Dividend policies are one of the important decisions that a company takes. Several factors affect the company’s payout policy, which includes various types of dividend models and repurchasing shares. Companies frame dividend policies as per their requirements. Shares repurchases are becoming more relevant and common in recent times.

Definition of Dividend Policy

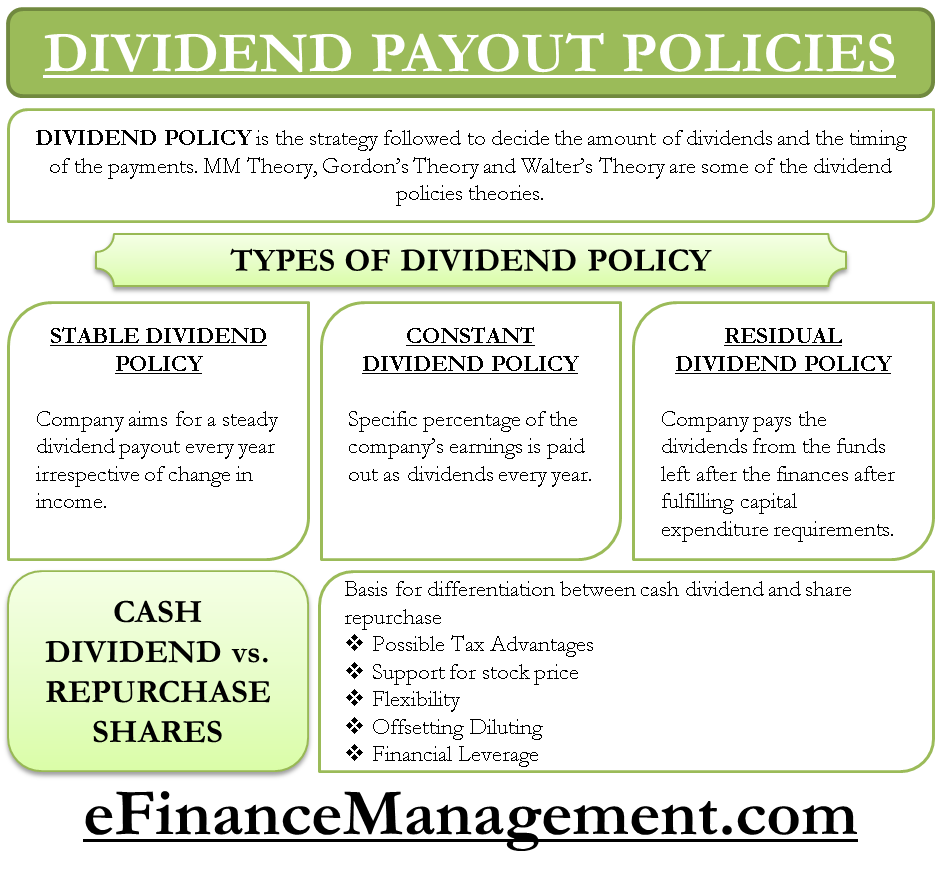

The dividend policy of a company is the strategy that the company follows to decide the amount of dividends and the timing of the payments. There are various factors that frame the dividend policy of the company. Availability of better investment opportunities, estimated volatility of future earnings, tax considerations, financial flexibility, flotation costs, and various other legal restrictions and factors that affect a company’s dividend policy. There are various famous theories on dividend policy, as stated below:

Modigliani- Miller Theory on Dividend Policy

Gordon’s Theory on Dividend Policy

Walter’s Theory on Dividend Policy

Types of Dividend Policies

Depending on the amount and the frequency of the dividend payouts, they are of three types:

- Stable dividend policy

- Constant dividend policy

- Residual dividend policy

Stable Dividend Policy

Under this policy, the company aims for a steady dividend payout every year. It does not change even if the earnings are volatile every year. A forecast of the company’s long-term earnings turns helpful in determining the approximate level of dividend payout. This approach aligns the company’s dividend growth rate with its long-run earnings growth rate.

It is the most popular dividend policy. This approach does not reflect short-term earnings’ volatility in payouts. Hence, the shareholders can be least uncertain about the level of the future dividend. This policy has the following very real possibilities:

Also Read: Factors affecting Dividend Policy

- Dividends may rise even in periods when the earnings of the company decline.

- Dividends may not increase at the same higher earnings rate in the booming years.

Because of these, the stable dividend policy may gradually move towards a target payout ratio. A target payout ratio is defined as a strategic goal representing the share of earnings that the company aims to distribute as dividends to shareholders over the long term. One such model on these lines of gradual adjustment is the target payout ratio adjustment, model. Under this model, if the earnings of the company are expected to rise, and the current dividend payout ratio is below the target dividend payout ratio, the investor can calculate the estimated future dividends as follows:

Expected Dividend = (Previous Dividend) + [(Expected Increase in EPS) * (Target Payout Ratio) * (Adjustment Factor)]

Where adjustment factor = 1/ number of years over which the dividends adjustments will happen.

Constant Dividend Policy

Under this, the company pays out a specific percentage of its earnings as dividends every year. The short-term earnings’ volatility affects the dividends in this case, and hence, the amount of dividends varies directly with the company’s earnings. However, this policy is not used very frequently in companies.

Residual Dividend Policy

Under the residual dividend policy, the company pays the dividends from the funds left after the finances for the capital expenditures of the current period are deducted from the internally generated funds of the company. This policy considers the company’s investment opportunity schedule, target capital structure, and the cost of capital raised externally.

The following steps determine the implementation of the payout ratio:

- Identify the optimal capital budget.

- Determine the equity required to finance the identified capital budget under a given capital structure.

- Use retained earnings to the maximum extent possible to meet the requirements of equity.

- Pay dividends from the residual earnings available after the requirements of the optimal capital budget are met.

It has the following advantages:

- This model is very simple to use. The company utilizes the funds for profitable projects and then distributes the remaining to the shareholders.

- The management is free to pursue profitable opportunities without worrying about dividend constraints.

However, there are a few disadvantages as well:

- The dividend payments are highly volatile as they fluctuate with the available investment opportunities.

- The investors may demand a higher rate of return on their equity because of the ambiguity about future dividends. It may also result in a lower valuation.

Share Repurchase

The payout policy of a company may have a provision of share repurchases along with return payments. Under a share repurchase, the company buys back its own shares from the shareholders. Since the company pays cash to buy back its own shares, this transaction could be a good alternative to cash dividends.

Also Read: How to Determine Dividend?

Cash Dividends vs. Repurchasing Shares

The rationale for repurchasing shares versus cash dividends is as follows:

Possible Tax Advantages

When the tax rates on dividend income are higher than those on capital gains, people prefer share repurchases over cash dividends as share repurchase has a tax advantage.

Support for the Stock Price

When a company buys back its own shares, it sends a signal to the market that its stock is a good investment. Such signaling is important when there is asymmetric information present in the market. The company uses this often when its share price is on a declining spree, and it wants to signal a positive future outlook to investors.

Flexibility

Share repurchases give a lot of flexibility to the company with respect to dividend decisions. There is no need for the company to commit to sharing repurchases for the long term. Hence, it can use this to supplement regular dividends to implement the residual dividend policy. Moreover, the share repurchases can be market-timed for the best results.

Offsetting Dilution

Employee stock options often dilute the EPS of the company when exercised. Share repurchases reduce this dilution.

Financial Leverage

Share repurchases increase the leverage of the company. The company’s management can change the company’s capital structure by reducing the percentage of equity.

Conclusion

Dividend policy is an important factor in the valuation of the company. Moreover, the signals interpreted by the investors from the various changes in the dividend payments also affect the company’s stock price. It is important for the analyst to know the impact of various dividend policies and share repurchases on the stock and its valuation.