High Low Method: Meaning

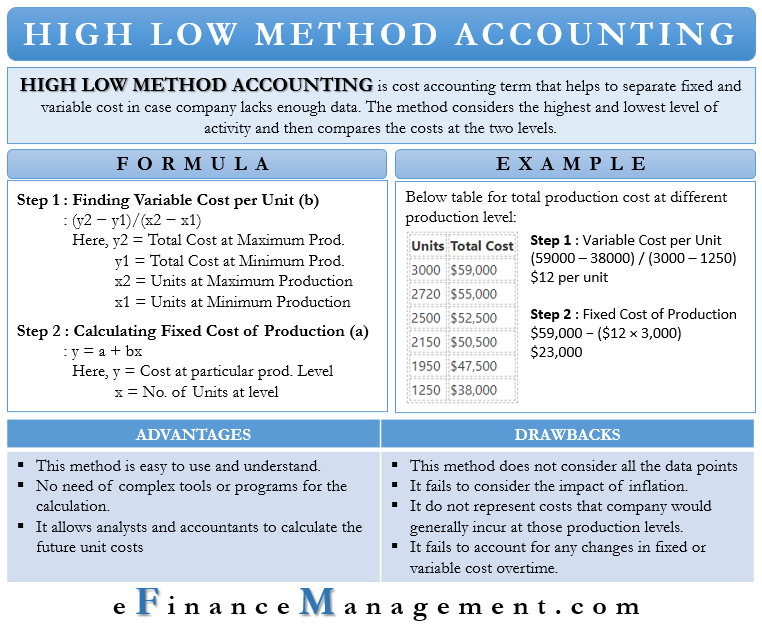

As we know in the cost accounting terminology, there are three types of costs – Fixed Cost, Variable Cost, and Semi-variable Cost. The High-low method is a cost accounting term that helps separate the fixed and variable costs if the company lacks enough data. The method considers the highest and lowest level of activity and then compares the costs at the two levels. We can say that from all costing data – including labor hours, machine hours, costs, and more – this method considers only the highest and the lowest data as inputs.

This method helps determine the variable and fixed cost if the variable cost is fixed per unit and the fixed cost is the same for all volume levels. In this method, we use the equations and formulas to get them fixed and variable costs. We can use this method anywhere we want to split the fixed and variable costs, be it the total cost for a company, production cost, process cost, project cost, payroll cost, and more.

Though this method is easy to use, it is not very popular. It could give inaccurate results due to the dependence on two extreme values (the high and low).

High-low Method Accounting – Formula

The high-low method is a two-step process.

- Here, the first step is to come up with an estimate of variable cost per unit.

- The next step is to use step one to determine the fixed cost for a certain level of production.

If you have resulted from the two stages, then it gets easy to calculate an approximate cost for a level of production.

Once we separate the fixed cost (a) and variable cost (b), we use a linear cost volume function to calculate the total cost.

This function is – y = a + bx.

Here y is the total cost, and x is the production level.

Now, let’s see the formula for the high low method. In this, first, we calculate the variable cost per unit (b).

Formula for this is: (y2 − y1)/(x2 − x1) OR

(Highest Production Level of Cost-Lowest Production Level of Cost) / (Highest Production level Units – Lowest Production level Units)

Here y2 is the total cost at maximum production, and y1 is the total cost at minimum production,

x2 is the number of units at maximum production, and x1 is the number of units at minimum production.

By solving this equation, we will get the variable cost per unit. This slope is nothing but the change in cost due to the change in production.

Also Read: High Low Method Calculator

Now to determine the total fixed cost, we need to deduct the total variable cost determined as per the above equation from the total cost of production. We can do this either at the maximum or minimum production. The answer will be the same in both cases because the fixed cost remains the same irrespective of the output.

So, the formula for Fixed Cost is y2 − bx2 or y1 − bx1

Example

Let us see an example to understand the calculation better using this method.

The table below represents the company’s total cost for different production levels in the first six months of a year.

| Units | Total Cost |

| 3000 | $59,000 |

| 2720 | $55,000 |

| 2500 | $52,500 |

| 2150 | $50,500 |

| 1950 | $47,500 |

| 1250 | $38,000 |

We first need to calculate the variable cost per unit using the formula above to calculate the fixed and variable costs. Here x2 will be 3000, and y2 will be $59,000, while x1 will be 1250, and y1 will be $38,000.

Putting the values in the formula: ($59,000 − $38,000) ÷ (3,000 − 1,250), we get variable cost as $12 per unit.

Let us now calculate the fixed cost. Putting the value in the formula:

Fixed cost will be $59,000 − ($12 × 3,000) or $38,000 − ($12 × 1,250). Hence, the fixed cost is $23,000.

Now that we have both fixed and variable costs, we can frame the cost volume function. It will be: y = $23,000 + 12x.

You can also use our High-Low Method Calculator

Benefits of High-low Method Accounting

The following are the advantages of using high-low method accounting:

- This method is easy to use and understand. All you need for this method is two data values to come up with the cost behavior.

- It does not require you to use complex tools or programs for the calculation.

- This method also allows analysts and accountants to calculate future unit costs with absolute ease.

Drawbacks

The following are the limitations of this method:

- This method assumes the presence of a linear relationship between cost and activity. It, however, is the over-simplification of the cost behavior. To get a better idea of the cost and volume behavior, we can use ABC (Activity-based costing).

- This method does not consider all the data points; instead, it uses just two data points. One can overcome this limitation by using regression analysis, which uses all data points and activity levels.

- Another limitation is that it fails to consider the impact of inflation. To overcome this, one needs to adjust the data for inflation before applying the high-low method accounting.

- It is possible that the high or low point (or both) do not represent the costs that a company would generally incur at those production levels.

- This method may ignore step cost and thus, could give inaccurate results. Step costs are the costs that a firm spends at a specific volume. If this cost comes at a point between the high and low points, then the high-low method could give inaccurate numbers.

- This method also fails to account for any changes in the fixed or variable cost over time.

Final Words

The high-low method of accounting is pretty straightforward and easy to use. It also makes the task quite simple when detailed stage-wise cost data is not available. However, as said above, it does not give very accurate results because of its two extreme data points. So, you must not depend solely on this data to get the actual variable and fixed cost. It is useful if you want to get an idea of variable and fixed costs quickly. But don’t depend entirely on it for accurate results, as semi-variable costs also play an essential role and sometimes could be substantial.

Quiz on High-Low Method Accounting.

This quiz will help you to take a quick test of what you have read here.