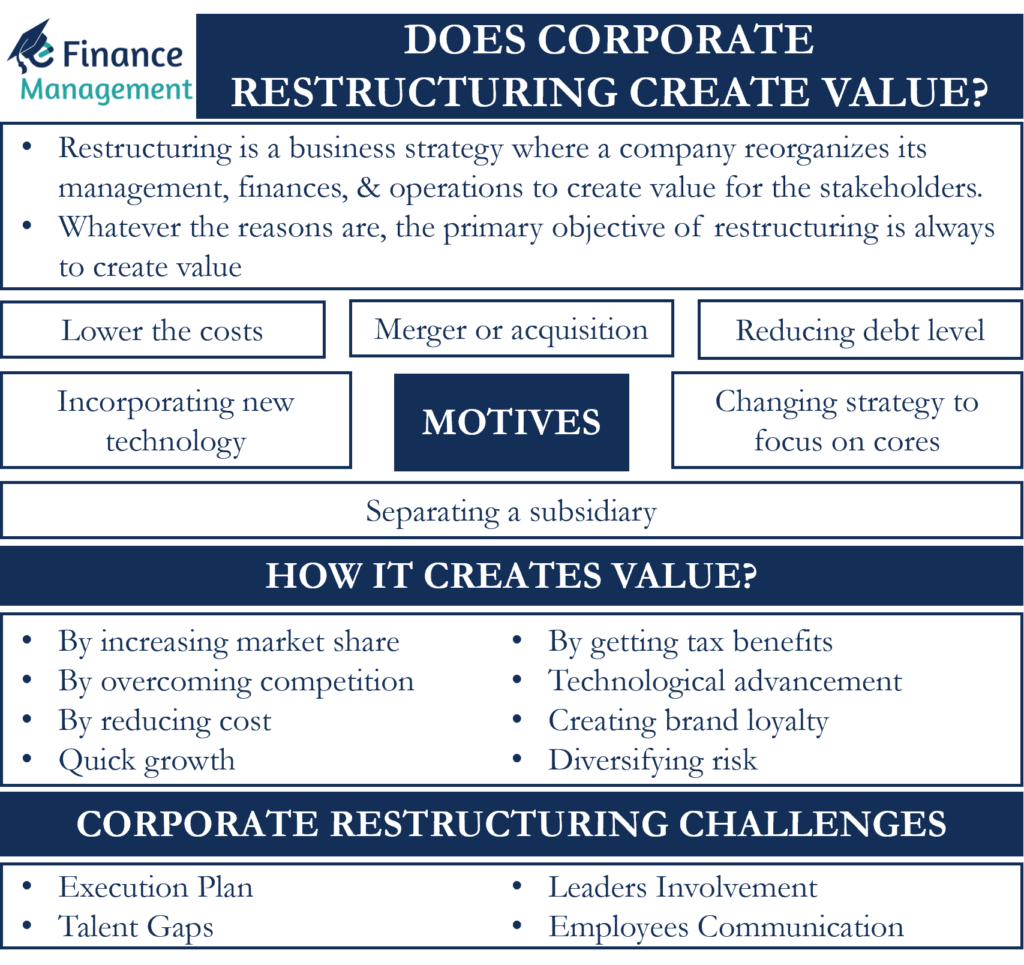

Corporate restructuring is a business strategy where a company reorganizes its management, finances, and operations to create value for the stakeholders. A business usually goes for restructuring when it is facing any financial and economic issues. For instance, if a firm is unable to pay its debt, it could decide to undergo a restructuring agreement with the creditors. This agreement could be to reduce the interest, reduce debt or offer easier and more convenient repayment options. Other reasons that can force a business to go for restructuring are acquisition, joint venture, and more. Whatever the reasons are, the primary objective of restructuring is always to create value. However, whether or not corporate restructuring creates value depends on the company’s ability to effectively overcome the challenges related to the restructuring process.

Motives for Corporate Restructuring

The motive of every business to go for corporate restructuring could be different. The following are the motives why companies go for restructuring:

- Lower the costs.

- Acquiring or merging with another company.

- Separating a subsidiary.

- Incorporating a new technology.

- Reducing the debt level.

- Change strategy to focus only on vital products and services.

How Corporate Restructuring Creates Value?

So far, we have seen the motives behind why a business may go for restructuring. Now, let’s take a look at how corporate restructuring creates value:

Increasing Market Share

If a business goes for an acquisition or merger, it could help it to raise its market share. Such a strategy could give the business new customers, allow it to offer more products and services to existing customers, or both.

Overcoming Competition

Adding more products or services, reducing the production cost, or offering better products or services at the same cost, could help a company to overcome competition.

Cost Reduction

When a company grows big, it could lead to economies of scale. And it eventually leads to a lowering of costs. Moreover, if a business undertakes operational restructuring or takes up new technology, it could also help in lowering costs.

Quick Growth

If a business intends to grow organically, it could take a long time. But, if a business goes for M&A, it could quickly increase its size to become bigger than the competitors. This could assist the business to raise its market value.

Tax Benefits

Restructuring could bring tax benefits to an entity. Moreover, there are instances when companies go for M&A for tax purposes only, such as a merger of profitable and loss-making businesses.

Technological Advancement

In the present era, it is extremely crucial for a business to constantly update and upgrade its technological capabilities. Doing this allows the business to gain or retain its competitive edge.

Brand Loyalty

Creating brand loyalty is one of the top priorities for any business. If your customers are loyal, they will not only give you repeat business but work as your word-of-publicity as well. This, in turn, will allow you to gain new customers. Offering innovative, better products and services is the best way to gain brand loyalty. And, restructuring could help a business to do that.

Reducing Risk

Diversification is one of the best ways to reduce risk. Using restructuring strategies, a company could get into businesses different from its current business. This could help a business to smoothen its cash flows even if one or more of its businesses aren’t performing well.

Corporate Restructuring Challenges

So, above were the ways in which corporate restructuring creates values. However, just adopting corporate restructuring strategies may not create value for the stakeholders. Like with any other thing, corporate restructuring has its own set of challenges. Thus, it is important for the management to overcome these challenges so as to actually create value for the stakeholders. Following are the challenges (and ways to overcome those challenges) associated with corporate restructuring:

Execution Plan

Restructuring could impact almost every aspect of business, including top management, employees, suppliers, customers, and other stakeholders. The impact could be due to internal or external forces related to restructuring. To overcome such issues, it is important for the company to develop a detailed execution plan. This plan must cover all aspects that restructuring could impact, as well as the steps to nullify the impact.

Talent Gaps

When a company undergoes restructuring due to any M&A activity, it may lead to overlapping roles or gaps in leadership. Such issues could arise due to the formation of new teams and assigning of new roles to employees. To overcome such challenges, companies can use modern org chart technology. Such technology could assist in identifying talent gaps or overlaps in teams.

Not Involving Leaders

Corporate restructuring is usually a hush-hush affair, and thus, most of its planning is kept confidential. Experts, however, say that a major reason for restructuring failure is the resistance by company leaders. Thus, it is important for the management to keep leaders in the loop. Keeping leaders informed will help them to prepare their teams, as well as make the team understand the ongoing changes in the business due to the restructuring.

Communication with Employees

Employees will be able to understand the logic behind the restructuring if they are clear on why and how restructuring impacts them. However, if management keeps secrets from employees, they are more likely to trust the rumors. Also, in such a case, employees could make their own assumptions on the basis of wrong or limited information. Thus, it is important to have clear and regular communications with employees regarding the restructuring.

These are the major corporate restructuring challenges that a business needs to overcome, in order, to maximize value creation.