What is Turnaround Strategy?

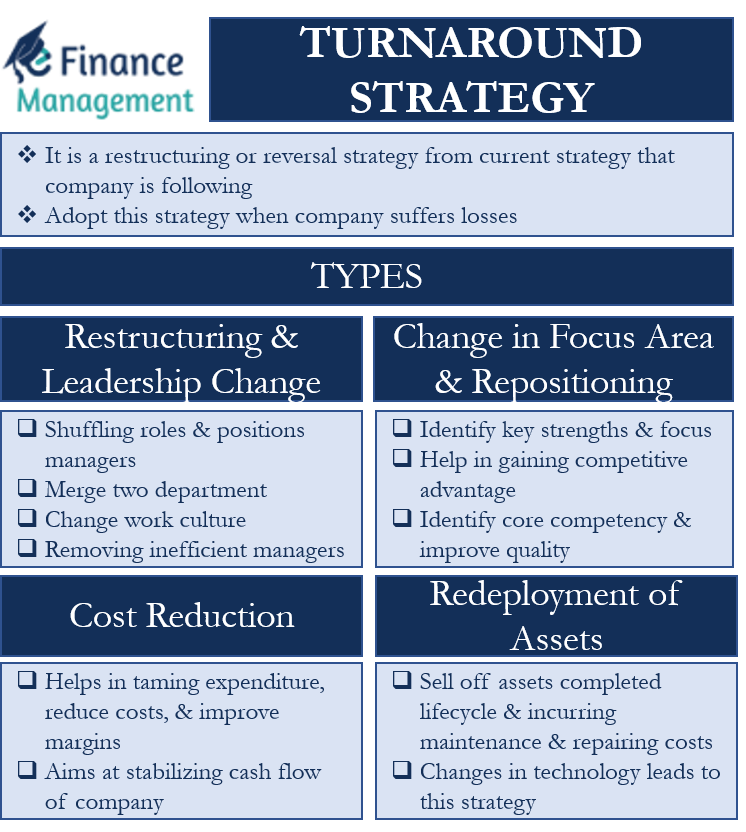

A turnaround strategy is a restructuring or a reversal strategy from the current strategy that the company is following. Companies usually adopt this strategy when their unit or department is suffering losses or is underperforming for a long time. It involves doing things differently to sort and pull things back on track. The company wants to change the modus operandi to convert the company or department into a profitable one. The companies bring about fundamental adjustments in strategy or the processes they use.

The reasons for under-performance can be many. The management might not be performing up to the mark. Or the economy might be going through a recessionary phase. The taste and choice of consumers might have changed. Or the country may have been hit by a natural catastrophe. Similarly, the company may be experiencing a heavy increase in inputs costs or the entrance of new competition. Or it may have financial and liquidity issues.

The reasons mentioned above can result in a constant fall in demand and profits. Fall in sales and under-performance of the departments forces the companies to go for turnaround strategies. It may look at changing the processes or style of working to bring the company back to normalcy. The general measure of the success of the turnaround strategy is an increase in the net income of the company. Hence, companies evaluate alternatives that can help in increasing the net profits of the company and choose the right path accordingly. And sometimes there is a need to restructure the financial arrangement, may need to inject further funds, and so on.

Types of Turnaround Strategies

Restructuring and Leadership Change

The first step towards restructuring and improving the overall health of the company is to bring a change in the current leadership regime of the company. This will call for the introduction of temporary structures or changes in the company’s current organizational structure/current hierarchy. The company may shuffle the roles and positions of its current managers. It may bring a change in the present hierarchy in the company. Also, it may have to take the harsh decision of removing a few inefficient or incompatible managers from the company. It may decide to merge two or more departments or a single manager for one or more departments to drive the synergy and balance.

Also Read: Does Corporate Restructuring Create Value?

Another major change that companies require with age is the need to change their work culture. Older companies operate with obsolete styles that may have become irrelevant under the present circumstances. The management must take sincere steps to replace such old and traditional ways with new ones to bring overall efficiency and harmony to the workplace. This will directly result in improving sales volume and profitability.

Cost Reduction

Most companies follow a cost reduction or cost-efficiency strategy to tame their expenditure, reduce costs, and to improve their margins. Cost reduction has a direct impact on profitability and helps the company to bring it back in line. The cost reduction strategy aims at stabilizing the cash flow of the company and improving it gradually.

There are numerous alternatives to cost reduction as a turnaround strategy. It can be done by cutting down salaries, administrative and marketing expenditure, and inventory, or bringing down its interest expenditure by delaying the accounts payable and quickening the accounts receivables cycle. Also, the company can cut any unwanted hikes in salaries and limit the budget for non-core activities such as research and development. The entities may also look for better purchasing efficiency as well as the better input-output ratio

The company can put in place control measures to ensure the success of the cost reduction strategy. However, an environment of rigorous controls can negatively affect employee morale. Also, over-emphasis on cost reduction techniques can sometimes result in a scarcity of essential resources. Therefore, excess reliance on this strategy can boomerang and may negatively affect the company’s overall performance. Sometimes, tightly controlled costs can give better results than absolute cost-cutting. Hence, every company should take this important decision by keeping in mind the internal effects of those decisions and their current circumstances.

Redeployment of Assets

Companies redeploy assets after implementing the turnaround strategy of cost reduction. They can sell off assets that have completed their valuable lifecycle and now are incurring repairs and maintenance costs regularly resulting in a loss. They can invest in new assets that can replace the older ones or complement them. This can help to achieve greater efficiency in day-to-day activities. The company can thereby achieve higher production goals.

Significant changes in technology may also warrant for the redeployment of assets. If the company does not bring in newer assets, the competitors can take advantage of the situation. They can start producing better products at lesser prices. Also, the company’s products will become obsolete in front of the products of other companies. The company can lose its market share to the competitors and incur losses. This can happen on account of the absence of improved features as well as a higher price.

Change in the Focus Area and Repositioning

Another turnaround strategy is to change the focus area/ market of the company and exit certain unprofitable areas. It should identify its key strengths and focus on areas where it can perform the best. All this analysis and change in the focus will facilitate the company in optimizing its product mix as well as market penetration. And it would help the company to gain a competitive advantage. It should allocate a higher marketing budget for its key products and areas for maximizing returns from such activities.

The company can identify its core competency and further improve the quality of its goods or services. This will also result in generating higher sales volume and profits.

Companies often face the challenge of markets with customers who are highly sensitive to price or quality. The company can identify such challenges and reposition itself in those markets. It should mold its offerings to satisfy the market demand and capture a higher market share.

Conclusion: Turnaround Strategy

Turnaround strategy is an important component of corporate strategy. It has a pivotal role when a company is facing constant stress on its financials and is consistently underperforming.

Strategists advocate the use of a proactive top-down management style for the success of turnaround strategies. This is so because companies and managements in trouble need a firm decision-maker at the top to bail them out of tough situations. Also, these strategies involve a rapid change in the positions and style of working in the company. This can be very tough, keeping in mind that people are always averse and resist to changes.

The success of turnaround strategies depends upon the seriousness of the management in implementing them throughout the organization. This in turn depends upon how severe the crisis is. If it is a question of the survival of the company, the management will seriously implement it. If the problem is not so severe, the management may be a bit lax in implementing these strategies which can affect its success and result in its failure.

RELATED POSTS

- Profit Strategy: Meaning, Assumption, Limitations and More

- What is the Difference between Internal and External Reconstruction?

- Takeovers

- Equity Recapitalization – Meaning, Impact, and Private Equity Recapitalization

- Leveraged Recapitalization – Meaning, Pros, Cons, and More

- Stability Strategy – Meaning, Types, Reasons and More

I find it very useful the way you elaborate in simple language make some one to understand ease. Keep on educating one who needs knowledge