There are various advantages and disadvantages of NPV. Let’s have a look at each to understand the peculiarities of NPV in depth. These pros and cons will also help in the right selection of capital budgeting methods like IRR, Payback Period, NPV, etc.

Let us recall the formula of NPV,

NPV = Present value of Inflows – Present value of outflows

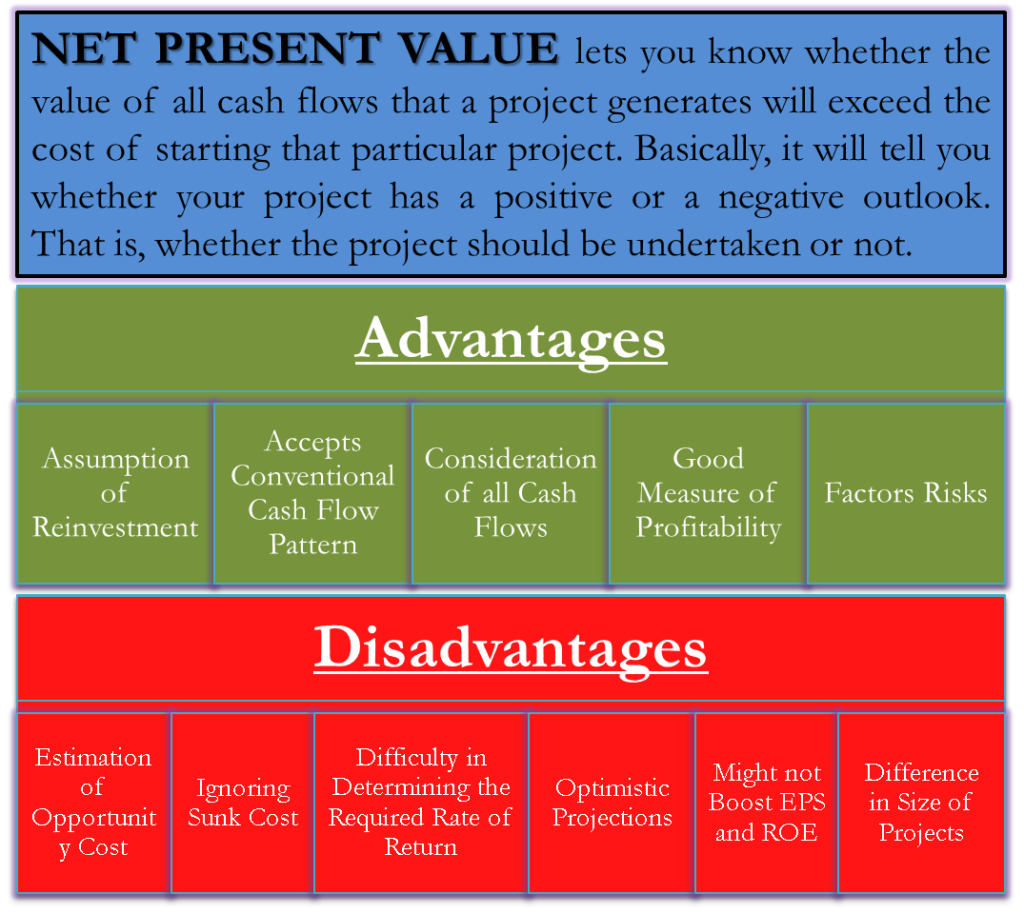

Net present value (NPV) lets you know whether the value of all cash flows that a project generates will exceed the cost of starting that particular project. Basically, it will tell you whether your project has a positive or a negative outlook. That is, whether the project should be undertaken or not.

Following are the advantages and disadvantages of NPV:

Advantages/Merits of NPV

Assumption of Reinvestment

Unlike IRR, using NPV makes sense because it does not assume that the cash flows will be reinvested at IRR, which is almost impossible. How can your cash flows get reinvested at the project’s rate of return? Reinvesting the cash flows at IRR would mean you are investing back the cash flows from your project into the market at the equivalent rate as that of your project’s rate of return. You need to find another investment yielding the same as your project for the reinvestment. Well, that isn’t easy.

Accepts Conventional Cash Flow Pattern

NPV gets unaffected by Conventional cash flow patterns. The conventional cash flow pattern is as follows –

| Year: | 0 | 1 | 2 | 3 | 4 |

| Cash Flow | -$1000 | -$400 | $300 | $800 | -$100 |

In year 0, there is an initial outlay, and from year 1, there are positive and negative cash flows. Using IRR under this cash flow pattern would result in no IRR or multiple IRR, which will distort your capital budgeting decisions. Under NPV, you don’t need to be bothered when dealing with conventional cash flow patterns.

Also Read: Can We Use Net Present Value Method to Compare Projects of Different Sizes and Durations?

Consideration of all Cash Flows

NPV takes into account each cash flow you define. It’s not like the payback period method or discounted payback period method, which ignores cash flows beyond the payback period.

E.g., Initial outlay: -$1000 at time 0 for projects A and B

| Year | Project A | Project B |

| 1 | $500 | $500 |

| 2 | $500 | $100 |

| 3 | $700 | $4000 |

Here project A looks smarter because it recovers its initial outlay in 2 years, and project B takes a little more time than project A. Here, what the payback period is ignoring is the huge cash flow of $4000. NPV will consider this $ 4000 and might as well say that project B appears smarter. I use the word ‘might’ here because at what rate the cash flows of both projects A and project B will be discounted is to be seen. But yes, NPV considers all the cash flows that you define.

Good Measure of Profitability

If you wish to choose one single project from amongst many, NPV will be a good measure of profitability. If you use IRR for mutually exclusive projects, you might end up selecting small projects with higher IRR and a short-term nature at the expense of long-term (long-term value creation is good for shareholders) and higher NPV projects.

Factors Risks

Discount rates are used in calculating NPV; the risk of undertaking the project (Business risk, financial risk, operating risk) gets factored into this method.

As we have seen the advantage, let’s see the disadvantages of NPV.

Disadvantages/Demerits of NPV

Estimation of Opportunity Cost

Determining the opportunity cost might become difficult. This opportunity cost is especially considered in the initial outlay. Therefore, underestimating the initial outlay will distort the result.

Ignoring Sunk Cost

In the capital budgeting world, sunk costs (costs incurred before you start a project. E.g., R&D costs) are not included. Hence, these costs might be huge, and ignoring these costs might sometimes become very difficult for the corporate finance team.

Difficulty in Determining the Required Rate of Return

Determining the rate at which the cash flows are to be discounted might be tough for the corporate finance team. A firm should not use WACC as the rate but must use the project’s rate of return as a discount rate, and thus the wrong estimation may lead to higher or lower NPVs. Remember, a high-risk project should not be discounted at its cost of capital but at its required rate of return.

Optimistic Projections

Sometimes managers are too optimistic about the success of the project, and since the corporate finance team needs to sit with the management to take into account the business scenario of the project, the cash flows considered might be too high. Hence, there can be an upward bias with respect to this method.

Might not Boost EPS and ROE

Short-term projects having higher NPV might not boost the earnings per share and return on equity of the company. EPS and ROE is what will increase the shareholder value. Short-term projects with higher NPV might not work in the shareholder’s favor.

Difference in Size of Projects

Capital rationing is where you don’t have access to unlimited funds, so you have to choose projects within your capital budget. Now, for a mutually exclusive project, comparing the NPV of the projects requiring different amounts of funds will not be suitable. E.g. – (assuming your capital budget is $7 million) Project A requires $10 million and produces an NPV of $2 million. There is a project B that requires $5 million and produces an NPV of $0.5 million. In this case, the NPV of project A and project B can’t be compared for the decision-making process since the size of the 2 projects is different. Therefore, NPV cannot be used to compare project of different sizes.

Conclusion

Regardless of its disadvantages, finance managers widely use NPV, and they consider it a good measure of profitability than IRR, discounted payback period, and payback period.

Continue reading – Why Net Present Value is the Best Measure for Investment Appraisal?

Quiz on Advantages and Disadvantages of NPV

This quiz will help you to take a quick test of what you have read here.

Sanjay Ji, I have gone through your blog contents about NPV.

I am Anuya Deshpande I want to pursue my Ph.D. on Application of Financial Modeling For Project Appraisal and Capital Structure Decisions with Special Reference to Franchise Business in India.

Can you help me out on how to estimate the inflows for the project?

Hi Anuya,

Thanks for writing.

See the following resources, I think, it should be helpful to you.

Estimate Project Cost