Understanding Scenario Analysis

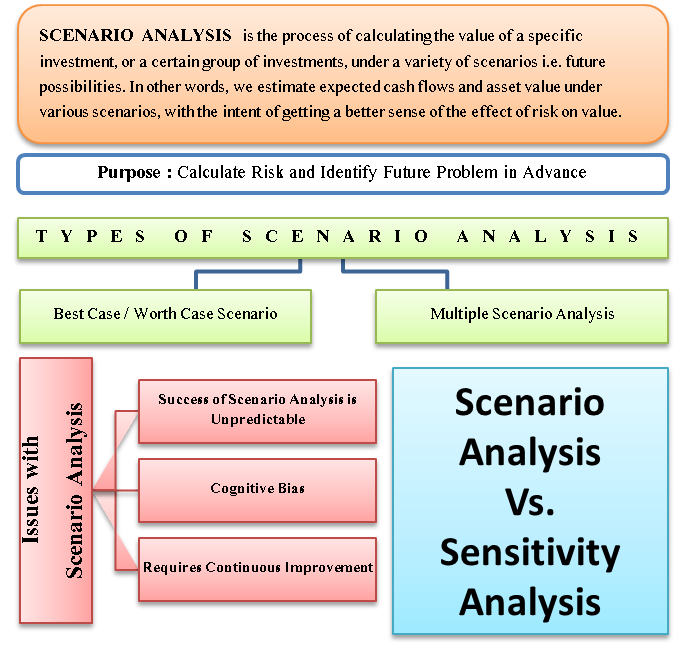

Scenario Analysis is the process of calculating the value of a specific investment, or a certain group of investments, under a variety of scenarios, i.e., future possibilities. In other words, we estimate expected cash flows and asset value under various scenarios to get a better sense of the effect of risk on value.

These scenarios may be very likely to occur, or their occurrence might be doubtful, yet quite possible. A key point to consider here is that scenario analysis is not dependent on past results. Historic data mainly provides a framework within which we can conduct future scenario analysis.

Purpose of Scenario Analysis

Scenario analysis can be done for many reasons, such as –

- Through scenario analysis, investors & business managers can determine the amount of risk. That they are taking before making the investment or starting a new project.

- It is a way of structured thinking about the future. As scenario analysis helps identify potential future problems, we can take necessary precautions to eliminate the problems or reduce the impact of these problems.

Types of Scenarios

There are mainly two types of scenario analysis that are widespread & used by most executives, managers, and investors. Following are the two types:

Best Case/ Worst Case scenario

We often realize that the actual outcome of an investment is much different from the one we have assumed. This is because we make assumptions and predict the outcomes based on our assumptions. But we never question whether our assumptions are right or wrong? Are there any other possibilities?

We consider multiple assumptions when we do best case/ worst case scenario analysis. In the best-case scenario, each input value is set to the best. For example, the economy & industry will grow at 6% (best growth rate), we assume the best projections, etc. Then we determine an outcome. This brings us to the situation where we say, “if every factor works out to the best, we will have X amount of returns.”

Also Read: Risk Analysis Methods – Meaning and Types

On the other hand, when we take the worst-case scenario, each input value is set to the worse, and we can conclude that “if every factor works out to the worse, we will have Y amount of returns.”

The best case/ worst case scenario gives out a range to the decision-maker. For example, if we are doing a best case/ worst case scenario analysis for the stock price of Company A, we might get a result such as – In the best case, we will get a return of 12%, and in the worst case, we will get a return of 8%. So the investor will know for sure that his returns will be between 8% and 12%. This will help him make better decisions.

Multiple Scenario Analysis

Scenario analysis does not have to be restricted to the best and worst cases. In fact, most of the time, the value of a particular investment is predicted by taking multiple scenarios into question. For example, suppose Apple Inc. wants to predict its future sales. In that case, it can take multiple scenarios, such as if the cell phone industry increases by 10% P.A., we will have X sales, if it increases by 15% P.A., we will have Y sales, and if it increases by 20% P.A. we will have Z sales. This way, they can predict multiple future outcomes and be more prepared.

Issues in Scenario Analysis

Success of Scenario Analysis is Unpredictable

We might do a proper detailed scenario analysis, get facts right, and make clear assumptions about all the scenarios, but we can never know if the scenario will play out exactly as we expect it to. For example, suppose a manager of a chocolate manufacturing company might assume that in the year 2017 if world chocolate consumers increase by 20%, his sale would rise by 10%. He came to this conclusion after following a step-by-step structured approach to scenario analysis. But when the year ended, he realized that the world chocolate consumers increased by 22%, but his sales increased only by 5%. After further investigation, he found that the increased consumers preferred white chocolate while he manufactured milk chocolate. By this example, we can conclude that while making a scenario, we may consider some factors, but we can’t possibly consider all factors as thousands of factors affect a situation.

Cognitive Bias

There are times when decision-makers take multiple scenarios – say best, average & worst. This is a dangerous situation because, as human nature, we consider that occurrence of an average scenario is the most likely. Thus we are biased to make decisions based on average scenarios. The human brain is wired in a certain way & its perceptions affect all decision-making.

Requires Continuous Improvement

Scenarios require continuous revision, refinement & control by an expert or a specialized team. In these fast-growing times, a scenario considered today may take a very form in the next 3-month period. One must periodically update the scenario analysis & make wise decisions to get the maximum benefit out of scenario analysis.

Scenario Analysis Vs. Sensitivity Analysis

Many people confuse scenario analysis with sensitivity analysis. Even though the base of both the concepts is similar, i.e., predicting outcomes given certain situations, they differ a lot. Sensitivity analysis is used to understand the effect of a set of independent variables on the same dependent variable. On the other hand, scenario analysis would require the financial analyst to describe a specific scenario in detail. Let us understand both with an example.

Scenario analysis example – What would be the sales growth of Apple iPhones if the GDP growth rate in the USA will be between 1% & 2% (low), 2% and 3% (average), more than 3% (high). After specifying the details of the scenario, the analyst would then have to specify all the variables so that they align with the scenario. The result is a very comprehensive picture of the future (a discrete scenario).

Sensitivity analysis example – What will be the effect of Apple Inc.’s net working capital (independent variable) on its net profit margin (dependent variable). The analysis will involve all the variables that have an impact on the company’s profit margin, such as the cost of goods sold, workers’ wages and managers’ wages, etc. The analysis will isolate each of these fixed and variable costs and record all the possible outcomes.