Many who followed the 2008 financial crisis closely would know about CDO (collateralized debt obligations). They were a major reason triggering the financial crises. There is another similar term, CLO (collateralized loan obligations), and many people do get confused between them. Though both CLO and CDO are similar types of debt instruments, they are very different from each other. The primary difference between CLO vs CDO is with the underlying assets backing them. CLO uses corporate loans, while CDO mostly uses mortgages.

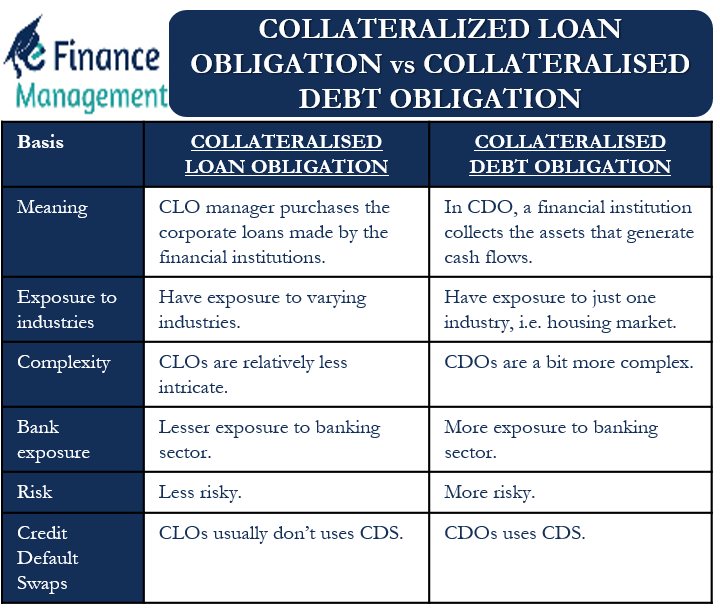

To better understand the two terms and their usage, we should understand the difference between CLO vs CDO.

CLO and CDO – What Are They?

We can say CLO is a loan fund that uses investors’ money to buy business loans. In simple words, we can say that a CLO manager purchases the corporate loans made by the financial institutions. These loans are largely to the companies that have a lower than investment grade rating (BB+ or lower).

However, these loans are usually senior secured loans and get priority on the cash flow of the company. Also, these are collateralized loans against assets or inventory. So, these loans serve as collateral and offer a reliable revenue stream for the investors.

In CLO, bundling of these corporate loans happens using the securitization process. Then repackaging of these securities occurs on the basis of individual loans’ risk. The interest that the company taking a loan pays goes to the investors in CLO.

On the other hand, CDOs depend upon mortgages and other similar debt, such as bonds, credit card debt, and more. Like CLO, they also get the backing of the pool of loans and other assets. It is also derivative security as its price depends on the types and strength of the underlying asset. To come up with a CDO, a financial institution collects the assets that generate cash flows. They then repackage them into varying classes on the basis of their credit risk.

We can classify CDOs on the basis of the type of underlying assets they represent. For instance, MBS (mortgage-backed securities) depend on mortgage loans. There are also asset-backed securities (ABS) that comprise auto loans, credit card debt, and more.

CLO vs CDO – Differences

Following are the differences between CLO vs CDO:

Exposure to Industries

CDOs mainly have exposure to just one industry, i.e., the housing market. The housing market has many loopholes, which was a significant reason that led to the 2008 financial crisis.

CLOs, on the other hand, usually have exposure to varying industries. Since these are corporate loans, and thus, could represent companies operating in different industries.

Complexity

CLO is relatively less intricate than CDOs. Generally, CDOs make use of many derivatives, such as credit default swaps. Such things make CDOs a bit more complex for an average investor. Moreover, these derivatives also increase the leverage and, in turn, increase the chances of a default. CLOs, on the other hand, are a combination of underlying loans depending upon the varying levels of risk.

Bank Exposure

The exposure of the banking sector in CLO is relatively lesser than in CDOs. As per an Atlantic article, Wells Fargo’s exposure to CLO was about $30 billion. This may appear big in absolute numbers, but it was just 1.5% of the bank’s total assets. Also, the banks usually go for CLOs with AAA ratings. So far, such a tranche has not lost the money.

Risk

CLOs are less risky than CDOs. This is because the former includes senior, secured loans, are diversified, and have less exposure to derivatives and leverage. On the other hand, CDOs are relatively riskier because of the use of derivatives and leverage. Also, they largely have exposure to just one industry – e.g., housing.

Default

AAA-rated tranches of CLOs have had no default since 1994. This is, however, not the case with CDOs. The CDO default was a major triggering point of the 2008 financial crisis.

Credit Default Swaps (CDS)

CDOs use CDS, and this makes CDOs more complex. CDS are basically insurance policies that protect against the losses from the riskiest tranches. Investors in CDOs feel safe investing in risky tranches because of such protection. However, at the time of the 2008 financial crisis, the companies offering CDS were unable to pay for the defaults. This led to panic in the financial markets.

CLOs, in contrast, usually don’t use CDS.

So looking from a different perspective, CLOs are loans disbursed to the businesses and corporates, so they are connected with corporate entities, where issuer ratings help, and thus default chances are lower. On the other hand, CDOs are mostly of individuals comprising of housing, mortgaged loans, unsecured credit card debts, personal loans, etc.

Who is More Likely to Brings Banking Crises – CLOs or CDOs?

Talking of who could trigger the next financial crisis, we can say both are unlikely to trigger crises now.

Following the 2008 crisis, CDOs are facing more regulations now and, thus, are not as risky as they were at the time.

Coming to CLOs, they have a less complex structure and have fewer exposures to derivatives. Additionally, the bank balance sheets are more robust now than they were a decade back. Moreover, the banks usually invest in the CLO tranches with the highest rating.

One more reason why CLOs are relatively less risky because of the financial analysts. By analyzing corporate loans, the analysts are able to come up with their verdict on the company. This way, any issue with the company taking a loan gets public well before it grows dangerous.

All these things mean that CLOs don’t pose a risk to the overall banking system.

Final Words

CDOs, because of their role in the 2008 financial crisis, are now less popular than before. Also, they are now subject to more regulations. CLOs, on the other hand, are popular because of their less complex structure. Moreover, they do not present a threat to the overall financial system since banks usually have exposure to the highest rating CLO tranches.