What is ‘Principle 3: Rational People Think at the Margin’?

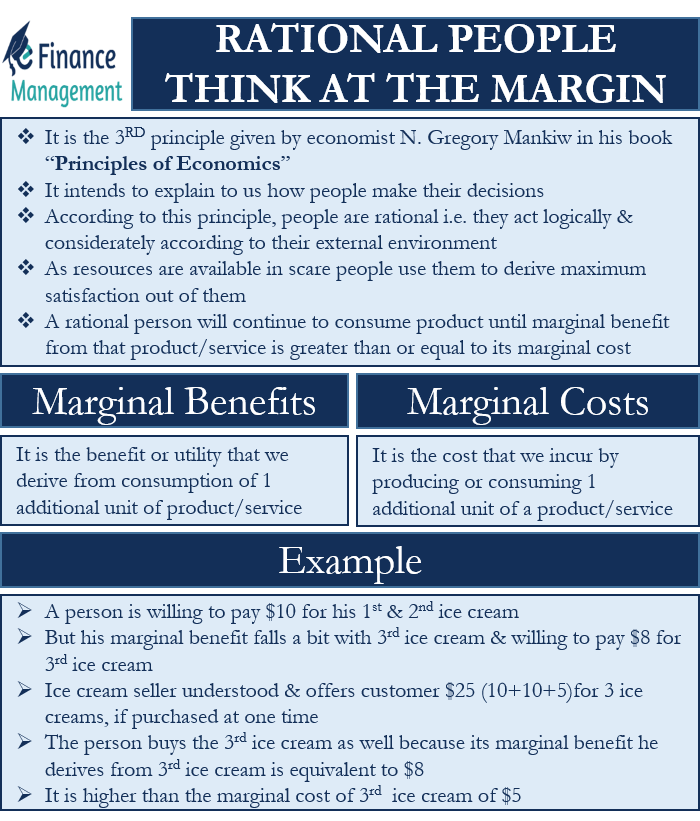

‘Rational people think at the margin’ is the third principle of the ten principles that economist N. Gregory Mankiw gave us in his book “Principles of Economics.” This principle intends to explain to us how people make their decisions. According to this principle, people are rational in an economy. By rational, we mean that they act logically and considerately according to their external environment.

People tend to act in the best possible manner to maximize the utility from the consumption of the good or service. The resources are scarce or limited. They make the best possible use of them to derive maximum possible satisfaction out of their actions. A rational person will continue to consume a product till the time his marginal benefit from that product or service is greater than or equal to its marginal cost.

What are Marginal Benefits and Marginal Costs?

Marginal benefit is the benefit or utility that we derive from the consumption of one additional unit of the product or service. It decreases with every additional unit of consumption of that product. For example, suppose we are very hungry. We are ready to pay $20 for a pizza. But after the second pizza, our hunger diminished. The third or additional pizza unit will now provide us diminished marginal benefit. Hence, we would be willing to pay lesser for that same pizza now.

Marginal cost is the cost that we incur by producing or consuming one additional unit of a product or service. Any rational person intends to maximize their marginal benefit. He will stop consuming a product as soon as his marginal cost of consuming that product gets higher than his marginal benefit.

Also Read: Ten Principles of Economics

How do Rational People Think at the Margin?

As discussed above, rational people will keep on consuming a product or service till the marginal benefit they derive from it is greater than or equal to its marginal cost. Let us understand this with the help of a few examples.

A person is willing to pay $10 for his first as well as second ice cream. But his marginal benefit falls a bit with the third ice cream. He is only willing to pay $8 for the third one because of diminishing marginal utility. The ice cream seller understands this phenomenon. He comes up with an offer of providing 3 ice-creams at $25 (10+10+5) only if the customer buys them all at once. The person buys the third ice cream as well because the marginal benefit he derives from the third ice cream is equivalent to $8. It is higher than the marginal cost of the third ice cream of $5.

The same concept applies to bigger businesses as well. Let us take the example of a movie hall. Suppose a movie hall has $500 of fixed daily expenditures comprising rent, salaries, electricity, maintenance, etc. It has a seating capacity of 100 people and runs only one show. Thus, its fixed expenditure per seat comes to $5. 20 seats are vacant at the start of a show, and a customer is willing to pay $4 for the movie ticket.

But $4 is lesser than the average cost of $5 per seat. Should the movie hall manager say no to the willing customer? No. Like movie halls, businesses with high fixed costs think at the margin and look to maximize their profits. The movie hall will be better off by allowing the person to watch the movie at $4 rather than letting him go and losing on that amount. There is no marginal cost involved in letting the person watch the show. However, the marginal benefit of issuing him the ticket will be $4.

Summary

The principle of people thinking at the margin is universally true. This principle answers complex questions like why sellers offer quantity discounts and why are big businesses with heavy fixed expenditures like airlines, amusement parks, and movie theatres willing to provide last-minute discounts on their tickets and sell them even below their average costs.

A consumer or a business aims to maximize marginal utility or benefit and achieve the highest levels of satisfaction. They will continue to consume or offer their services until they experience a higher marginal benefit than its marginal cost or at least equal to it.