Buying or selling options is just a one-click job for an investor. But behind the screen, there are many processes that go on, including marking to market, closing or settling positions, premium collection, margin collection, and more. In this article, we will look at how options are settled.

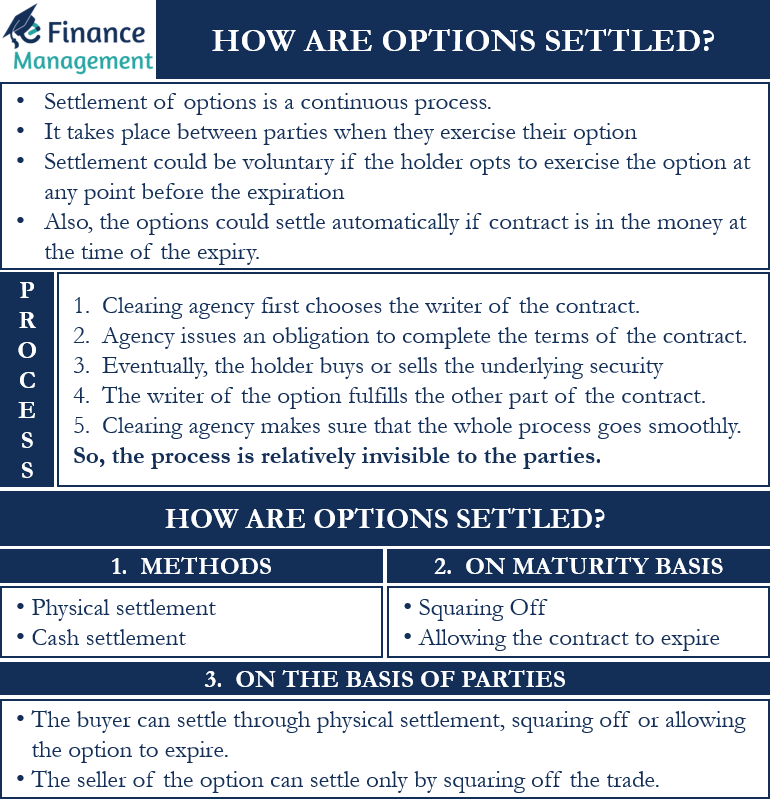

Settlement of options is a continuous process, and to understand the process, we need to see the buy-side and the sell-side separately. The settlement takes place between parties when they exercise their option. A settlement could be voluntary if the holder opts to exercise the option at any point before the expiration. Also, the options could settle automatically if the contract is in the money at the time of the expiry.

Before we detail how options are settled, we first need to understand the settlement process.

Settlement Process

Technically, the settlement is between the holder and writer of the options contract. But in reality, it is the clearing agency that manages the whole settlement process. So, if the parties exercise the option or the options settle automatically, it is the clearing agency that works behind the scene to settle the contract.

Talking about the whole process, the clearing agency first chooses the writer of the contract. The agency then issues an obligation to complete the terms of the contract. Eventually, the holder buys or sells the underlying security (depending on the call or put option). And the writer of the option fulfills the other part of the contract. The clearing agency makes sure that the whole process goes smoothly. So, the process is relatively invisible to the parties.

How are Options Settled: Methods

Primarily there are two methods by which an option can be settled. The two methods are:

Physical Settlement

It is the most popular method to settle options. Such a settlement involves the actual delivery of the underlying security. In this case, the call option holder would buy the underlying security. And the holder of the put option would sell the underlying security. The options that are settled physically are American style. The majority of the stock options settle physically.

Cash Settlement

This type of settlement is not as common as physical settlement. Such a type of settlement, however, is common for securities that can’t be easily transferred or delivered. For example, contracts that depend on indices, currency, and commodities are generally subject to a cash settlement.

Usually, the options that settle in cash are European style. This means that they automatically settle at the time of expiry when they are in profit. At the time of the expiry, if the contract has any intrinsic value, then that profit goes to the holder. And, if the contract is at the money or out of the money, or has no intrinsic value, then such a contract expires worthless. There is no exchange of cash in this case.

How are Options Settled: On the Basis of Maturity

There are two ways to settle options on the basis of maturity:

Squaring Off

If, before the expiry of the option, the holder reverses the trade, it means he or she is squaring off the position. For instance, you buy one Call option, and to square off or settle this, you will need to sell one call option carrying the same underlying asset and expiration. In this case, the difference in the premium is the profit or loss that a trader makes.

For example, Mr. A buys 1 lot of Company X Call having a strike price of $3000 for March 31 expiry at a premium of $30. To square it off, Mr. A needs to sell 1 lot of Company X Call having a strike price of $3000 for a March 31 expiry. Suppose Mr. A sells the Call at a premium of $40. In this case, Mr. A will make a profit of $10.

Allowing the Contract to Expire

Allowing a contract to expire worthlessly is another way to settle an option contract. In this case, the holder will have to give away the premium. Or the premium amount is the loss for the holder. Such a way to settle an option contract is useful when the trade doesn’t go as per expectations.

How are Options Settled: On the Basis Parties

The settlement will be different for an option buyer as compared to an option seller. Let’s understand how:

The buyer of an option (call or put) can settle through physical settlement, squaring off or allowing the option to expire.

The seller of the option can settle only by squaring off the trade. The other two options (physical settlement and allowing the option to expire) aren’t available to the seller. So, the seller will have to buy the option with the same underlying asset and the same maturity date to square off the trade.

Final Words

When looking at the list of options it is difficult to tell whether an option is physically or cash-settled. In reality, it doesn’t really matter much to most investors. It is because most options traders don’t really exercise the option; instead, they try to make a profit by buying and selling the contract before the expiry.