Variable Costs and Fixed Costs are a type of classification of costs based on their behavior pattern with the volume of activity of the business. In short, the total variable cost varies in proportion to the change in output/activity/volume of the business, whereas the total fixed costs remain the same. Based on their behavior with respect to the change in output, their names are variable and fixed.

Variable Cost

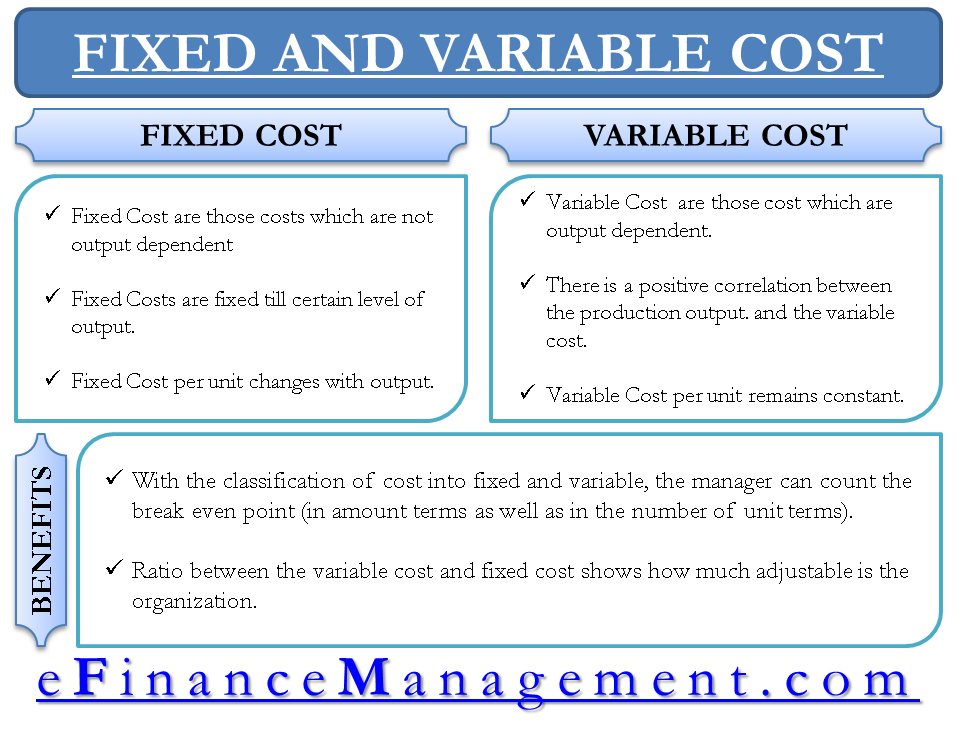

As hinted earlier, variable costs are those costs that are output-dependent. Direct material cost is the most common example of variable costs. When there is a positive correlation between production input and the cost of such input, such material cost is a variable cost. We should note that total variable cost varies with output, but variable cost remains fixed per unit. These costs are easily and automatically controllable because they incur when required. And, therefore, name it controllable costs.

Fixed Cost

Unlike variable costs, fixed costs are not output-dependent. The best example of fixed costs is the machinery cost, supervision costs, etc. Generally, the fixed costs are either incur in advance or are almost certain to incur irrespective of the activity levels of the manufacturing unit. Therefore, it is challenging to control fixed costs in a short span of time. Controlling fixed costs requires the special attention of the manager. The notable point here is that in the very long term, all costs are variable costs. Fixed costs are fixed till a certain level of activity. Total fixed costs remain unchanged, but per-unit fixed costs changes with the output level.

Semi-Variable Cost

A product may also have a semi-variable cost. A semi-variable cost is a cost have characteristics of both fixed and variable costs. It is necessary to divide this semi-variable cost into fixed and variable costs to arrive at the total cost of a product and determine the selling price. The high-low method of accounting helps in this bifurcation of variable and fixed costs.

How to Identify a cost as Variable or Fixed?

At the very outset, we should understand that the same cost can be variable or fixed under different circumstances. Suppose machinery requires replacement every 2 years. The cost of machinery is a fixed cost if we look at a term of say 1 year, but if we take a term of 10 years, it is also a variable cost. Now, suppose machinery requires replacement after every 1 million production units. The cost of machinery is fixed if we consider 10,000 units, but if we consider 50 million units, the cost of machinery is variable. Essentially, two things differentiate a cost between fixed or variable, i.e., Given Time Period and Specific Activity Level.

Benefit of Classification between Variable & Fixed Costs

With the help of this classification only, a manager can find out its breakeven point, which acts as a planning guide for him. The variable costs to fixed costs ratio show how much adjustable an organization is to changing situations. The higher the percentage of variable costs, the lower is the chances of that organization going into losses. Higher fixed costs have complications related to under-utilization etc. Slowly and gradually, a manager may think of making most of its costs variable if he perceives terrible economic conditions. Fixed costs give leverage when the volume of sales is high, but when that is lower than the breakeven point, the same fixed costs take organizations towards losses.

Read more about other Types of Costs and their Basis of Classification.

I am new to your website so I apologize if I haven’t figured out its full content. Most CVP and other financial analyses consider direct labor as a variable cost based on the historical practice of paying on a piece rate system in manufacturing but after WWII most manufacturers started and continue to pay direct labor on an hourly rate system whether direct labor produces an item or not. Goldratt called those costs that vary directly with producing one more or one less unit of output as a truly variable cost (direct materials, shipping, sales commissions for example) in computing “throughput” (selling price – truly variable price) and normal “traditional variable cost” categories (those that no longer vary with producing (shipping and selling one more unit) as Operating Expenses. How do these concepts of throughput accounting change your different types of analyses? What assumption(s) are violated in these traditional analytic methods? Is there a listing of traditional cost accounting and managerial accounting assumptions for various methods?