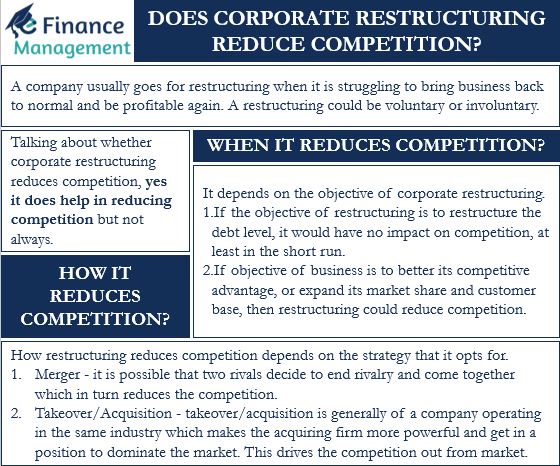

Corporate restructuring, as the word suggests, is a plan that changes the structure of an organization. The change in structure could be operational, financial, or managerial. Usually, restructuring involves reworking the business model, disposing of assets, forming an alliance with other companies, creating new groups, reducing staff, etc. A company usually goes for restructuring when it is struggling, to bring business back to normal and be profitable again. A restructuring could be voluntary or involuntary. When a company takes up restructuring on its own, we call it voluntary restructuring. And, when bankruptcy laws force a company to undergo restructuring, we call it involuntary restructuring. Whatever the reason for restructuring is, its ultimate objective is to create value for the stakeholders. Talking about whether or not corporate restructuring reduces competition, yes it does help in reducing competition but not always.

We can say that there are a few scenarios in which restructuring helps to reduce competition. Let’s take a look at those scenarios when corporate restructuring reduces competition.

When Restructuring Reduces Competition?

Whether or not corporate restructuring reduces competition depends primarily on the objective of corporate restructuring. For instance, if the objective of restructuring is to restructure the debt level, then it would have no impact on the competition, at least in the short run.

In the long run, however, it is possible that due to the restructuring of the debt level, the company starts to make big profits. This could then help the company to expand its market share, and thereby reduce competition.

Also Read: Does Corporate Restructuring Create Value?

On the other hand, if the objective of the business is to better its competitive advantage, or expand its market share and customer base, then restructuring could help to reduce competition.

Now that you know the scenarios when restructuring helps to reduce competition, let’s look at how it helps companies to reduce competition.

How Restructuring Reduces Competition?

The corporate restructuring includes several types of strategies. And, whether or not, corporate restructuring reduces competition directly depends on the strategy that a company chooses. Let’s take a look at the restructuring strategies that could reduce competition directly and quickly:

Merger – in a merger two companies, usually in the same industry, come together. A merger could result in the creation of a new entity, or one of the entities ceases to exist. In a merger, it is possible that two rivals decide to end the rivalry and come together. The decision to merge could be inspired to overcome challenges facing the industry. Thus, in such a case restructuring helps to reduce competition.

Takeover/Acquisition – in this strategy, one company completely takes over or acquires another company. In this also, the takeover or acquisition is generally of a company operating in the same industry. After the takeover or acquisition, the acquiring firm gets more powerful and could get in a position to dominate the market. This could drive out competition from the market.

Mainly these are the two strategies that could allow corporate restructuring to reduce competition. On the other hand, other corporate restructuring strategies could also help in reducing the competition, but not in the short term.

As said above, other corporate restructuring strategies (such as demerger, reverse merger, disinvestment, sump sale, and more) could first allow the company to better its financial standing, products, or services. Once a company gets in a position to take on the rivals or gets the competitive edge, it may then work to reduce the competition.