effect of leverage from the beta of company A. By applying the formula, we find the unlevered beta value to be 0.91.

Unlevered Beta (βCompany A) = Levered Beta (βCompany A) / {1+(1-Tax)*(Debt/Equity)}

Unlevered Beta (βCompany A) = 1.2 / {1+(1-0.35)*(0.5)} = 0.91 - Find Company X’s Unlevered Beta by Adjusting Company A’s (comparable company) unlevered beta for the capital structure of Company X.

The last step is to adjust Company A’s (comparable company) unlevered beta for the capital structure of Company X. We will assume the unlevered beta of Company A will be the same as Company X because they are similar in nature. By adjusting the unlevered beta of Company X for its leverage, we will find the beta of Company X to be 1.17.

Levered beta (βCompany X) = Unlevered Beta (Company X) * [1 + {(1- Tax) (Debt/Equity)}]

Levered beta (βCompany X) = 0.91 * [1+{1-0.3)(0.4)}] = 1.17Also Read: Unlevered Beta Calculator

Interpretation

Unlevered beta ignores the debt portion on capital structure and hence, makes a comparison of securities with different debt-equity ratios. It is always less than the levered beta as it does not consider debt financing.

Cautions

As stated above, the unlevered beta helps in making a comparison between companies having different debt-equity ratios. But it does not consider the effects of debt financing on earnings.

Also, you can use Unlevered Beta Calculator

Quiz on Unlevered Beta

Sir for either of beta levered or unlevered we have to have the value of either of the beta. How do we calculate unlevered beta if we do not have value of levered beta or vice versa.