Meaning of CAGR

There are various metrics or indicators in the financial world to understand the return and quality of investment returns. Two such metrics are- CAGR and IRR.

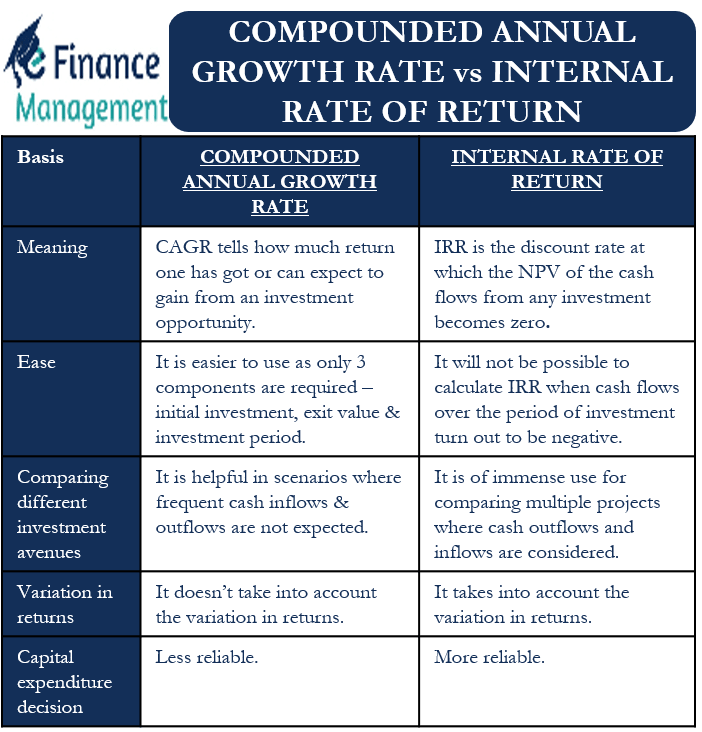

CAGR is the compounded annual growth rate of an investment over a specific period of time. The calculation of CAGR is done on an annual basis. It tells us how much return one has got or can expect to gain from an investment opportunity. Hence, it is a vital calculation and helps to make a prudent and wise investment decision. Internal Rate of return or IRR is also an important tool to calculate returns from an investment. But it is often more complex to calculate and is more useful in case of difficult situations of various factors. These situations may comprise multiple cash inflow and outflow events that are not possible to calculate using the CAGR.

The compounded annual growth rate is useful in the case of investments that last for a period of over a year. This can be the case with mutual funds, investments in stocks, securities, commodities, etc. It helps to calculate the returns in an annualized form. The returns in every individual year may vary, but CAGR will give the average return the investment generates over the investment period.

Meaning of Internal Rate of Return

The internal rate of return is the discount rate at which the NPV or net present value of the cash flows from any investment becomes zero. The objective remains to determine the rate of interest (by trial and error) that makes the net present value of all cash inflows and outflows over the period at Zero levels. This will include both types of cash flows- positive and negative.

Also Read: What Is CAGR And How It’s Useful?

This rate should be higher than the cost of capital a company or an individual incurs on a particular project or investment. A lower IRR than the cost of capital would imply that the company will incur a loss if it undertakes to do that project. Similarly, an IRR equal to the cost of capital will mean that the company will be in a no-profit no-loss situation if it does that project or invests in it. IRR is useful for capital budgeting, private equity, venture capital investments, etc.

How to Calculate CAGR and IRR?

Compounded Annual Growth Rate

The beginning and ending values of any investment and the time period are the major components for calculating CAGR. The formula for its calculation is:

(Ending value/ Beginning value of the investment)^1/time period of investment – 1

Let us suppose that Mr.A has an investment of US$ 10000 in mutual funds at the beginning of year 1. The value of his investment after a period of five years is US$ 20000. For a layman, the investment has given a 100% return over the period of five years. But the right approach will be to use CAGR to find out the annual return from his investments.

CAGR of the above example- (20000/10000) ^1/5 -1

= 2^ 1/5 -1

=1.15 -1

=15% p.a.

Therefore, the above investment gives an average yearly return of 15% p.a. over the period of five years. An important point to note in the calculation of CAGR is that it just gives the average returns over a period of time. It is possible for the returns to fluctuate over the period. For some time periods, it may be very high, and for a particular time period, it may even be negative. It gives an idea of how much return the investment generates if it provides a uniform return year after year over the investment time period.

Also Read: Annualized return on investment

Internal Rate of Return

The calculation of IRR makes use of the time period of the investment and the cash flows over that time period. Here we calculate the discount rate or the IRR at which the Net Present Value of the investment becomes zero.

Hence, NPV = Cash flow over the time period/ (1 + r)^n = 0

where r is the discount rate or IRR, and n is the number of time periods.

Let us suppose that a project involves an initial spend of US$ 50000. The cash flow for year 1 is US$ 8000, for year 2, it is US$ 15000, and for year 3, it is US$ 33345. The IRR, in this case, will be:

NPV= – 50000 + 8000/(1 +r)^1 + 15000/ (1+r)^2 + 33345/(1+r)^3= 0

= 5% where r in our calculation is .05

Therefore, the IRR in the above example is 5% p.a. The cost of capital for the project should be below 5% p.a. in order to make the project profitable and worthy to be undertaken. In case the cost of capital is higher than 5%, the company should not go ahead with the project.

A simplified way to understand the formula and concept of IRR is :

NPV = Today’s value of all future expected cash flows – Today’s value of investment requirements.

Advantages of CAGR over IRR

Easy to use

The concept of CAGR is much easier to use than IRR. We need only three inputs for its calculation – initial investment, exit value, and investment period, which are easily available. Moreover, these factors are available without any complex accounting or calculation. Further, it will not be possible to calculate IRR in case all the cash flows over the period of investment turn out to be negative.

Compare different investment avenues

CAGR can be very helpful in cases where frequent cash inflows and outflows are not expected. Comparing the CAGR of different projects or investment avenues can help decide which one is the better option and where to invest. For example, an investor can compare the CAGR of a mutual fund and a savings bank account or investments in a Bond over a period of, say, three years. He can easily do so by using the ending value of his investment in all three cases. Thus, CAGR can help to compare and make prudent investment decisions.

What are the advantages of IRR over CAGR?

Variation in returns

Unlike CAGR, the IRR considers the variations in returns or the market volatility over the period of investment. It considers the cash flow that the investment generates over the entire time period, and thus automatically accounts for the ups and downs of the businesses or projects that face over a period of time.

Helpful in project comparison

IRR is of immense use for the comparison of multiple projects and chooses the best among them. It considers the initial cash outflow and the cash inflows that each project can generate over its time frame. Thus, it provides a much broader outlook than the CAGR. The time value of money concept plays a vital role in business investments. And IRR is a better and preferred method to understand this. CAGR average outs the returns that may be coming at a later stage.

Capital expenditure decisions

The time value of money concept plays a vital role in business investments. And IRR is a better and preferred method to understand this. CAGR average outs the returns that may be coming at a later stage. Hence, IRR is a more reliable and useful method than CAGR for making important capital expenditure decisions. A company may use this concept to judge whether it will be more beneficial to invest in a new facility or renovate and expand the already existing facility.