Dividends vs Capital Gains: Meaning

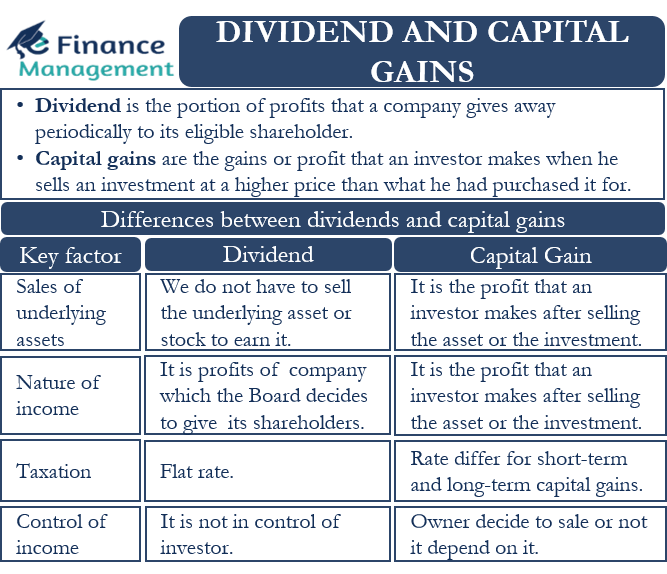

All companies doing well reward their shareholders by paying dividends regularly. Hence, the dividend is that part of profits that a company decides to distribute to its shareholders regularly. The Board of Directors of the company decides the amount and frequency of dividends to be given away. And sometimes also the eligibility of the category of shareholders. It is sort of a reward to the shareholders for believing in the company and investing their money in it. Capital gains are the gains or profit that an investor makes when he sells an investment at a higher price than the price at which he had purchased it. Therefore, the capital gain is the difference between the realized value and the purchase price of that stock. Both dividends and capital gains result in creating income and wealth for an investor.

The dividend is an income for the shareholders, which we measure in terms of yield at a particular stock price. A shareholder receives it immediately after the company declares and distributes it. But in the case of a capital gain, it remains a paper profit/gain or returns from the asset till we do not sell it actually. The profit from the sale becomes a capital gain only after the realization or accrual of the sale amount. Moreover, depending upon the period of holding the asset, the capital gains could either be short-term or long-term if we hold an asset for a period of one year or more and then sell it. Then the profit from the sale will qualify as long-term capital gains. But if the asset is sold within a year of purchase, its profit will qualify as short-term capital gains.

Dividends vs Capital Gains: Key Differences

Let us now look at the major differences between dividends vs capital gains.

Sale of the Underlying Asset

The sale transaction of the asset/stock is the most critical and important difference between these two forms of income. In the case of dividends, we do not have to sell the underlying asset or stock to earn it. Companies declare dividends over regular intervals according to their profits at that time. Anyone holding a share before the date of the announcement/record date for the dividend becomes eligible to get it.

However, in the case of capital gains, a sale transaction of the asset or stock is a must. One has to sell the underlying asset and realize the money. The difference between the selling price and purchase price will only be the capital gain, but only after the actual sale. For example, if we are holding a stock priced at $140 today, and we had bought it for $120, the difference between the two prices is $20. It will be our capital gain only after we actually sell the stock. If the current price falls to $130, our prospective or notional capital gain reduces to $10 only.

Nature of Income

The dividend is the part of the profits of a company that the Board decides to give away to its shareholders. It is usually a small percentage of profits, and the company itself retains the rest for meeting its internal requirements and funding its development projects.

But the capital gain is the profit that an investor makes after selling the asset or the investment. And it is not part of the realizable value, or nothing gets retained out of this for future requirements or growth.

Number of Beneficiaries

In the case of dividend distribution by a company, the number of beneficiaries receiving the dividend is humongous. The number can be in millions, depending upon the number of shareholders of the eligible category with the company.

But in the case of capital gains, the number of beneficiaries will be limited just to the owner himself or co-owners if the asset is owned jointly.

Also Read: Stock Dividends

Taxation

There is a flat rate of taxation for dividend income. But this is not so in the case of capital gains. The tax rates differ for short-term and long-term capital gains.

Frequency

An investor can earn dividend income multiple numbers of times as and when the company decides to distribute it. Also, there is no law or compulsion for companies to declare and distribute dividends to their shareholders. It is totally up to the Board to decide if they want to declare a dividend or not. So the frequency is not guaranteed. Despite huge profits, the company may decide to retain the profits and may decide not to distribute anything by way of dividends.

But an investor can earn capital gains from an asset only once since he will have to sell the asset to earn it. Hence, it is a one-time gain.

Control of Income

Dividend income is not in the control of the investor. The Board of Directors of a company decides how, when and how much of the profits do they want to distribute as dividends and how much do they intend to keep as retained earnings. An investor or shareholder cannot control this decision.

In the case of capital gains, the decision to sell the underlying asset and realize the gain lies solely in the hands of the owners. The owner alone will have a say in the entire sale transaction and will be free to decide the timing and amount at which he wants to sell the asset. Hence, he is the decision-maker to sell and realize the sale proceeds and eventually the capital gain from that asset.

Effect on the Price of the Underlying Asset

The decision to distribute dividends by a company usually affects its stock prices. It initially increases when the news spreads in the market that the company is about to announce a dividend. The stock price immediately goes down after the distribution of dividends. In some cases, the stock price can go up in case the dividend declaration is at a much higher rate than anticipated.

However, there is no such impact on the price of the underlying asset or stock in the case of capital gains. This is so because the underlying asset or stock is sold away and not held anymore. Hence, any price variation is of no consequence to the seller/investor.

Conclusion: Dividends vs Capital Gains

Dividends and capital gains both add value to an investor’s wealth. The dividend is a sort of regular income, whereas capital gains could be on and off. However, both are growth on investments or return on investments. However, which one is better and which one is preferable is difficult to say as it varies with the specific individual’s perception, income level, taxation impact, liquidity requirements, and so many other such factors. The actual gains that an investor can make depend upon the market conditions and his timing. It is always advisable to keep both types of assets in the portfolio. A good approach is to keep earning dividends on stocks and sell them when the market price is high, earning capital gains in the process.

Capital gains can be very beneficial if an investor has the ability to perfectly time the market. He can buy multiple assets at low prices and sell them at a higher price, making good profits in the process. Also, this can be very beneficial for the growth of his portfolio. However, he will have to be careful of the tax implications in this process. On the other hand, dividends can be a good source of regular income for investors who prefer to hold quality stocks for the long term and not indulge in speculative trading.

Frequently Asked Questions (FAQs)

The most basic difference between dividends and capital gain is that the dividends are the part of the profits a company distributes to its shareholders regularly. In contrast, a capital gain arises in the case of shares sold by the shareholders.

Dividend income is an income of a revenue nature.

a. Dividends

b. Capital gains

a. Dividends. Since a company generally distributes dividends at the end of each period it earns, its frequency is more. While capital gains can be realized only once, that is, at the time of sale.