What is a Slump Sale?

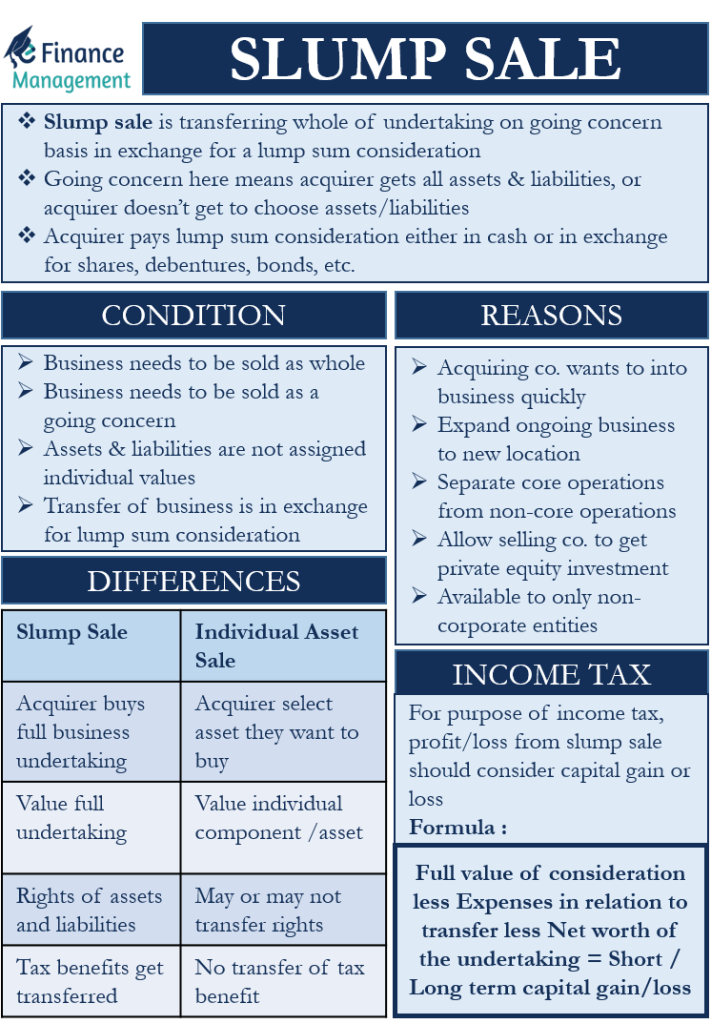

Slump Sale is a term that we usually hear in case of a merger or acquisition. It is the sale or transfer of the whole undertaking with all its assets and liabilities as a going concern for a lump sum consideration. Or, we can say, it means transferring the business without assigning individual values to the assets and liabilities, i.e., for a lump sum consideration.

The going concern here means the acquirer gets all assets and liabilities, or the acquirer does not get to choose the assets or liabilities. An undertaking is mainly a business of a firm, which, if separated from the company, has enough assets to operate and function separately.

The acquirer pays the lump sum consideration either in cash or in exchange for shares, debentures, bonds, etc.

In the case of land (or any other assets and liabilities), it is valued individually for stamp duty, registration fee, or other taxes. Then also it would fall under the slump sale.

Conditions

For a transfer to qualify as a slump sale, it needs to meet the following conditions:

- The business comprising of all its assets and liabilities should be sold as a whole and not in parts.

- Similar way the business operations have to be sold as a going concern.

- All the assets and liabilities of the business should be assigned an overall value, combined value, and not the individual values.

- The transfer of business is in exchange for a lump sum consideration.

Many believe such a sale is the most effective and quickest way to transfer assets and liabilities. This is because such a strategy has simple and well-defined tax rules and easy-to-understand procedures. All this results in the saving of time and money while carrying out mergers and acquisitions.

Also Read: Divestitures

Reasons for Slump Sale

The primary motive of the acquirer in such type of a sale is to acquire the full setup of a business, including its assets and liabilities. But without acquiring the target company which owns the assets and liabilities. For example, Company A has two businesses, mobile and electronic appliances. Company B takes over all the assets and liabilities of Company A’s mobile business. Now, Company A will be having only the Electronic appliances business.

Following are the major reasons why companies go for such a type of sale:

- The acquiring company wants to jump into a business quickly. Or wants to expand their ongoing business to a new location. Slump sales will help it to start the operations within a short time, sometimes rather immediately. Because it need not go through the creation of an operational setup. Nor does it need to seek regulatory clearances etc for starting the business.

- When the selling company would like to concentrate on its core operations. And therefore wants to split its core and non-core operations.

- Such a sale may also allow the selling company to get private equity investment into the business that it wants to separate.

- Slump sale is one of the few options available to non-corporate entities, including sole proprietorships, partnerships, co-operative societies, and others, for transferring the business. This is because non-corporate entities are not eligible for court-approved demergers.

Slump Sale in Income Tax

For income tax, the profit or loss from the slump sale should consider a capital gain or loss.

We can calculate the profit or loss from the slump sale using the below formula:

The full value of consideration less (Expenses about transfer plus Net worth of the undertaking) = Short / Long term capital gain/loss

For capital gain calculation here, the net worth is usually the difference between the book value of the assets and liabilities. Also, the short and long-term capital gain/loss would depend on the time an undertaking is with the business.

Slump vs. Individual Asset Sale

Following are the differences between the slump sale (SS) and individual asset sales:

- In a SS, the acquirer buys the full business undertaking. But, in the case of an individual asset sale, the acquirer can select the asset they want to buy.

- In a SS, the managers value the full undertaking. But in an individual asset sale, the valuation is of an individual component or an asset.

- The acquirer gets the rights of all the assets and liabilities in a SS. In an individual asset sale, the rights of the assets and liabilities may or may not transfer to the acquirer depending on the mutual agreement.

- All tax benefits, including tax incentives/ tax holiday, also gets transferred to the acquirer in the case of SS. The tax benefits of the existing owner do not get transferred to the new owner in an individual asset sale.

- There could be different rules in both types of sales regarding the sale of depreciable assets attracting either short or long-term capital gain.

Final Word

A slump Sale is a quick and effective way to transfer an undertaking. It has benefits for both – the seller and the acquirer. However, for this strategy to be successful, both parties must act in good faith.