Growth is a significant success factor for any firm. The growth in revenue, profit, asset base, or other things helps to measure the growth of the business. Both high and low growth affects business. The high growth impacts the resources of the business. On the other hand, slow growth shows less competitiveness and makes the survival of businesses difficult. As a result, to overcome such situations, the business requires to know the sustainable growth rate.

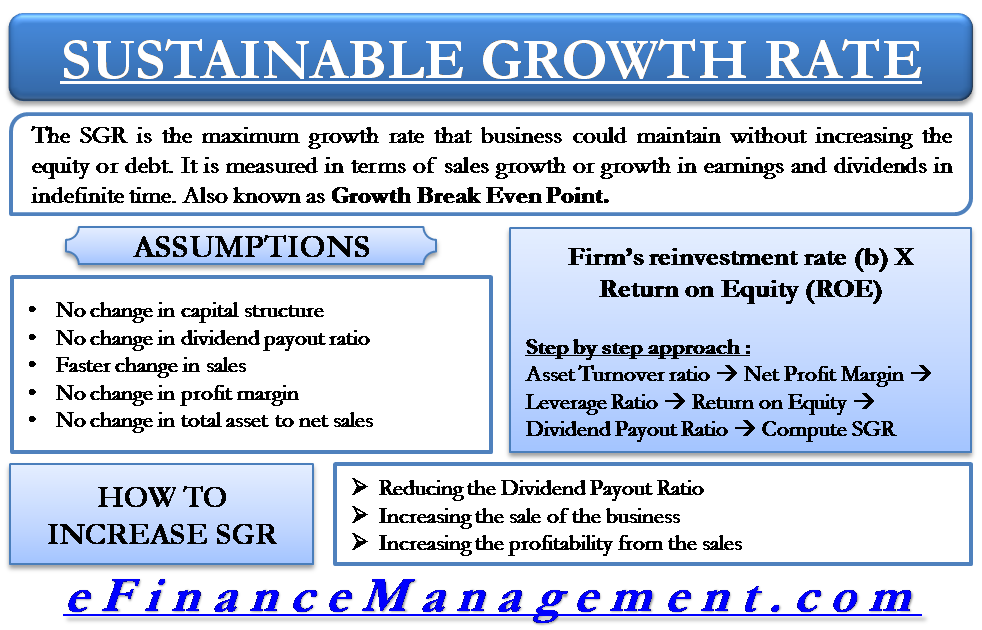

The sustainable growth rate is also known as SGR. It calculates the maximum growth rate that a business could maintain without increasing the equity or debt. SGR is measured in terms of sales growth or growth in earnings and dividends in an indefinite time.

It is also known as the growth break-even point. Generally, the break-even point is the minimum level of sales that a firm requires to cover its operating expenses. In this way, the company can report neither the profit nor the loss. Similarly, SGR is the ceiling or the maximum growth in sales a business should reach without increasing its financial leverage.

Assumptions of Sustainable Growth Rate

The calculation of SGR is based on three assumptions:

No Change in the Capital Structure

The main assumption of the SGR is that the business grows only by investing the amount that it earns. That means the business does not change its capital structure. Business does not raise any additional equity or borrow external funds. The retained earnings are the only source of capital, which earns the return by reinvestment.

No Change in the Dividend Payout Ratio

To calculate the dividend payout ratio, divide dividends by total earnings or divide the dividend per share by earnings per share. Hence, it is the percentage of earnings paid to the shareholder. After paying the dividend to the shareholders, the amount that remains is the amount reinvested in the business. Hence, the constant dividend payout ratio is important to calculate SGR.

Sales Need to Increase Faster to the Level Market Factors Allow

The main focus of the business is to increase revenue by utilizing the available internally accrued capital. The sales and assets growth is limited and cannot increase faster than the retained earnings.

Other Assumptions

For the calculation of the SGR, several other assumptions are considered

- The profit margins will not change.

- There will be no change in total assets to net sales.

- The depreciation on the assets will be adequate.

Calculation of Sustainable Growth Rate

Having an understanding of the assumptions of SGR, it becomes easier to understand how to calculate it. The business has retained earnings only to fulfill the capital requirements. Therefore, the returns on retained earnings are the return on equity (ROE). Multiply this to the firm’s reinvestment rate to obtain the SGR.

SGR=b*ROE

ROE=return on equity

b= firm’s reinvestment rate

Step by Step Approach

The step-by-step approach to calculating SGR

- Step 1: Compute the Asset turnover ratio

Asset Turnover Ratio = Net Sales/Total Assets

- Step2: Compute the Net Profit Margin

Net Profit Margin = (Net Profit/Net Sales)*100

- Step 3: Compute the Leverage Ratio

Leverage Ratio = (Total Debt/Total Equity)*100

- Step 4: Compute ROE

ROE = Asset Turnover Ratio*Net Profit Margin*Leverage Ratio

Or

ROE = (Net Income/Shareholder’s Equity)*100 - Step 5: Compute Dividend Payout Ratio(DPR)

DPR = (Dividend/Net Profit)*100

- Step 6: Compute Reinvestment Rate (b)

b = 1-DPR

- Step7: Compute SGR

SGR = b*ROE

Example of SGR Calculation

Calculate SGR for a business having a shareholder’s equity of $800, net income of $230, and dividend payout ratio of 35%

ROE= $230/$800=28.75%

b= 1-35%=65%

SGR=29%*65%=18.85%

How to Increase SGR?

The SGR is the function of ROE and Reinvestment Rate. A business can increase the SGR by increasing any one of these two factors. The factors include:

Also Read: Internal Growth Rate Calculator

- Reducing the dividend payout ratio

- Increasing the sales of the business

- Increasing the profitability from sales

The SGR has the assumption that the sales of the business increase without any restrictions, and the business has more than enough chance to grow. However, when the market demand is low, it does not matter how high the SGR is; it cannot help the business to grow.

Conclusion

Hence, the sustainable growth rate is very important to find out the future prospect of the company. Analysts who analyze the business keep a very close eye on this rate. To calculate this rate, we use two very important parameters. The first parameter is the return on equity shareholders of the company. The second parameter used is the reinvestment rate. Therefore, this rate, when analyzed with the actual growth rate, helps business managers to make decisions.

Quiz on Sustainable Growth Rate or SGR

RELATED POSTS

- Two Stage Growth Model Calculator

- Retention Ratio – Definition, Calculation, Interpretation, Factors, and Limitation

- Cost of Equity – Dividend Discount Model

- Constant Growth Rate Discounted Cash Flow Model/Gordon Growth Model

- Zero Growth Model – Meaning, Calculation, and Example

- Growth Maximization as a Financial Management Objective

Good read , informative .