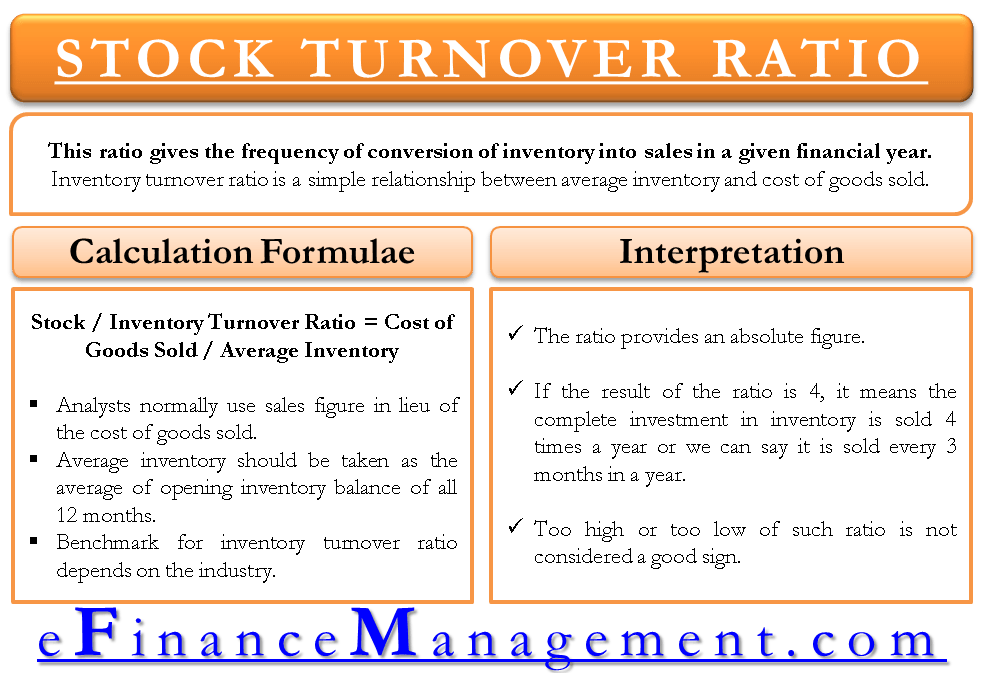

The inventory/stock turnover ratio is an important financial ratio to evaluate the efficiency and effectiveness of the firm’s inventory management. This ratio indicates how often the sale and replacement of inventory occur in a financial year. In other words, the ratio gives the frequency of conversion of inventory into sales in a given financial year.

This ratio also talks of the effective utilization of the working capital, especially the capital that inventories block. Optimum utilization of working capital may reduce the working capital requirement and thereby save interest costs for the firm.

How to Calculate Stock / Inventory Turnover Ratio?

This ratio is a simple relationship between the average inventory and the cost of goods sold. With these data in hand, the calculation of inventory turnover is very simple which is as follows:

Formula for Inventory Turnover Ratio

| Stock / Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory |

The dark side of the calculation is the non-availability of required data, i.e., Cost of Goods Sold and Average Inventory.

The cost of goods sold is normally not a part of financial statements, which is a practical difficulty for an analyst. Analysts usually use sales figures in place of the cost of goods sold. Logically speaking, the ratio should not give the correct result in that case, and the reason is that the sales are based on market value, and inventory is based on cost. So the two figures are not comparable to each other.

Average inventory should be taken as the average opening inventory balance of all 12 months. This method will smoothen the seasonal effect in inventory levels and normalize the data. Like the cost of goods sold, the availability of such detailed data for analysis is difficult many times, and therefore in the absence of that, an average of yearly opening and closing inventory is taken for the calculation.

Read more on Days Inventory Outstanding. It is the reciprocal of the inventory turnover ratio.

Inventory Turnover Ratio Calculator

Interpretation of the Ratio

The stock/inventory turnover ratio indicates how frequently one replaces inventory. The ratio provides an absolute figure. Let’s understand with an example what it conveys. If the ratio result is 4, it means the complete investment in inventory is sold 4 times a year, or we can say it is sold every 3 months in a year.

Read more: How to Analyze and Improve Inventory Turnover Ratio?

Benchmark Ratio

A benchmark for inventory turnover ratio depends on the industry. A good ratio in one industry may be bad for the other. For example, FMCG goods would generally have a higher stock turnover ratio because the goods are cheaper and consumption is speedy, and on top, they are perishable also. On the other hand, big machinery that is costly in nature would always have a lower stock turnover ratio. The best way to benchmark this ratio is to compare the concerned company ratio to the average of its respective industry in which it falls.

Refer to What is a Good Inventory Turnover Ratio? for more details.

Also, refer to EFFICIENCY RATIOS for learning its other type