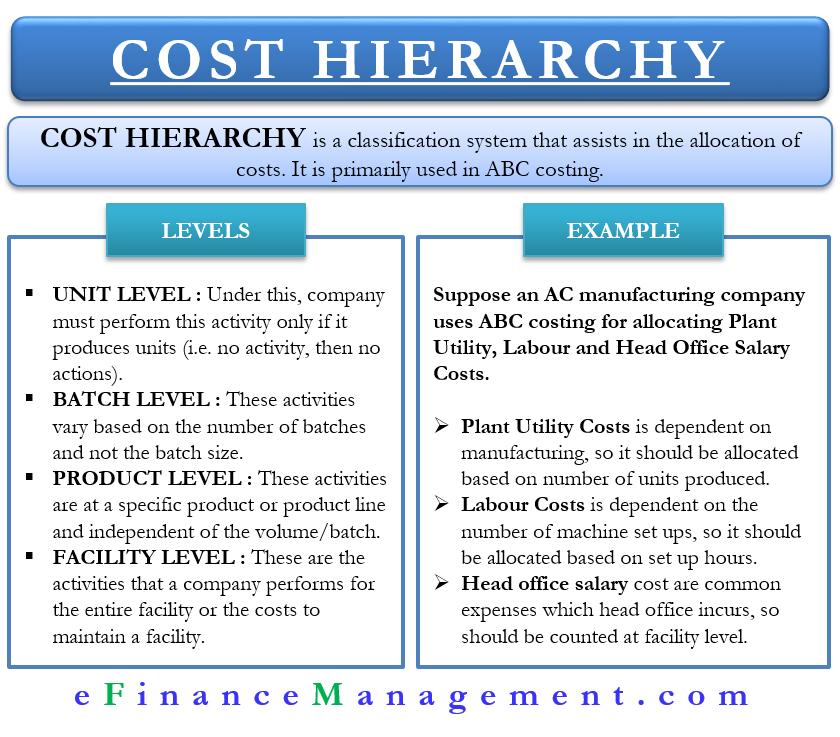

Cost Hierarchy is a classification system that assists in the allocation of costs. It helps to allocate costs more precisely and is primarily used in ABC (activity-based costing) system. Under the cost hierarchy, a company categorizes costs based on activity levels. These categories, in turn, are based on how easily one can trace these activities to a product.

Often it gets tough to assign a cost to a product. Even in such situations, cost hierarchy defines a framework to assist managers in forming cost pools. Moreover, it also helps determine the driving factors for the changes in each cost pool.

Another benefit of this system is that it gives an idea about how fast or slow the costs change based on the decisions taken by the top management. R. Cooper and R. S. Kaplan are the ones to develop this approach.

Cost Hierarchy – Levels

Following are the four levels of cost hierarchy:

Unit Level

Under this, the activities are related to the number of units that a company produces. It means that if a company does not produce anything, then such actions should not take place. Or, we can say, a company must perform this activity if it produces even a single unit. The work will vary based on volume—for example, direct materials and direct labor.

Also Read: Types of Costs and their Classification

Batch Level

These activities relate to the number of batches that a company processes. Such operations happen only when a batch of units is produced, no matter how many units are in the batch. Or, we can say these activities vary based on the number of batches, not the batch size. A company will usually incur the same cost even if the batch is 1000 units or 100 units. Examples are the cost of setting up machines, processing purchase orders, and cost for inspecting batch quality.

Product Level

As the name suggests, these activities are at a specific product or product line. These activities are independent of the volume of batches or units a company produces. For example, marketing and advertising of a product, managing customer records, developing a new product, and cost of processing an engineering change order.

Facility Level

These activities are independent of the number of units, batches, or products that a facility handles—for example, rent, depreciation, and insurance.

Cost Hierarchy – Example

Suppose Company A, which uses the ABC system, manufacturers three different models of AC. So, how will it allocate costs?

Generally, a company that manufactures AC incurs several expenses, but in this example, we will focus only on its three highest indirect costs.

The first cost is the Plant utility cost, such as heating, lighting, and more. Company A knows that it incurs it while manufacturing. So, this is a unit-level cost, and its allocation base is machine hours.

Next is the Labor cost. Company A incurs it while setting up the machine to produce another AC model. So, it is at the product level, and its allocation base is set-up hours.

Also Read: Cost Structure

Last is the Head-office salary. It is for the ongoing administrative services, such as legal and accounting, that the head office provides. Such costs are for the whole facility. So, such costs are counted and termed at the facility level.

Refer to Costing Terms to learn more about basic cost concepts.